The recent sudden drop in the cryptocurrency market has put many decentralised finance (DeFi) borrowing positions at risk. Among these, one address is set to be liquidated 200,000 Ether (ETH) if the price falls below $950. Fortunately, this mysterious individual has begun to pay back his loan, breathing some life back into the ecosystem.

$200 million in liquidations threaten DeFi

In recent weeks, the cryptocurrency market has suffered a violent storm that has sent it plunging to lows not seen in a long time. The collapse of the Terra ecosystem (LUNA) was the domino that set off a cascade of events, the repercussions of which continue to be felt today.

The most recent is the Celsius affair, one of the largest centralized lending platforms in the market. Impacted by the collapse of the UST stablecoin and blamed for its mismanagement of client assets, Celsius is threatening to go bankrupt.

Moreover, it is not an isolated case as the famous investment fund Three Arrow Capital is also experiencing difficult days following liquidations. In addition, falling stock prices have forced the entity to sell its positions at a loss to avoid further liquidations.

The selling volumes of these large portfolios are such that they have pushed the market further into the abyss. So much so that many DeFi users now find themselves in uncomfortable positions. Loans that were relatively safe a few weeks ago are now on the verge of liquidation.

In fact, for the past few days, the Aave protocol has been threatened by a wall of potential liquidations. If the Ether (ETH) falls below about $950, a single address could see its loan of nearly $200 million liquidated.

This sword of Damocles hung over the Aave protocol and threatened the entire cryptocurrency market. Fortunately, the address in question – long suspected to be that of Three Arrow Capital – made moves to secure its position and thus breathe some life back into the market.

The address pays off part of its loan

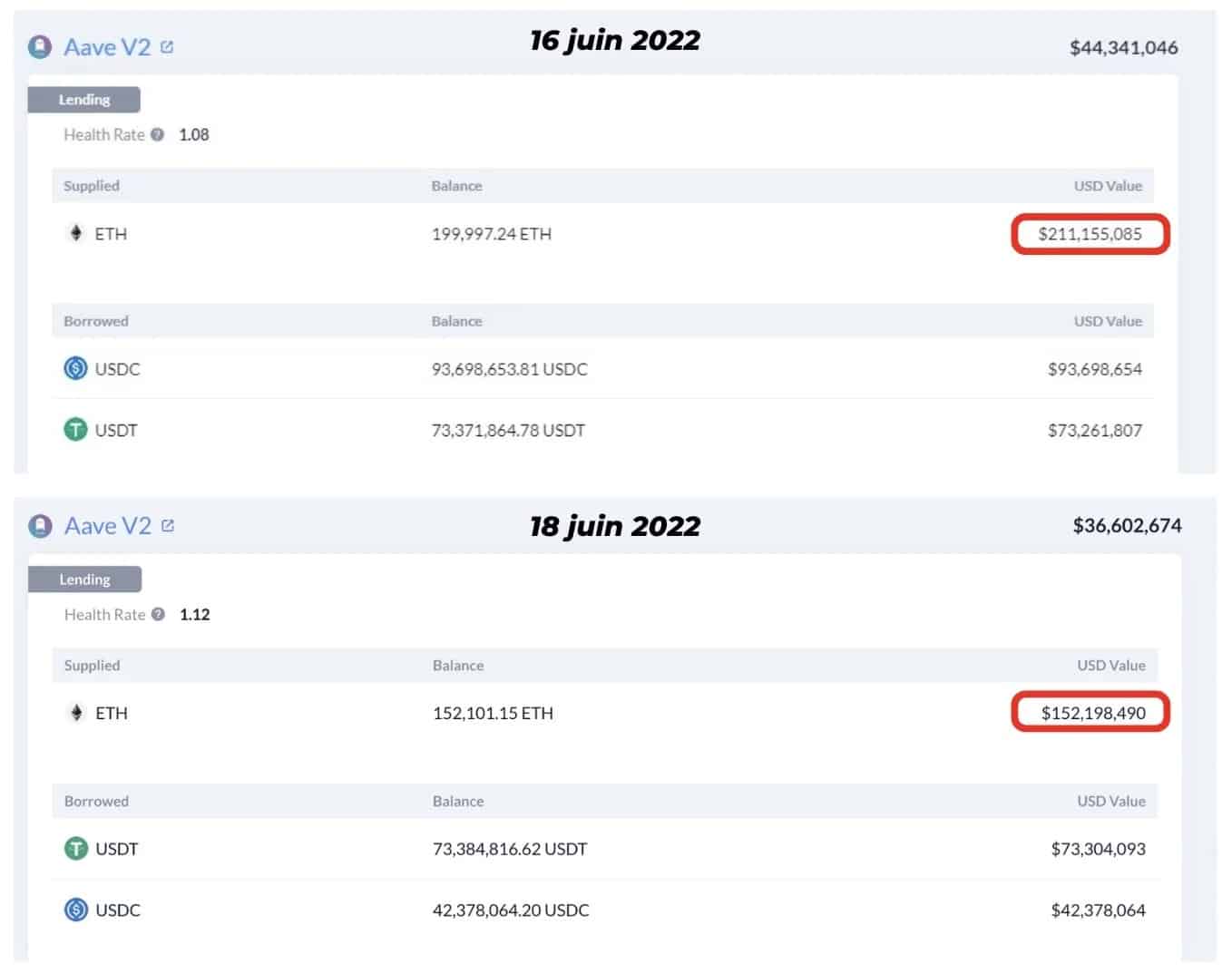

As of June 16, 2021, this address had a loan of $167 million on the Aave protocol. As collateral, it had 200,000 ETH, then valued at approximately $211 million. The loan’s health factor was 1.08, which meant that a simple 8% movement in Ether could result in liquidation.

However, there was one particular concern: who would want to liquidate this position? The 5% fee offered to the liquidators would not be enough to compensate for the drop in the Ether price caused by the liquidation of such an amount.

There was only one solution: the mysterious individual had to bring in capital to repay his loan and secure his position. And that’s exactly what happened: the address in question repaid 25% of its loan, or $50 million, in order to lower its liquidation price.

Fig. 1 – Comparison of the position on Aave as of 16 June and 18 June 2022

As you can see from the screenshot above, the health factor is now at 1.12, while the Ether has already fallen by almost 15% since June 16.

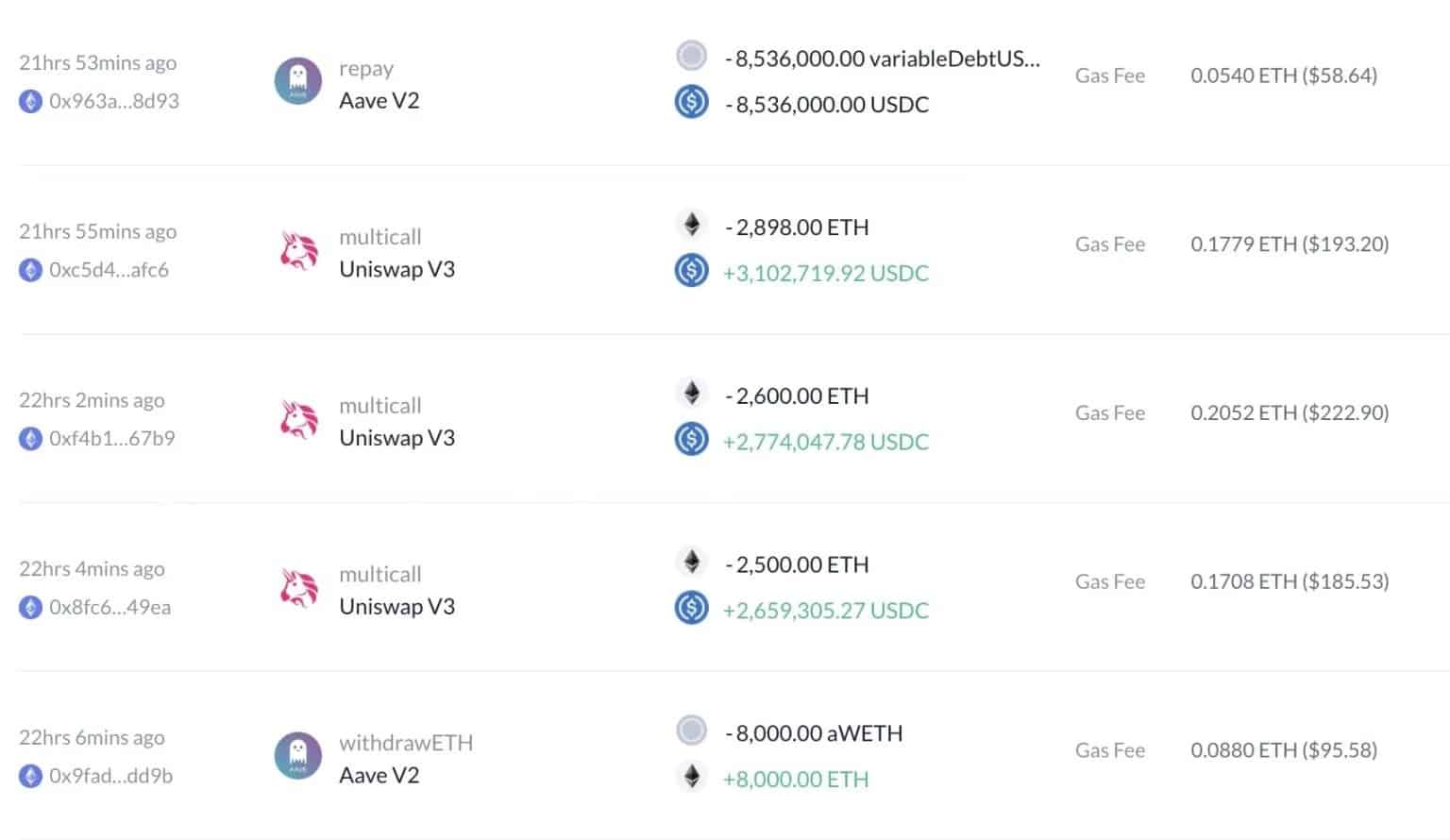

This individual made several similar trades, which you can see in the screenshot below. In concrete terms, these consisted of swapping ETH for USDC in order to pay them back to the protocol. As a result, approximately 30 million USDC were taken out of the position.

Fig. 2 -Example of operations performed to secure the position

Note also that we have identified another address linked to this one, which has also offloaded several million dollars from a borrowed position on the Compound protocol.

While there are still significant liquidation risks around this position, the individual’s responsiveness was a lifesaver for the ecosystem. It threatened dangerously to bring down the market but more importantly, to put the Aave protocol at risk.