The code for crvUSD, the future algorithmic stablecoin of the decentralised finance (DeFi) protocol Curve, has just been published on the GitHub platform. According to the whitepaper written by Curve’s founder himself, the stablecoin will be over-collateralised by various cryptocurrencies and can be minted by users when they deposit liquidity.

Curve releases code for its stablecoin

Quickly announced in July by Curve founder Michael Egorov, the algorithmic stablecoin of the popular decentralised finance protocol (DeFi) has had its code and whitepaper published publicly on the GitHub platform.

As we reported back in August, the “crvUSD” will indeed be a decentralised stablecoin that is over-collateralised by different cryptocurrencies in a similar way to Maker DAI.

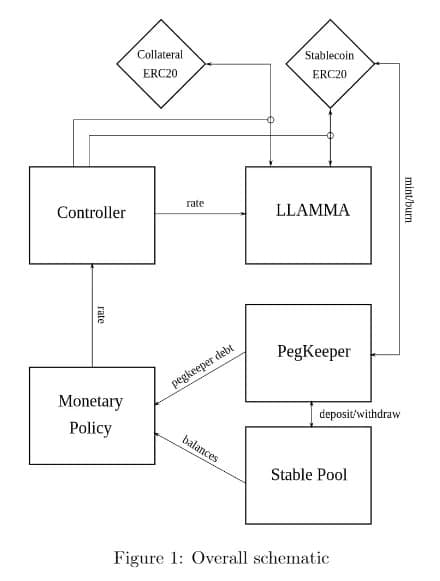

According to the whitepaper written by Michael Egorov himself, users will be able to mint the crvUSD by participating in its over-collateralisation by depositing crypto-currencies on Curve, all structured by a unique mechanism called Lending-Liquidating AMM Algorithm, or simply LLAMA.

Diagram of the crvUSD structure

In his conclusion, Curve’s founder explains that these different mechanisms could solve the different problems inherent in algorithmic stablecoins:

The mechanisms presented can hopefully solve the risk of liquidations for making and borrowing stablecoins. In addition, stabilisation and automatic monetary policy mechanisms can help maintain the peg without the need to maintain an excessive PSM. “

Effectively, unlike stablecoins like USDC or USDT that are over-collateralised with “real” money, algorithmic stablecoins are backed by different cryptocurrencies. Often, in order to cope with market volatility, algorithmic stablecoins are over-collateralised to some extent with USDC or USDT.

Although the crvUSD code has been publicly revealed, no date has been issued for the official release of the stablecoin.

The crvUSD will join Curve’s CRV token, which is distributed as a reward on the decentralised finance platform for users depositing cash. In keeping with the decentralisation theme, the CRV token also acts as Curve’s governance token.