By overtaking Aave in total locked value (TVL), JustLend this week became the leading lending protocol in DeFi. But are these figures really comparable?

JustLend becomes the leading lending protocol ahead of Aave

This week, the lending and borrowing protocol JustLend operating on the Tron blockchain (TRX) overtook Aave in terms of total locked value (TVL), thus taking the lead in this aspect of the ranking.

At the time of writing, JustLend has a TVL of $5.94 billion, $11 million more than Aave:

Figure 1 – Ranking of lending protocols by TVL

Over all decentralized finance applications (DeFi), JustLend also has the 3rd largest TVL, behind Lido and MakerDao.

Nevertheless, we can ask ourselves how comparable this data is, for a number of reasons.

A protocol massively supported by Justin Sun?

Firstly, Aave is a multi-channel application, operating on networks with a large number of varied applications over which liquidity is distributed. For example, DefiLlama data lists 957 applications on Ethereum (ETH) versus 26 on Tron, of which JustLend accounts for over 72% of TVL.

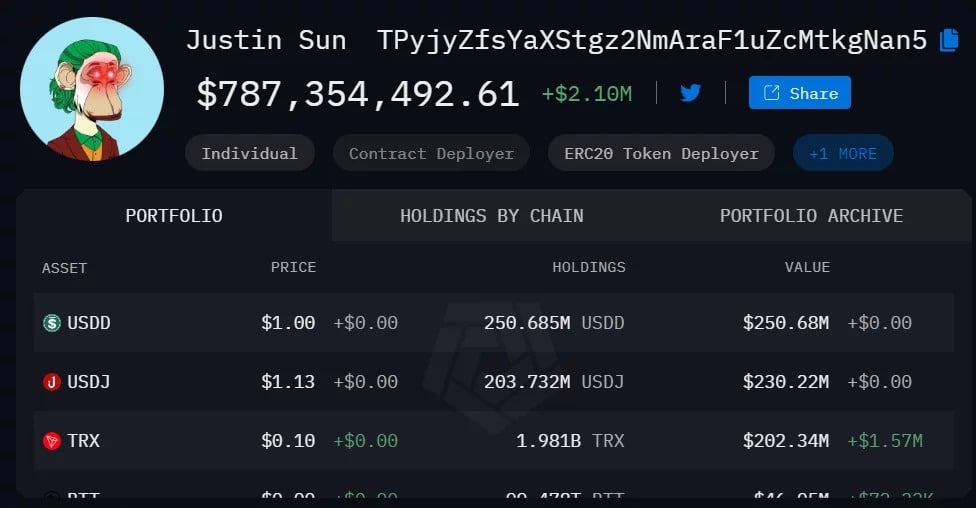

Secondly, it’s worth remembering that Justin Sun, founder of the Tron ecosystem, is also known to be a whale of a whale on the network. In particular, data from the on-chain analysis tool Arkham shows that just one of his addresses holds USDD 250 million in its portfolio, i.e. 34% of stablecoin capitalization:

Figure 2 – One of Justin Sun’s addresses identified on Arkham

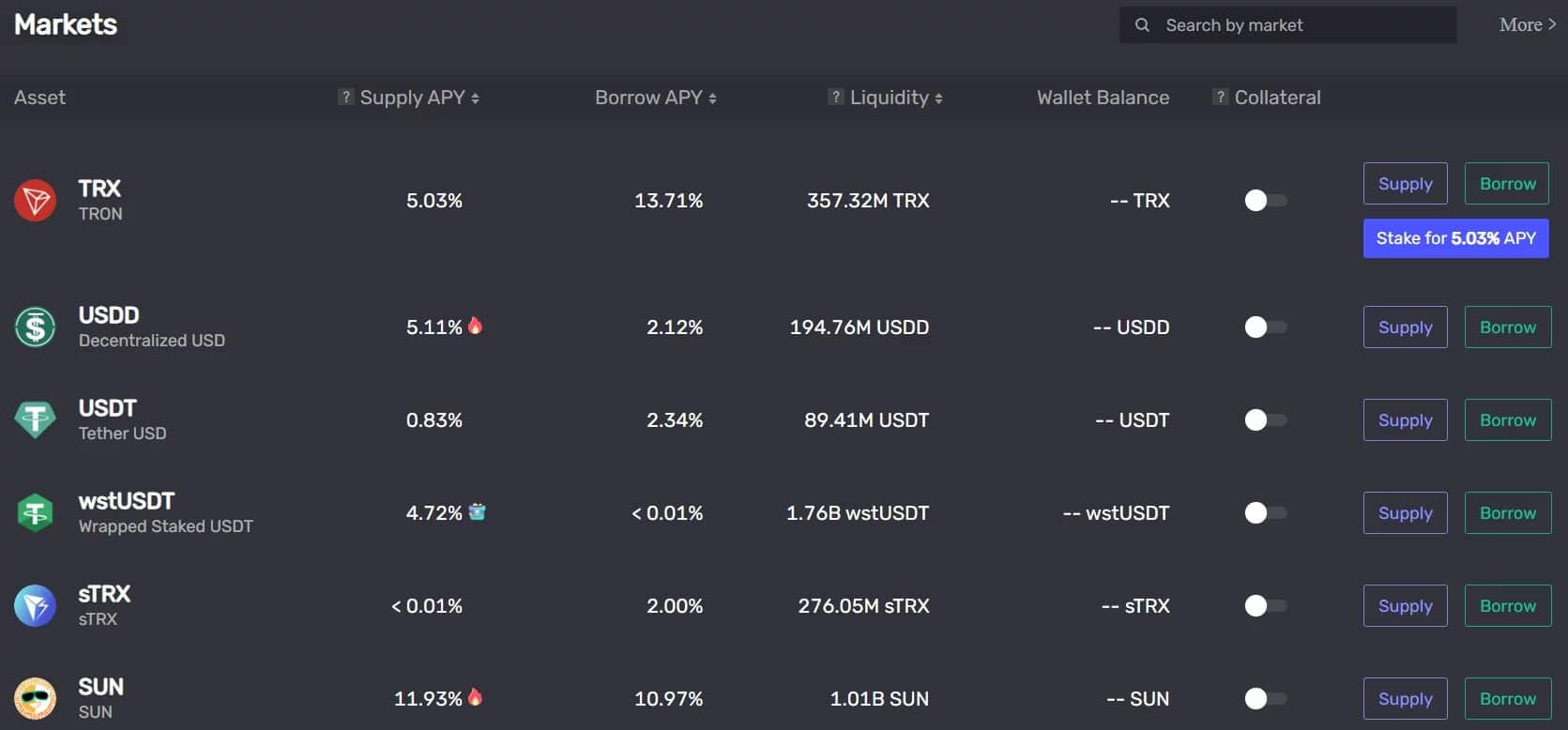

By analyzing this same address on the blockchain explorer, we can see that it holds over 150 million additional USDD, precisely deposited on JustLend. On this single address, Justin Sun thus gathers 55% of its stablecoin capitalization and around 77% of the USDD deposited on JustLend :

Figure 3 – Overview of the JustLend protocol

Similar calculations can also be made on TRX, with 357 million tokens deposited on the protocol, of which 202.7 million are attributed to the interested party.

With $470 million placed on JustLend, a single address identified as Justin Sun’s therefore represents 7.9% of deposits on the application.

This is not to call into question JustLend’s first place in the ranking of lending protocols by TVL, but it is interesting to look at the way in which TVL is composed.

With an ecosystem in full expansion and still under-capitalized, whales can thus hold a strong market share, which can give the illusion of greater adoption than it really is on certain projects.