A short comes from the term “short selling”. Shorting a cryptocurrency means betting on its decline and making money if the price drops between the buying and selling price. This is a trading technique that offers many possibilities, including pure speculation, but it is also a way to hedge your portfolio. We explain it all in our guide

What are shorts?

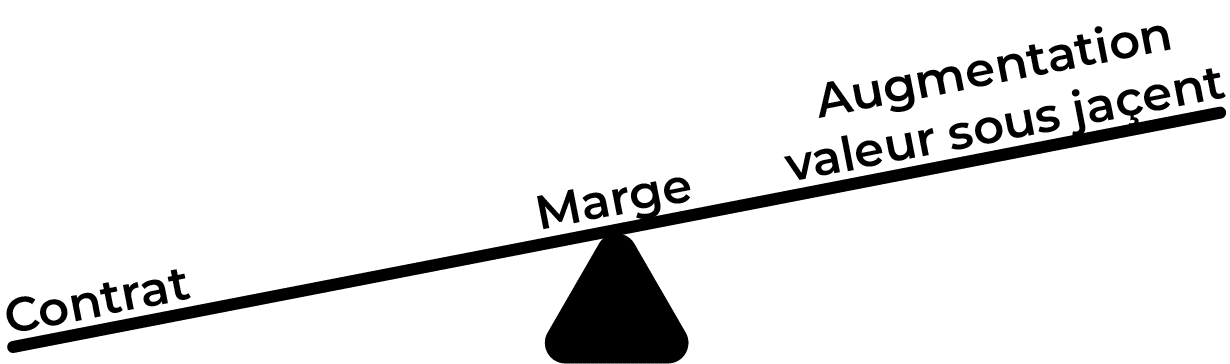

A short is “selling short”, i.e. selling an asset that you don’t own with the aim of buying the contract back later at a lower price. If the investor decides to short a cryptocurrency and the value of the underlying asset falls, then the difference between the purchase price and the sale price allows for a capital gain.

Shorting allows you to make money when the financial markets fall, but not only that, it also offers the possibility to hedge against the risk of a falling cryptocurrency price.

Strictly speaking, this is not a “live” investment, as it is the derivative that replicates the underlying (the crypto-currency) that you are buying, not the underlying itself. This is a major difference, as it allows you to speculate on the decline of an asset you do not own, but also to use leverage.

What is leverage?

Leverage allows you to increase your exposure to the market with a low initial investment and works in both the buying and selling direction. Unlike a cash trade where you need to hold €100 to buy €100, leverage offers the trader the opportunity to invest more than their initial capital.

But how? The trader finances only part of the investment, the rest is provided by the intermediary who gives him credit. The only condition for opening a position is that the intermediary requires a deposit, which corresponds to a guarantee. Every day this deposit, also called a “margin call”, fluctuates according to market conditions.

If the position is in deficit, the margin call will increase: the intermediary requires a higher deposit to keep the position open. If the trader fails to pay the cost of the margin call on time, then the position is automatically closed out by the financial intermediary.

Principle of leverage

Leverage may be very risky, but it is popular with investors. In fact, with a leverage of 10, it is possible to invest €1,000 in crypto-currencies with a starting stake of only €100. But be careful, because if the market moves in the opposite direction to the expected scenario, you can lose your entire stake or have to replenish your account very quickly to keep the position open.

Derivatives that short a cryptocurrency

Derivatives are a large family that can take different forms: contract for difference (CFD), futures, forward contracts, turbos or even options… All have their own specificities.

What do they have in common? They are called “derivatives” in the sense that they are derived from the value of the asset. They were designed as insurance contracts to protect against a hazard, such as a drop in price. These products create a time lag between the time the contract is signed and the time it is completed, which allows you to do two things that are not possible with a cash contract: short selling and leverage.

Conclusion

Derivatives, such as futures and CFDs, are therefore a great way to sell short and use leverage. But they are also very risky! They should be handled with extreme caution, or you could lose your entire stake in no time.