The Sell in May and Go Away sequence put the crypto market under high fundamental and technical pressure, but the main thing had been preserved in extremis, the preservation of the $24,000/25,000 pivot support zone. This week, the market developed a bullish impulse that carries with it the technical hopes of going in search of new resistance.

Bitcoin, leader of the crypto market

In the stock market, history has become accustomed to repeating itself and the crypto market is no exception to the rule. This week’s rise in the bitcoin price may come as a surprise to many, as it runs counter to the major stock market indices, which have started a profit-taking sequence of their own.

In reality, there is nothing surprising about it. The same thing is happening as during the FTX collapse in the last three months of 2022. At that time, the price of bitcoin made a new low by briefly falling below $15,000 (on the future contract), while risky assets on the stock market had begun a new medium-term bull phase from October 2022.

The bitcoin price then missed the boat, as it was completely impervious to the return of risk appetite due to massive withdrawals from centralised platforms.

In May/June, the same pattern was repeated. The bitcoin price proved unable to keep up with the upward thrust of the major stock market indices. This was particularly true of the Nasdaq, but also of the entire information technology sector, which returned to its all-time highs.

Mired in regulatory, legal and fund security difficulties, the crypto market was even impervious to the resumption of the US dollar’s downward trend on the foreign exchange market. Yet this leading factor generally acts with an inverse correlation on the price of cryptos.

As a result, bitcoin’s rebound from the decisive $24,000/$25,000 support level should be seen simply as a process of catching up and aligning itself with risky assets, as happened in January.

Naturally, the encouraging signals from institutional investors (new annual high on the measure of open interest in crypto futures) give structure to this rebound. Moreover, if this rebound is confirmed at the weekly close, it will allow new bullish targets to be set.

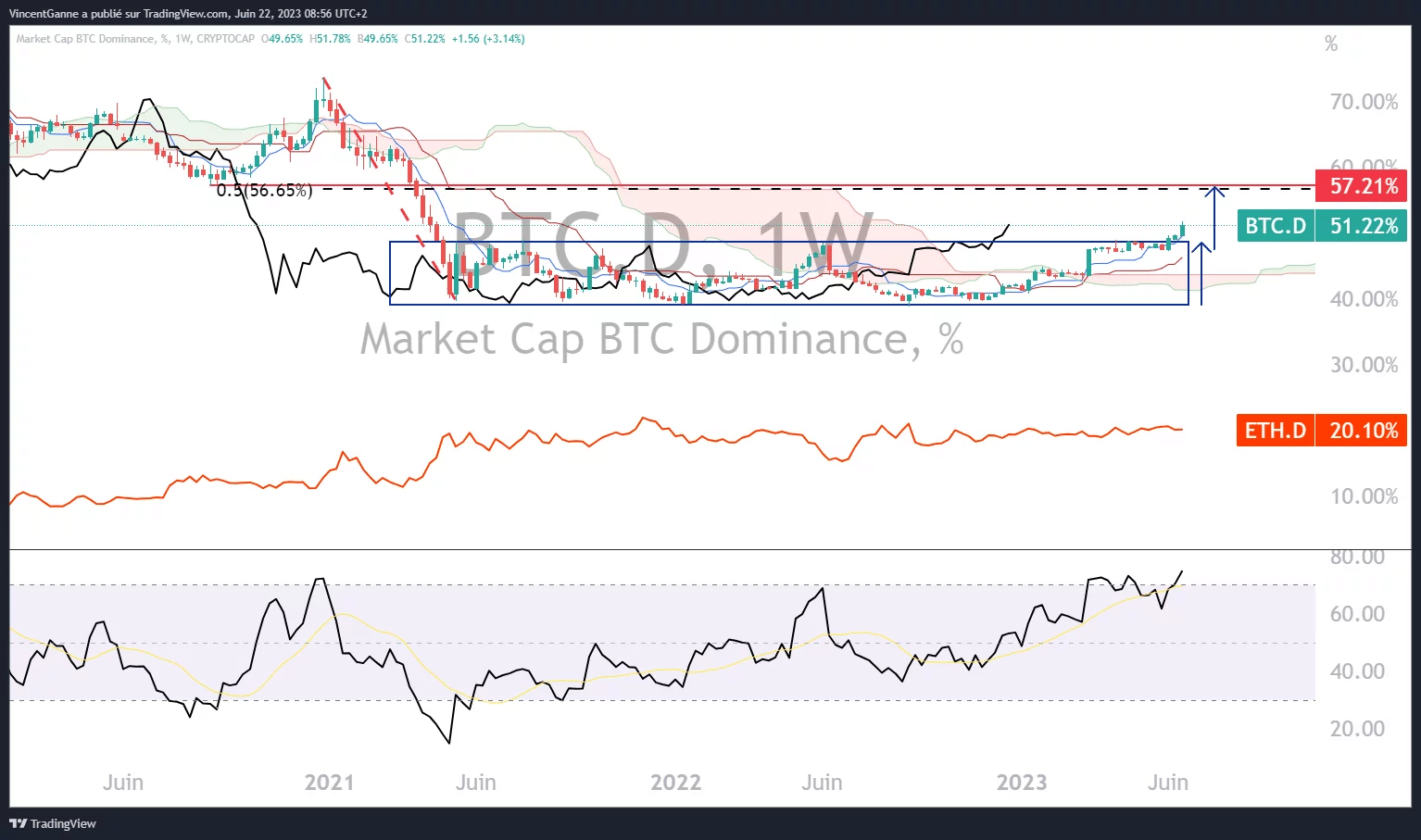

As for altcoins, bitcoin should continue to outperform, with a BTC dominance target of 57%.

Graph produced with the TradingView website showing bitcoin’s dominance in Japanese candlesticks and Ethereum’s dominance in closing prices

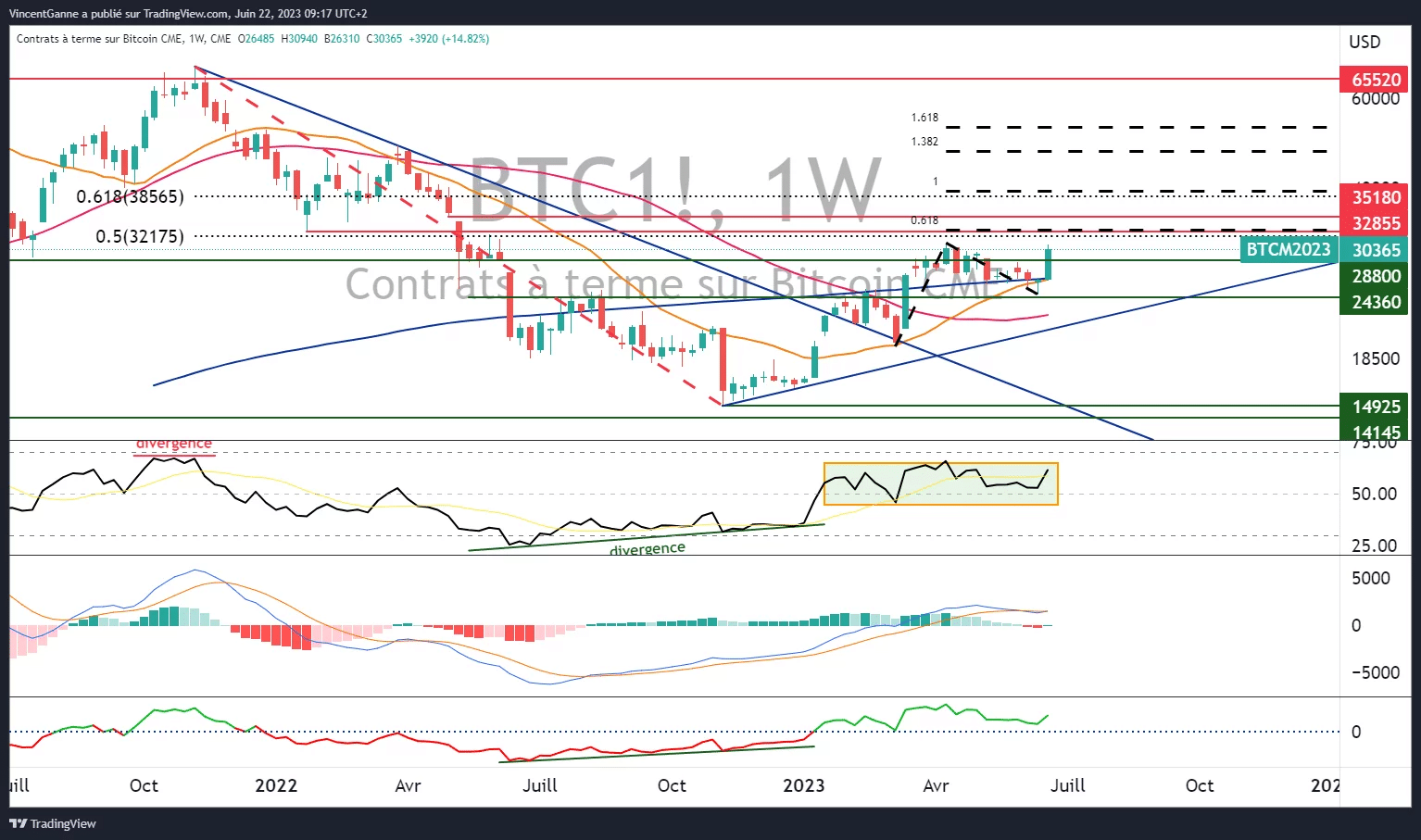

Next resistance: $33,000

The upward movement that began last Friday on the bitcoin price is interesting, although it is only a delayed return to the configuration of the equity market. In fact, this impetus has enabled the corrective compression in place since the beginning of May to be broken out at the top, and is part of the fractal construction that has been in place since the start of the year.

This is the fifth identifiable uptrend, with a theoretical target of $33,000, i.e. 0.618 of an extension of wave 3 carried over to the low of wave 4. This target also corresponds to chartist resistance at $32,800, the lows of January 2022, and to the 50% retracement of the entire bear market of 2021/2022.

In conclusion, this is the bullish target as long as new support at $28,800 is defended.

Graph produced with the TradingView website showing the weekly Japanese candlesticks for the CME BTC future contract