Tether, the issuer of the stablecoin USDT, has reportedly resumed its lending activities less than a year after announcing their suspension. Why did Tether decide to offer new loans, when it continues to dominate the market and rake in hundreds of millions of dollars in profits?

Tether starts lending USDT again

Tether, the issuer of USDT, the most highly capitalized stablecoin on the market, is reported to have finally resumed lending less than a year after announcing it would stop the practice.

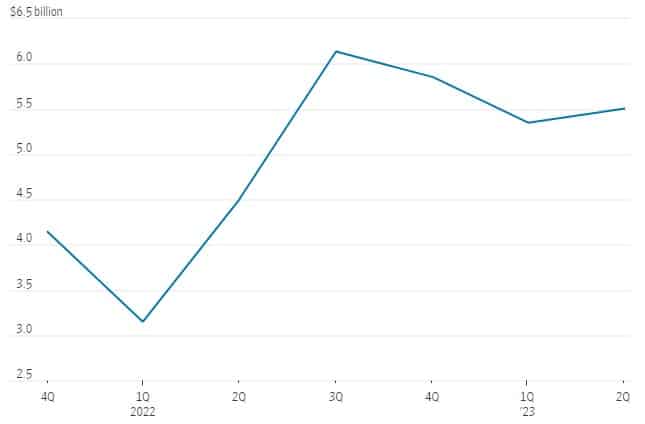

According to the Wall Street Journal, Tether currently has the equivalent of $5.5 billion in active USDT loans, compared with $5.3 billion reported in the second quarter of 2023. Asked about this, a Tether spokeswoman confirmed the information, stating that these loans were made to “long-standing customers”:

“During the second quarter of 2023, we received a few requests for short-term loans from customers with whom we have cultivated long-standing relationships, and we made the decision to grant these requests. “

Evolution of the amount of USDT lent by Tether (in billions of dollars)

At the time when Tether was navigating troubled waters, it had assured that these loans were indeed over-collateralized in real dollars, and that doubts from various sources were just FUD. The Wall Street Journal reiterated its concerns in its new article about the real collateralization of USDT and therefore of these loans, to which Tether responded publicly:

“Anyone with a modicum of understanding of financial markets would understand how a company with $3.3 billion in excess equity and on track for $4 billion in annual profits is actually offsetting the secured loans and keeping those profits on the company’s balance sheet. “

While Tether was supposed to stop offering USDT loans this year, the company’s spokeswoman announced that this would finally end in 2024.

To date, Tether has still not published an independent audit of its reserves, but has simply carried out attestations drawn up by the firm BDO Italia, which continues to cast doubt on the real composition of its reserves aimed at securing USDT.