If the FTX affair has shown one thing, it’s that the adage “Not your keys, not your cryptos” is more appropriate than ever. As FTX users have their funds frozen, with little hope of getting them back, the panic is spreading to other services. Centralized exchange platforms have seen massive withdrawals by their users. Focus on

Massive withdrawals from exchange platforms

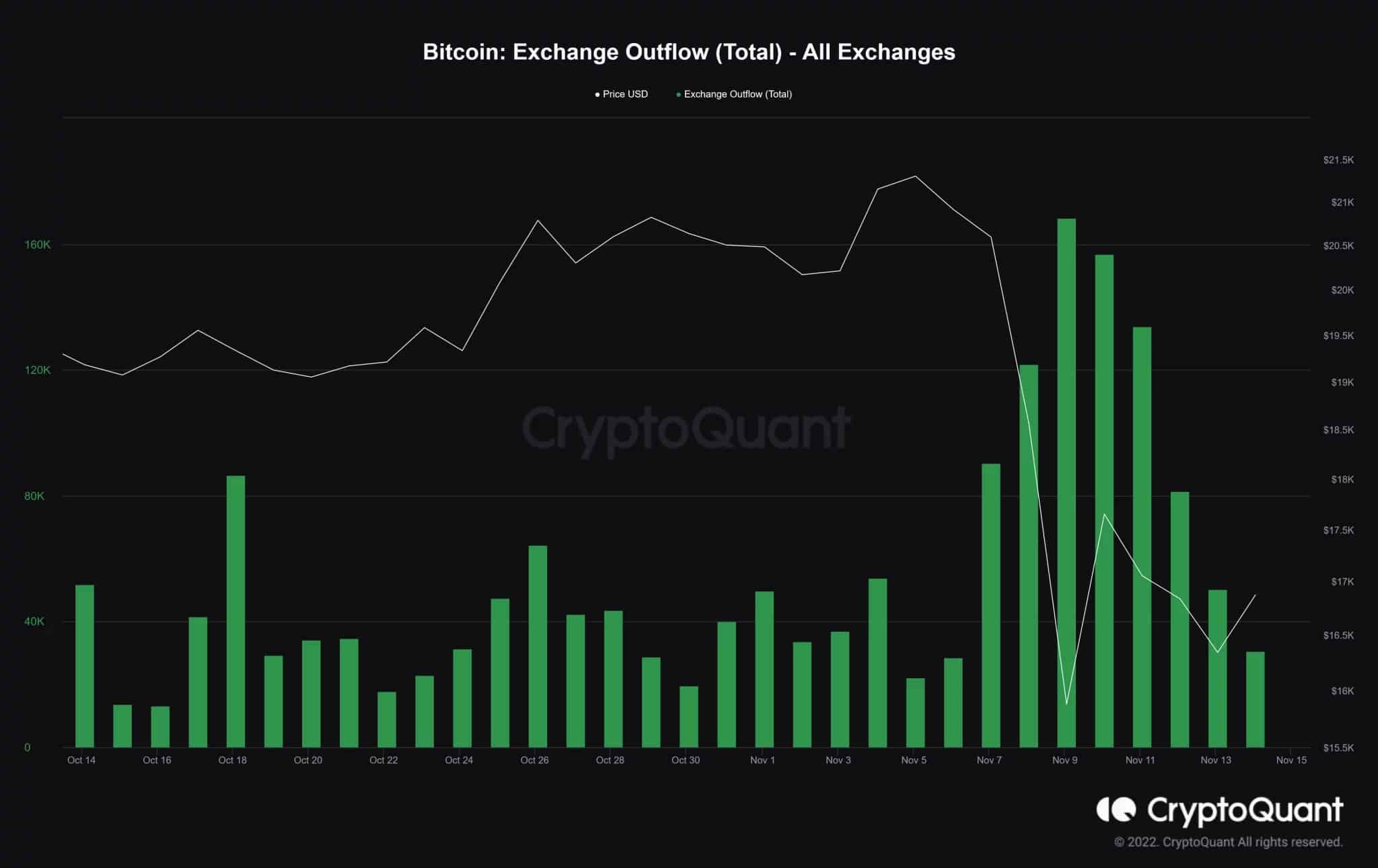

The trend is visible on all trading platforms, with massive withdrawals triggered around 7 November, when the first signs of the FTX affair were felt. Since then, users have continued to transfer their funds, contributing to the general panic.

According to data published by CryptoQuant, Bitcoin withdrawals from platforms peaked on 9 November, with over 168,000 coins withdrawn. This equates to over $2.6 billion, as the BTC price hit a low:

BTC withdrawals soar in wake of FTX case

For Ether (ETH), the trend is the same. On November 9, 1.3 million ETH were withdrawn from the exchange platforms, which corresponded to a sum of 1.4 billion dollars. Some of the reported money is of course from FTX, before withdrawals were blocked for users.

Transparency a tool to stop the bleeding

What options do trading platforms have to stop the bleeding? With the ecosystem in the midst of a crisis, and waiting to see if other large companies will be affected, regaining investor confidence is proving to be a challenge. As several commentators have pointed out, the fall of FTX should serve one purpose: to make the operations of exchanges more transparent.

Already, Binance has taken the lead in inviting other platforms to reveal their withdrawal addresses (and in the process showing a substantial reserve of over $70 billion). All the major exchanges have issued a statement saying they have no liquidity problems

But can the community believe them, when Sam Bankman-Fried was denying any liquidity problems days before FTX’s collapse? It will take hard data to reverse the trend. The proof of reserve systems used by Kraken and soon Binance seem to be a way to prove the reliability of exchanges.

However, regaining the trust of the ecosystem will certainly take a long time. Not to mention the waves of regulation that are likely to follow, as institutions have already started to look into the matter. The fall of FTX is therefore only the beginning of a period of great uncertainty