Thanks to a strong rise since the beginning of the year, the Terra (LUNA) blockchain is now the second largest in decentralised finance (DeFi) in terms of total locked value (TVL). Let’s take a look at this meteoric rise.

Terra is the second largest network in DeFi

While the BNB Chain (formerly Binance Smart Chain), is treading water, Terra is definitely the hot blockchain in the DeFi ecosystem lately. With a steadily increasing total locked value (TVL), it has managed to take second place in the ranking.

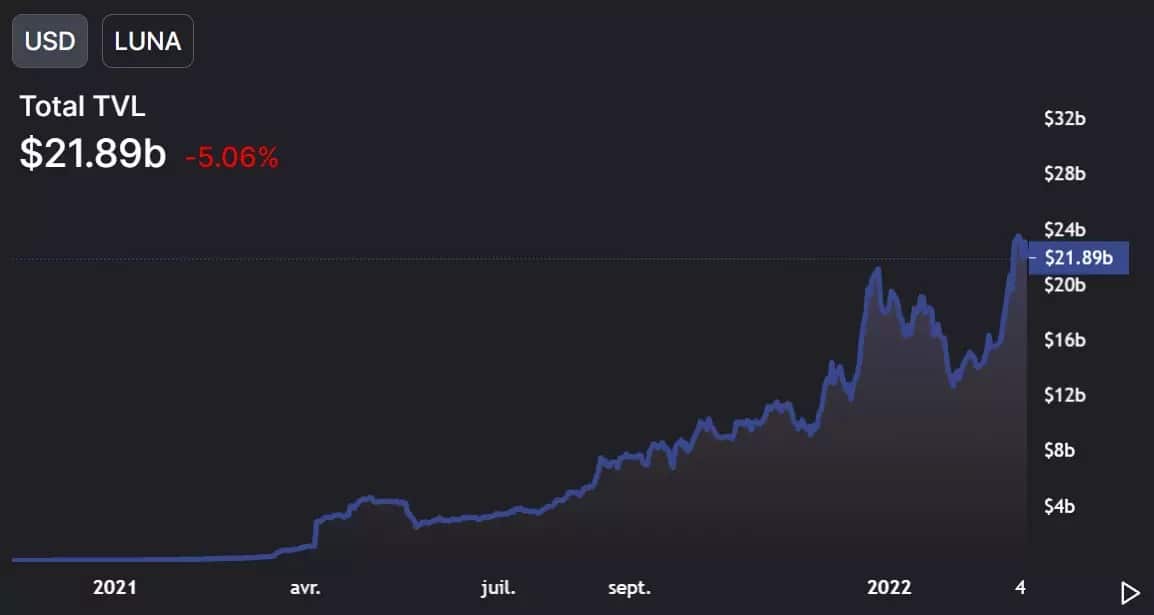

Figure 1: Terra’s TVL growth over one year

This TVL, now valued at nearly $22 billion, is in line with the rise in the LUNA price, which is outperforming at the start of the year.

Figure 2: LUNA-USDT price

This is a healthy asset that is notably driven by announcements such as the recent UST, the platform’s algorithmic stablecoin. Indeed, the Luna Foundation Guard raised a billion dollars in Bitcoin (BTC) at the end of February to improve the stability of the UST.

An increase to be put in perspective

Of course, this progress against the competition is quite notable, but it should be put into context. Firstly, even though the Terra ecosystem is in second place, Ethereum (ETH) is still far ahead with $107 billion in TVL, or 5 times more.

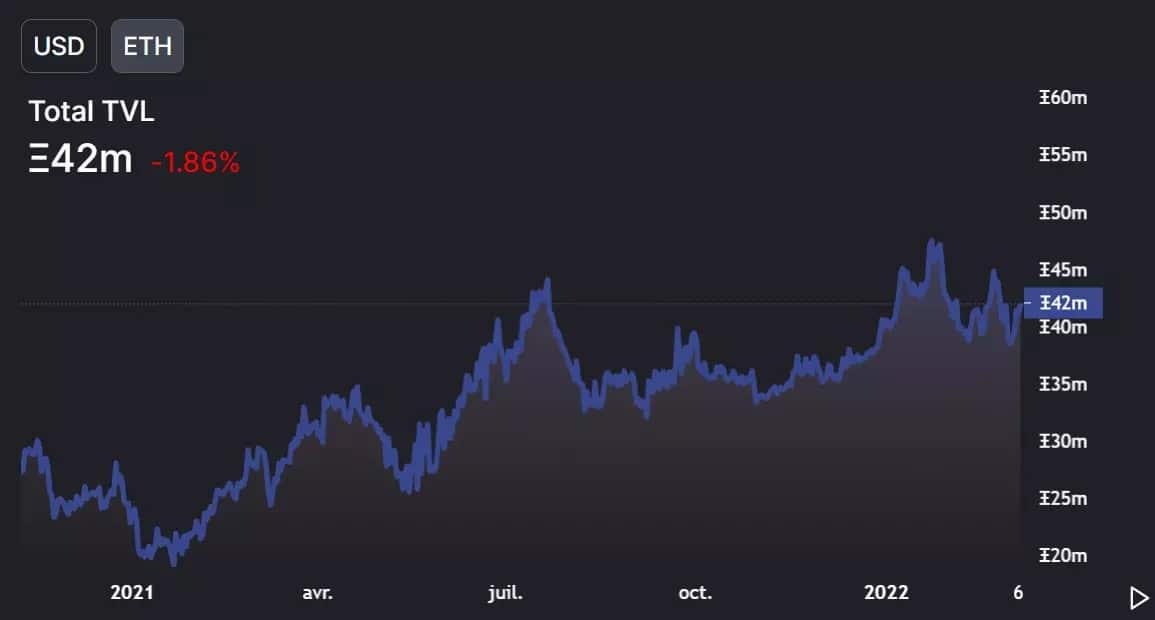

Let’s take a look at this locked-in value progression from the perspective of the quantity of cryptocurrencies:

Figure 3: Amount of ETH locked to DeFi protocols

With 42 million ETH from TVL, there has been a relatively linear increase over the past year. This is in contrast to the increase in the number of locked LUNAs.

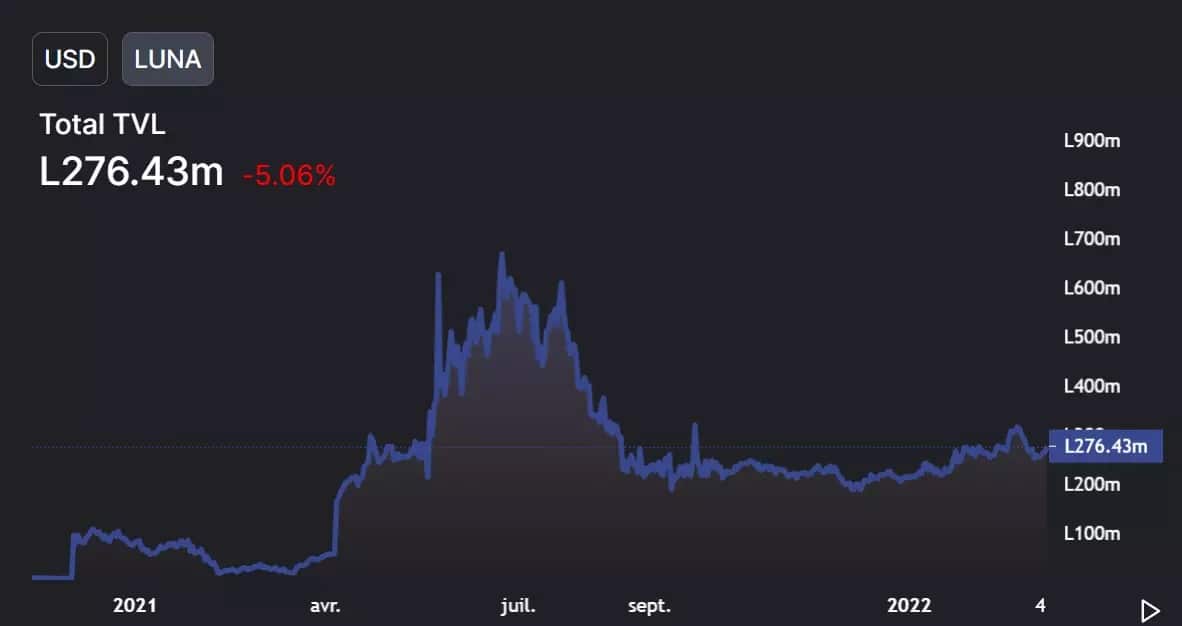

Figure 4: Amount of LUNA locked on DeFi protocols

In comparison, the increase in the number of LUNAs is much more random, implying that its rise in the rankings is mainly due to its valuation. Although it should be borne in mind that the token may be burned to support the UST, and thus become deflationary.

Figure 5: LUNA burned (blue) vs price (white)

It can be seen from the above chart that the deflation argument has limitations in explaining the small increase in LUNAs locked to DeFi applications. Indeed, since February 10, only 9% have been burned while valuation has climbed 48%.

After peaking at 315 million on 21 February, the number of UNLs is now at 257 million, a 16% increase since the same date on 10 February.

Terra’s second place in the DeFi rankings is largely due to the value of its token. But of course, it must be recognized that if this one sees its price increase, it is precisely because the users find an interest in the ecosystem, that does not take anything away from the merit of the progression of the blockchain.