After a $45 million penalty last month, Nexo is shutting down access to its Earn Interest product for US users. Other customers of the platform are not impacted.

Nexo is reviewing its Earn Interest product policy

After a $45 million penalty last month following a run-in with the Securities and Exchange Commission (SEC), Nexo has announced the end of its Earn Interest product for US users.

This will take effect on 1 April and those affected are advised to take the necessary steps as soon as possible. This decision also applies to Nexo’s credit service, although it is stated that US users will be notified in due course, they are nonetheless required to repay their debts.

For all other Nexo customers, the application will continue to offer all its features. Moreover, it is stated that if a user has been wrongly identified as a US resident, they are invited to repeat the Know Your Customer (KYC) verification process, by contacting customer service.

A clear lack of transparency

While the SEC is going on the offensive with cryptocurrency platforms, and in particular regarding staking services, it is worth differentiating the latter from the Nexo case.

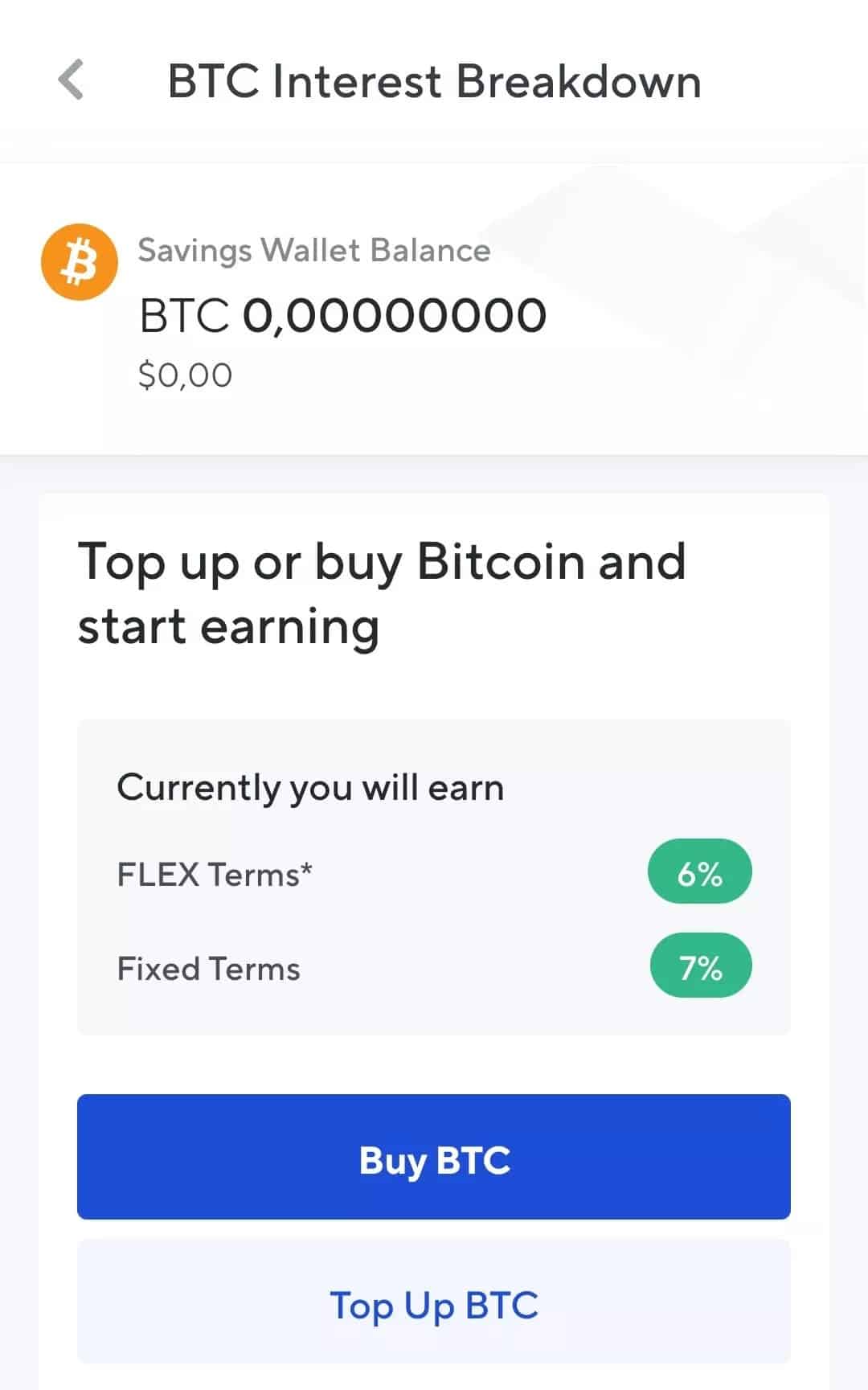

And for good reason, the fact is that Nexo lacks transparency on how the promised interest is generated. For example, it is fundamentally impossible to offer 7% on Bitcoin (BTC) through staking, and it is not presented as such:

Interest offered by Nexo on Bitcoin

Nexo offers similar or even higher interest rates on many cryptocurrencies. In addition, receiving said interest in NEXO tokens allows you to accumulate an additional return.

While the manner in which this performance is generated is not formally identified at first glance, it is likely that customer assets are converted and distributed across various lending products in order to maximise returns. If this is the case, it should be noted that such practices have led to bankruptcies such as Celsius, although Nexo claims to over-collateralisation of its loans.

It is then a matter of differentiating these products, which may indeed be similar to financial securities, from staking services, which operate in a completely different way. Although the White House called for more regulation earlier this year, it will be necessary to differentiate between legitimate SEC interventions and those that seem less so.