With the arrival of the Shanghai update, the behaviour of Ether (ETH) holders is expected to change significantly. We expect an increase in the number of users wishing to deposit their ETH in staking and thus the popularity of Liquidity Staking protocols. Check out the crypto projects to watch as Shanghai approaches

Shanghai propels Liquidity Staking

The Ethereum (ETH) network is just weeks away from the Shanghai update, while liquidity staking solutions are starting to catch the eye of investors. As a reminder, Shanghai will allow users to withdraw their locked Ethers on the Beacon Chain before The Merge.

Logically, these users will want to re-stake their ETH. Indeed, in addition to helping to support the security of the blockchain and the validation of transactions, this will generate an interesting return of around 4 or 5%.

But what are the solutions available to these users? The most obvious would be to follow the ordinary staking process, which consists of creating your own validation node by depositing 32 ETH on the blockchain. Since Ether holders often do not have the funds or technical expertise for this option, they turn to Liquidity Staking.

The best known protocols are Lido, Rocket Pool or Frax Finance. Their advantages are multiple: they remove the technical barrier of entry to staking on Ethereum, but above all they solve the problem of illiquidity of locked tokens.

Indeed, if you stake Ethers, then you can no longer use them: they are illiquid. Whereas when you deposit 1 ETH on a Liquidity Staking protocol such as Lido for example, you receive 1 stETH in return. This token indicates that you have 1 ETH in staking but it can be used in various decentralised applications.

LDO, RPL, FRX: an interesting potential

Currently, only 14% of Ethers are locked in to help run the network, which is much less than other blockchains. There are elements that currently hold users back from participating in staking, including the fear that locked tokens can never be recovered. A problem that will be solved by Shanghai.

In the face of these elements, we can anticipate an increase in the number of users wishing to stage their Ethers. Thus, Liquidity Staking protocols could become more and more popular. Whether it is because of the new Ether releases, or because of the less experienced users looking for a simple solution to earn a return on their ETH, they should see their user numbers grow in 2023.

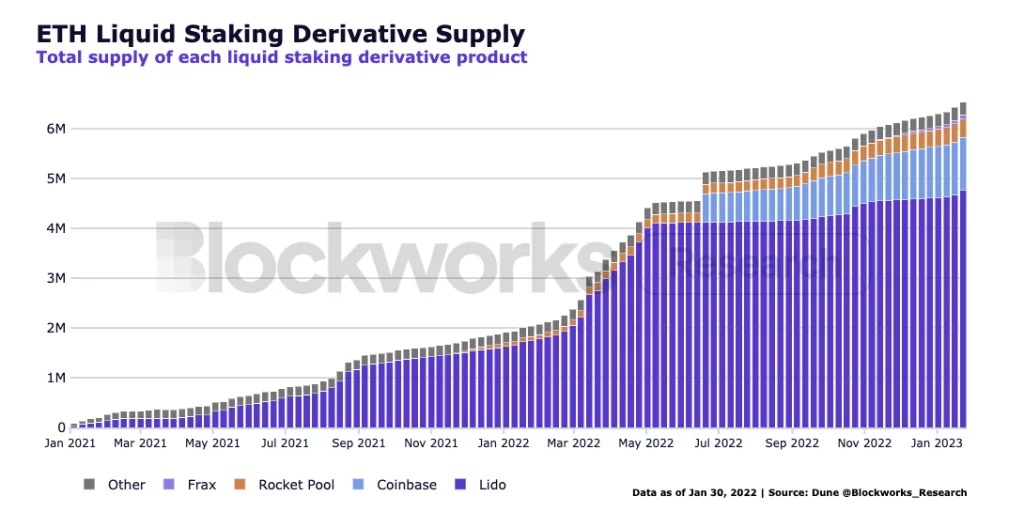

Increase in the amount of ETH locked in Liquidity Staking

As the above figure shows, the trend is already being seen on-chain. It can also be felt on the cryptocurrency market. While Bitcoin (BTC) is up 40% over 2023, tokens in Liquidity Staking protocols are growing even more phenomenally:

- Frax Finance (FXS): 135% ;

- Rocket Pool (RPL): 94%;

- Lido DAO (LDO): 91%.

Note that these are the governance tokens for these protocols. Their interest is simple, since they allow you to receive part of the protocol’s rewards. They therefore represent an alternative way to get exposure to the upcoming trend of liquidity staking.