FTX has obtained authorization to sell its stakes in Grayscale and Bitwise to raise funds to reimburse customers affected by the platform’s problems. The assets in question, including Grayscale GBTC, are currently valued at around $873 million. One step closer to reimbursing FTX customers

FTX may sell assets to continue raising funds

FTX, the cryptocurrency exchange under the leadership of John Ray III for almost 1 year now, has received permission to sell its affiliated assets to Grayscale and Bitwise with a view to continuing to raise funds to reimburse the platform’s aggrieved customers.

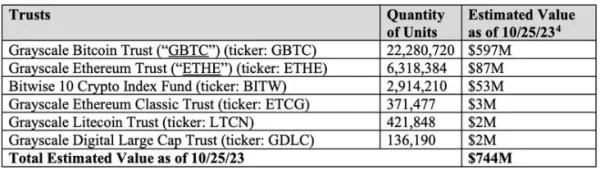

According to court documents, FTX intends to sell the assets in question so as to impact the cryptocurrency market to a lesser extent. It should be pointed out that, according to the documentation submitted, FTX has obtained authorization to sell its shares in GBTC, ETHE, BITW, ETCG, LTCN and GLDC, shares purporting to represent the actual price of cryptocurrencies.

The GBTC, for example, which corresponds to the ticker of the Grayscale Bitcoin Trust (the world’s largest crypto fund), works by holding Bitcoin and issuing shares representing a certain quantity of BTC. Investors can buy these shares on the open market, giving them indirect exposure to the Bitcoin price without having to buy and store the cryptocurrency themselves.

As we can see below in this capture, the total assets that can now be sold by FTX were worth $744 million last month. However, with the GBTC having moved significantly closer to its net asset value (NAV), namely Bitcoin, the assets held by FTX are now valued at around $873 million.

Screenshot of the court documents authorizing the sale of the assets involved

According to the latest reports, FTX’s new management team has managed to raise around $7 billion with a view to reimbursing the platform’s former customers who lost funds. Of this $7 billion, around $3.4 is still held by the exchange in the form of cryptocurrencies, so this value is bound to fluctuate.

According to a calculation from last June, around $8.7 billion will be needed to reimburse all affected FTX customers. Last month, FTX placed 5.5 million SOL (Solana) tokens in staking, with a view to increasing the value of its crypto portfolio, now co-managed by Galaxy Digital under the previously established court agreement.