It’s been a week since LayerZero deployed a bridge between the Goerli testnet and the Ethereum backbone, allowing gETH to be purchased directly for ETH. While the price of this test token has increased fourfold, this could have unintended consequences.

The price of the Goerli testnet gETH has increased from $0.1 to $0.4

For the past week, LayerZero Labs has deployed a bridge to trade gETH against ETH, between the Goerli testnet and the Ethereum blockchain (ETH).

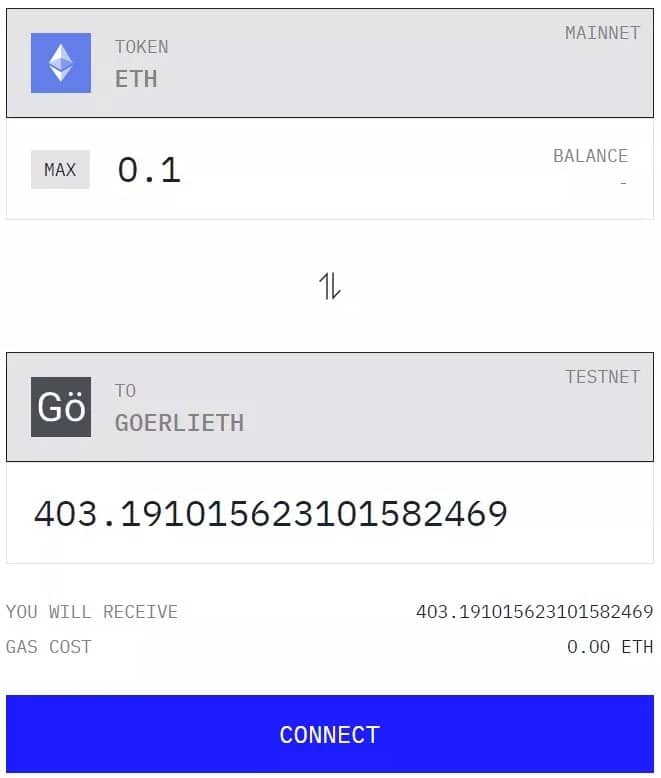

Thus, it is possible to buy these “fake ETH” testnets with real ETH. At the time of writing, for example, it was possible to buy just over 400 gETH at a price of 0.1 ETH, or $0.4 per unit:

Bridge from LayerZero to Goerli testnet

Initially, LayerZero had applied a starting price of $0.1 for the gETH.

To put it simply, this bridge works thanks to two pools of cash deployed on Uniswap (UNI), allowing to establish a connection between the two networks:

- ETH/mETH on Goerli;

- gETH/ETH on Ethereum.

LayerZero justifies the creation of this bridge by the difficulty that developers may encounter in obtaining large quantities of gETH in order to carry out tests on their applications. Indeed, faucets, which deliver gETH for free, only distribute a limited quantity on a daily basis, and may not always work. This may necessitate buying gETH directly over the counter (OTC).

For investors, the use of a testnet is interesting, as applications can sometimes deliver airdrops to members of their community testing their functionality before deployment on the main network.

Trading in testnet tokens: a bad idea

While the idea of being able to easily acquire gETHs at low prices may seem attractive, there are a few things to consider.

Firstly, as the founder of CrocSwap pointed out on Twitter, the gETH, which was supposed to be a fictitious token, becomes taxable:

Fun fact: Now that there’s a liquid priced market, any Goerli ETH you get from a faucet counts as taxable income, and any testnet transaction you send triggers a taxable capital gains event. pic.twitter.com/SKaMKaeEyF

– Doug Colkitt (,) (@0xdoug) February 21, 2023

Indeed, now that he has a prize, it must be included in the calculation of his taxation, if taxable events have occurred in the year concerned.

The initiative also stems from the fact that it is difficult to obtain large quantities of gETH on the Goerli test network. However, making it easily tradable could fuel speculation that creates even more barriers to entry: swedes become less accessible, and OTC prices also rise along with those of the liquidity pool.

This scenario may then make access to the network even more complicated for users just testing various applications in the hope of being eligible for an airdrop, but may also increase production costs for developers.

Now that this bridge has been deployed by LayerZero, it will be interesting to follow the impacts this will have on the Goerli test blockchain.