The evidence of growing cryptocurrency adoption continues to mount. A study conducted by Coinbase and The Block Research found that 50% of Fortune 100 companies have undertaken cryptocurrency initiatives and projects.

The Fortune 100 believes in cryptos

Once perfectly watertight, the boundaries of the cryptocurrency ecosystem are becoming increasingly blurred. What’s more, it’s not impossible that the major players of tomorrow will no longer be the ones in the news today, as a new study by Coinbase and The Block Research suggests.

Entitled “The State of Crypto: Corporate Adoption”, the report reveals that 52% of Fortune 100 companies are investing – or have already invested – in cryptocurrency or blockchain-related initiatives since the start of 2020.

For the record, the Fortune 100 is a ranking of the top 100 US companies, sorted by revenue size. They include companies such as Walmart, Amazon, Apple, Alphabet (Google’s parent company) and Microsoft.

The finance, technology and retail sectors are the most represented in this study. These three areas account for more than 75% of all projects initiated by Fortune 100 companies since the start of 2020.

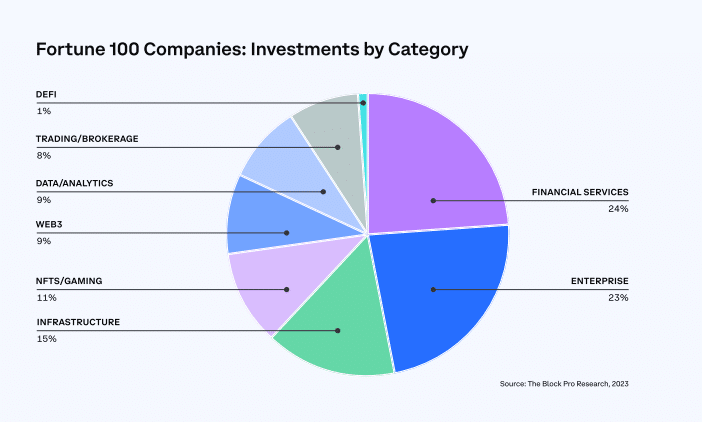

Breakdown of crypto investment sectors of Fortune 100 companies

By category, it is interesting to note that 11% of the wealthiest US companies are interested in NFTs compared with just 1% in decentralised finance (DeFi). The majority of initiatives relate to financial services, without specifying their nature. Nor does the report specify the proportion of projects involving Bitcoin (BTC) itself.

A brake… US regulation

While the overall sentiment of the report shows that Fortune 100 companies believe that blockchain technology will significantly disrupt the future of the financial system, nearly 90% acknowledge that there remains a lack of regulatory clarity in the US. In their view, this is something that is hindering wider adoption of the sector.

The report literally comes out in favour of clearer regulation of the cryptocurrency sector in the US. In its view, the risks are as follows:

“The US stands to lose 1 million web3 developer jobs and 3 million related non-technical jobs to other countries by 2030 if it continues on its current path of regulation by enforcement. “

These thoughts on regulation are not new, but their echo is all the stronger since the recent case pitting the Securities and Exchange Commission (SEC) against the main crypto exchanges, including Binance and Coinbase.

As we have mentioned on numerous occasions in TCN, the stakes in this regulatory battle are high. While regulation of the industry is gathering pace in Europe, the UK and now Hong Kong, it is imperative that the US comes up with a solution if it is not to see its main players flee for other horizons.