Binance, the world’s largest cryptocurrency exchange platform, has announced that it has sold its entire Russian business to CommEX for an undisclosed sum. However, CommEX is a crypto exchange created yesterday, and many observers have pointed out the many similarities between the exchanges, suspecting the creation of a shell company by Changpeng Zhao.

Binance announces departure from Russian crypto market

Binance, the world’s largest cryptocurrency exchange, has officially ended its activities in Russia. Via a succinct statement, Changpeng Zhao’s platform announces that it has reached an agreement with CommEX, a crypto exchange established yesterday, to sell it its entire local business.

Binance certifies that its users’ funds remain secure and will soon be transferred to CommEX, a process that could take up to a year to ensure that “the migration […] is carried out in an orderly manner”. The platform has also announced that it will no longer be operating in Russia within the next few months.

Noah Perlman, Binance’s Chief Compliance Officer, stated that it was no longer possible for the exchange to continue its activity there given the sanctions applied to Russia:

“As we look to the future, we recognize that operating in Russia is not compatible with Binance’s compliance strategy. We remain confident in the long-term growth of the Web3 industry worldwide and will focus our energies on the hundred or so other countries in which we operate. “

Finally, Binance specifies that it “will not receive regular income from the sale” and that it “will not have the opportunity to buy back shares in the company”.

At the end of August, the Wall Street Journal revealed that Binance had enabled Russian citizens to exchange their rubles for cryptocurrencies, mainly USDT, the stablecoin issued by Tether. And this for substantial sums: according to the Bank of Russia, the equivalent of $428 million had passed through the platform in the space of a few months, even though it was supposed to have ceased operating locally as a result of Western sanctions.

At the time, a Binance spokesperson replied that the platform was in no way circumventing the sanctions and that these were false allegations on the part of the Wall Street Journal.

CommEX, a rather vague exchange

Concerning CommEX, this cryptocurrency exchange was created yesterday, Tuesday September 26. Little information is visible on the site, which notably states that the company is backed by “leading venture capital firms” without naming any.

On the platform’s official Telegram channel, a spokesperson stated that CommEX was registered in the Seychelles and would serve the Commonwealth of Independent States (CIS) as well as Asia.

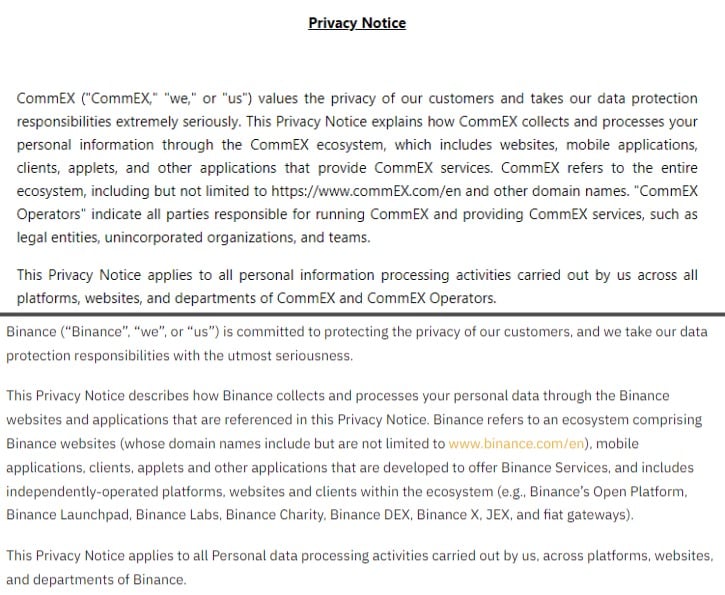

Many observers have also noted the many similarities between Binance and CommEX, for example in their privacy policies:

Privacy policy of CommEX (left) and Binance (right)

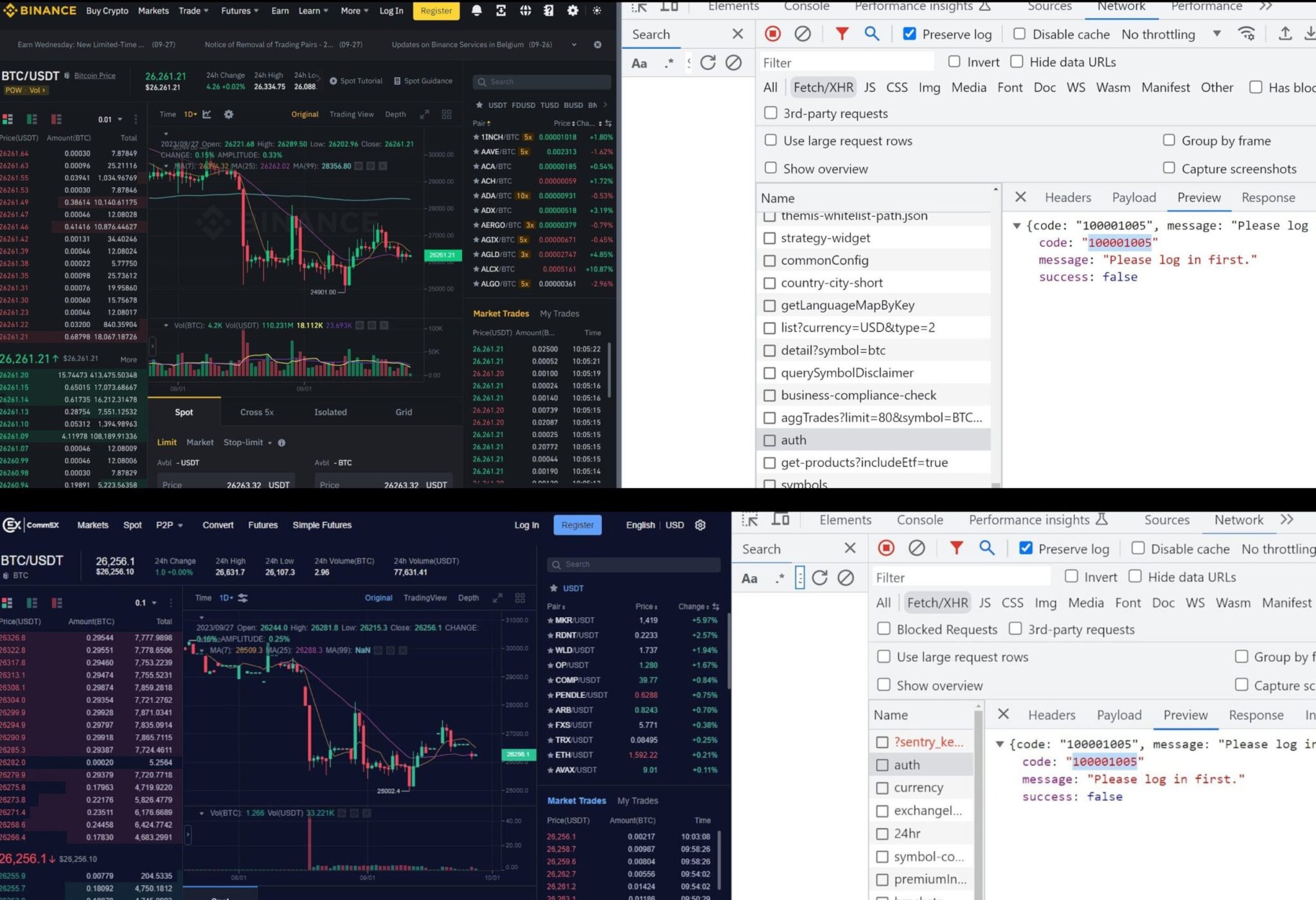

Or their trading interface:

Binance (top) and CommEX (bottom) trading interface

Many users of CommEX’s official Telegram channel highlighted these similarities, with some adding that it was “obvious to guess” who was behind CommEX. Questioned by Fortune, however, a Binance spokesperson claimed that “Neither Binance nor its executives have any shares or profit participation with CommEx”.

Adam Cochran, a well-known figure in the ecosystem, has also highlighted a number of troubling elements regarding potential links between Binance and this new crypto exchange.

Finally, according to an X publication by Changpeng Zhao, CommEX users will be entitled to a 25% discount on their trading fees if they are holders of BNB, Binance’s token.

Is CommEX a Binance shell company? Only time will tell