A consecration for Ethereum (ETH)? The network has moved more money than Visa over the course of 2021, and is now well ahead of Bitcoin (BTC). We take a look at the reasons for this meteoric rise.

Ethereum’s transaction volume exceeds Visa’s in 2021

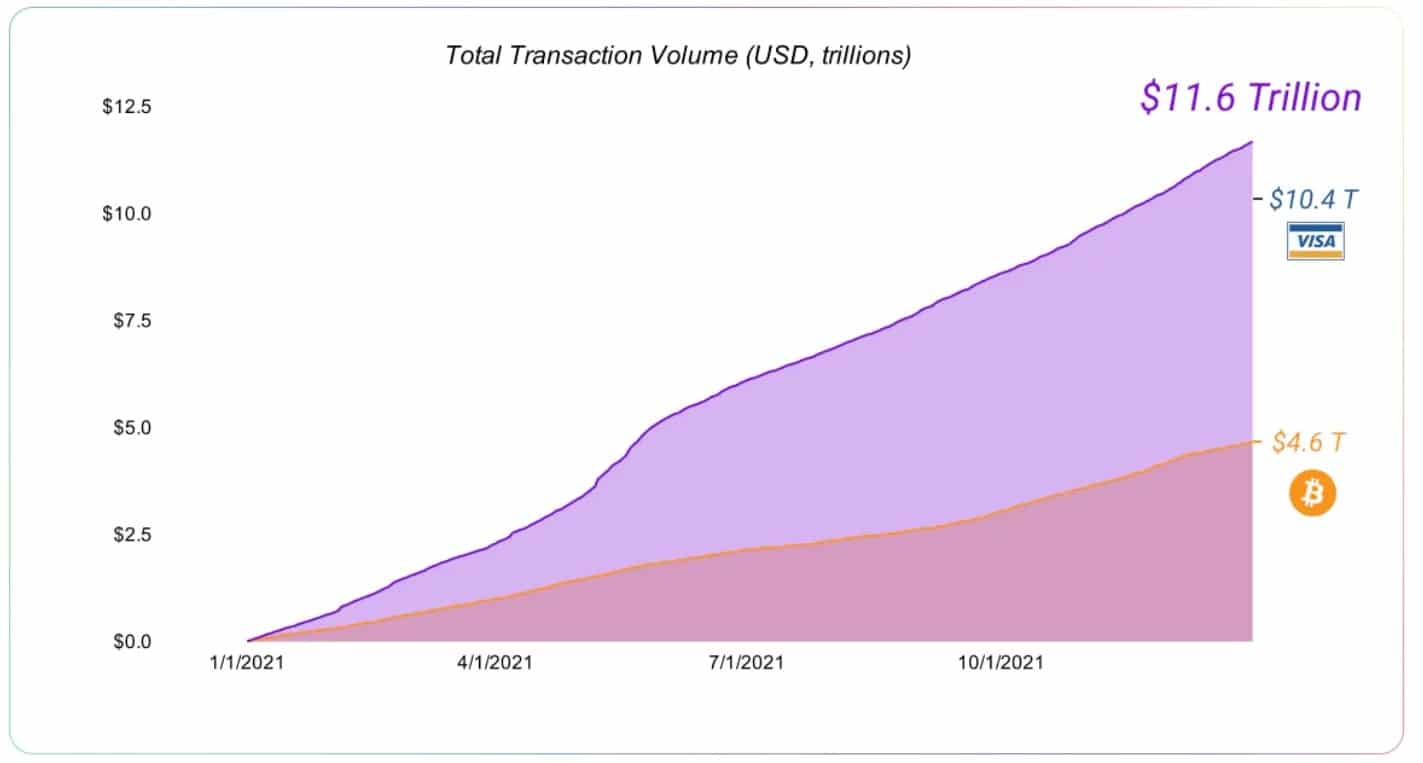

As a reminder, the Ethereum network only surpassed the Bitcoin network in terms of volume processed in mid-2020. Since then, the growth has been particularly rapid: Ethereum has enabled $11.6 trillion to be transited in 2021, compared to $10.4 trillion for the Visa network, according to a report published by Josh Stark, of the Ethereum Foundation:

Figure 1: Ethereum, Visa and Bitcoin transaction volume growth (2021)

The report notes that the actual volume processed by Ethereum is actually higher, with this figure only taking into account major ERC-20 tokens with a transaction volume exceeding $500 million. It is now twice as high as Bitcoin, which in 2021 processed $4.6 trillion.

The reasons for this breakthrough

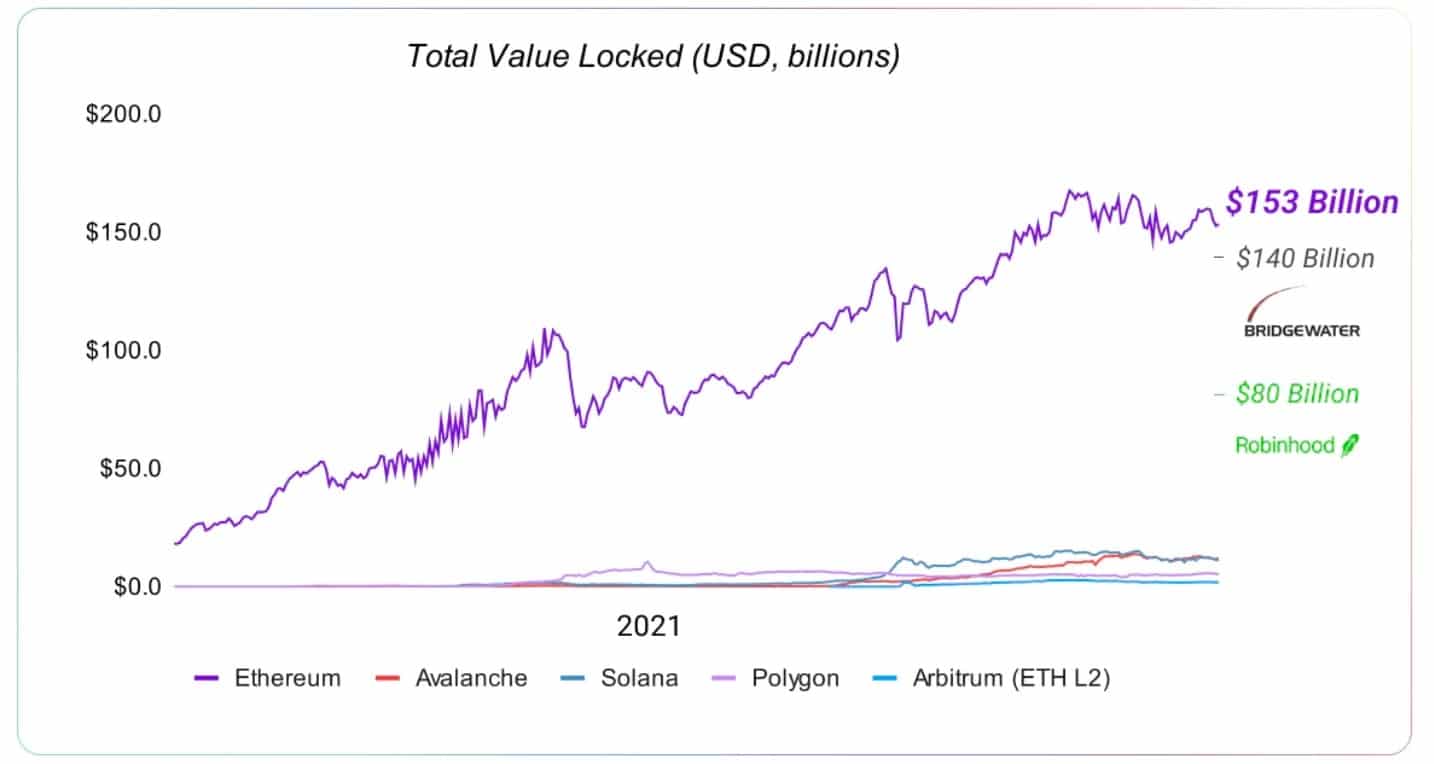

One of the reasons for this breakthrough in the volume processed by Ethereum is of course the explosion of certain use cases, including non-fungible tokens (NFT) and decentralised finance (DeFi). The report notes that the total locked-in value (TVL) on Ethereum reached $153 billion in 2021. This is more than the assets under management of the investment fund Bridgewater Associates, or the financial service Robinhood:

Figure 2: Ethereum’s TVL progression over the year 2021

Recent data published by DeFi aggregator Llama tends to confirm the trend, although it is noted that other blockchains are increasingly present in the DeFi sector:

Figure 3: Other blockchains are starting to make their way into DeFi

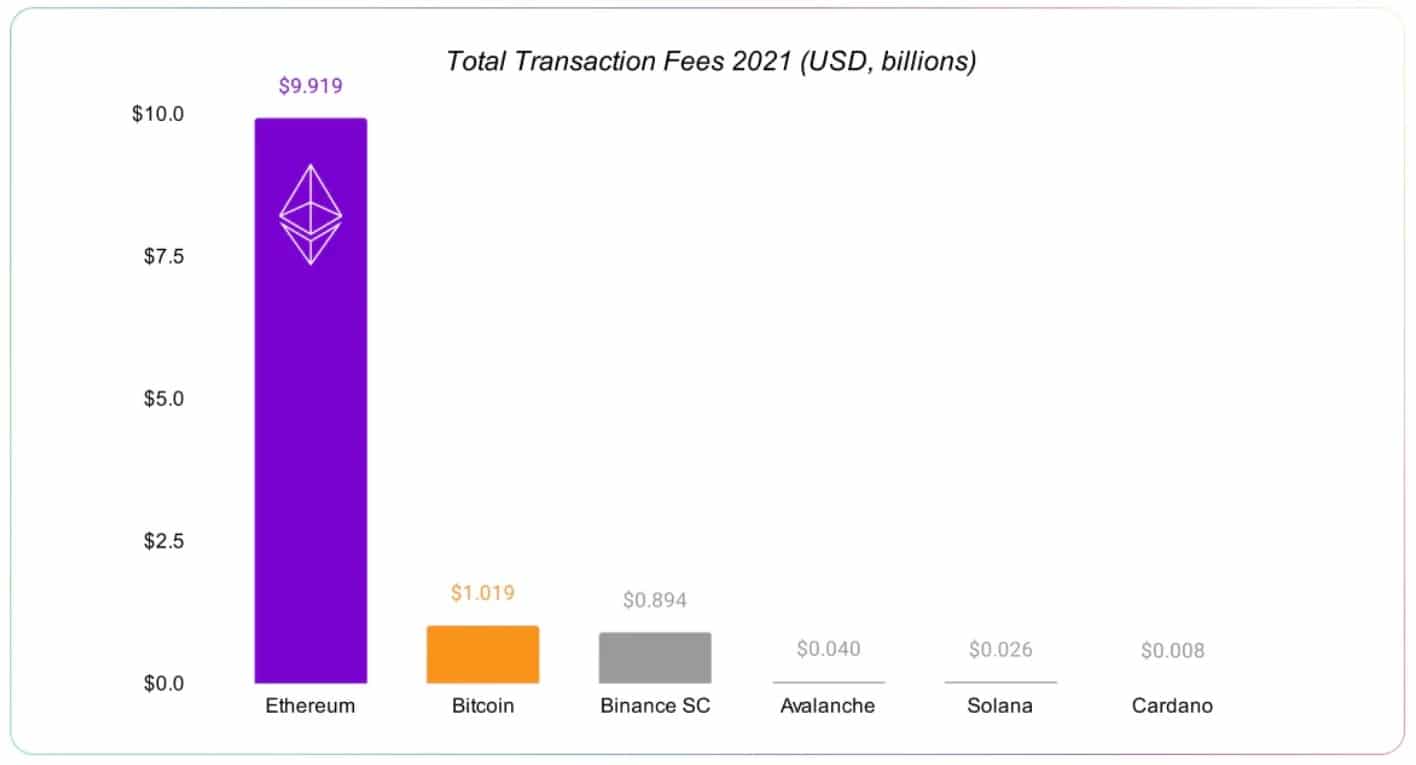

Another important element is transaction fees. They remain high on Ethereum, but that doesn’t seem to be holding back users, who paid $9.9 billion in fees during 2021, compared to $1 billion at Bitcoin:

Figure 4: Transaction fees paid in 2021 for different major blockchains

Comparing Ethereum’s volumes and locked-in values with other sectors shows how much the network has grown in recent months. This can also be seen with the capitalisation of Ether (ETH), Ethereum’s native cryptocurrency. It now trails Visa’s competitor, Mastercard. The latter is currently worth $319 billion, compared to $303 billion for ETH, according to data from Infinite Marketcap.

The next step for Ethereum is of course the long overdue move to proof of stake. Currently, $23.9 billion in ETH is locked into Ethereum’s staking contract, but that’s only about 8% of the supply. So it’s another huge change for investors in the coming months.