This week, the Optimism Foundation sold 116 million OP tokens, equivalent to over $150 million at the current price. Let’s take a look back at the reasons for this sale, and take the opportunity to analyze some data concerning the adoption of this layer 2 of Ethereum (ETH).

Optimism Foundation sells over $150 million worth of OP

On Wednesday, the Optimism Foundation, in charge of developing Ethereum’s (ETH) second-largest layer 2 in terms of total locked value (TVL) on decentralized finance (DeFi), announced the sale of 116 million OP tokens:

Starting today, there will be several transactions totaling approximately 116M OP tokens. We’re sharing as a heads up to our community that these are planned transactions.

– Optimism (✨_✨) (@optimismFND) September 20, 2023

To explain this choice, she also posted a message on her governance forum. However, few details were provided, except that the sale is intended to finance “treasury operations”. In all, seven buyers will share the tokens, with a two-year lock-up period :

” The tokens are subject to a two-year lock-in. During the lock-in period, buyers may delegate tokens to unaffiliated third parties to participate in governance. The tokens come from the unallocated portion of the OP Token treasury and are part of the Foundation’s initial working budget of 30% of the initial OP token offering. “

At the time of writing, the proceeds of this sale represent $150.96 million. However, members of the Optimism Foundation have made it clear that, given the private nature of the sale, its terms and the names of the seven buyers cannot be disclosed.

According to DefiLlama data, Optimism Foundation has the equivalent of almost $1.19 billion in OP tokens left in its treasury.

Optimism’s role in Ethereum’s scalability

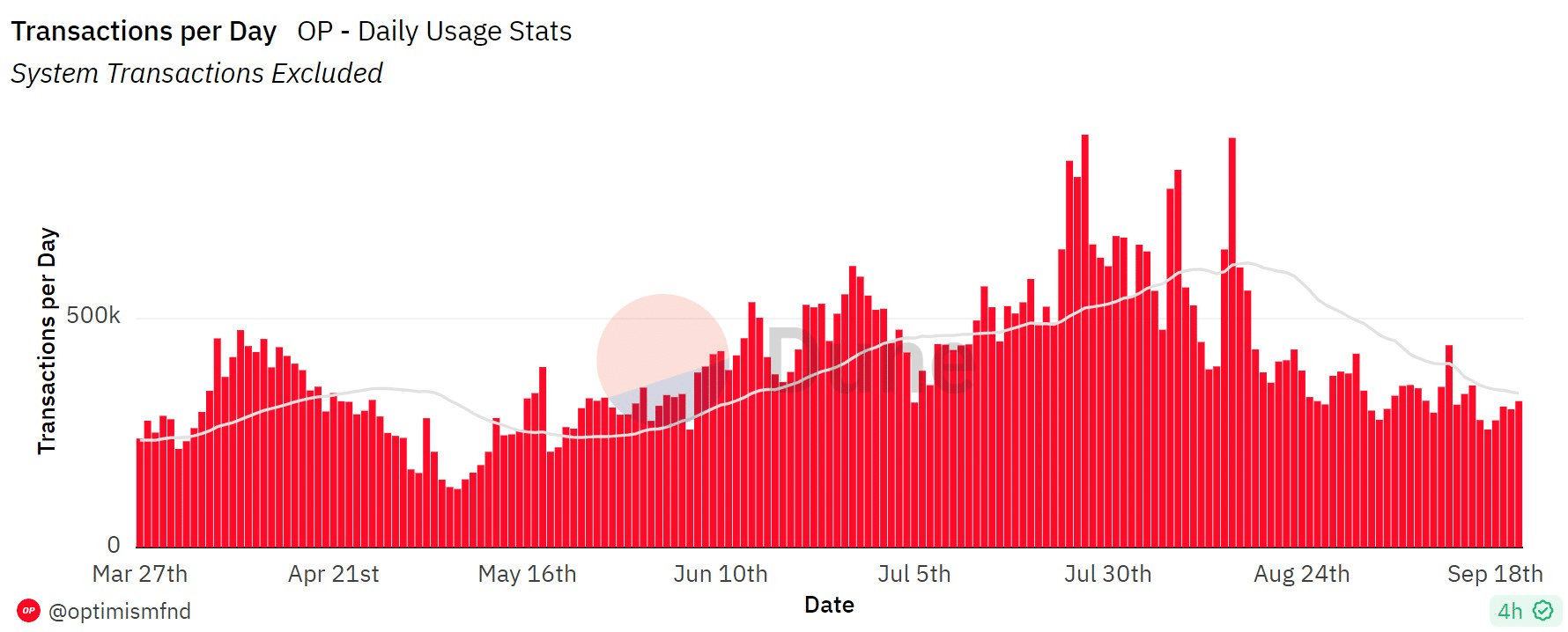

As mentioned above, Optimism is the second largest layer 2 on Ethereum. To date, the network counts over 15.56 million unique addresses, with an average of almost 337,000 transactions per day over the last 30 days:

Daily transactions on Optimism excluding system transactions

At the DeFi level, layer 2 brings together a TVL of over $655 million, spread over 190 applications according to DefiLlama. The podium is occupied by the Synthetix, Velodrome and Aave protocols, for $148.9, $147.7 and $71.55 million respectively.

At present, the OP token is trading at $1.31 each, down around 7% since Wednesday’s announcement of the private sale.

In addition to its own network, Optimism’s technology is also used by other Optimistic Rollups. These include Arbitrum One, Coinbase’s Base and Binance’s opBNB. This makes the project one of the cornerstones of Ethereum’s scaling solutions.