In a survey conducted by Binance Research, we learn that 88% of institutional investors surveyed say they are confident about the cryptocurrency ecosystem over the next decade. What are the other highlights of this study?

Binance Research presents its survey of institutional investors

According to a survey of 200 institutional investors conducted by Binance Research, 88% say they are confident about the cryptocurrency sector over the next decade. When it comes to the next 12 months, the same metric is more nuanced, although 63.5% are optimistic.

Of the players surveyed, 47.1% have maintained their allocation over the past year, and 35.6% have even increased it. Looking ahead to the next 12 months, half expect to increase their allocation, while only 4.3% expect to decrease it.

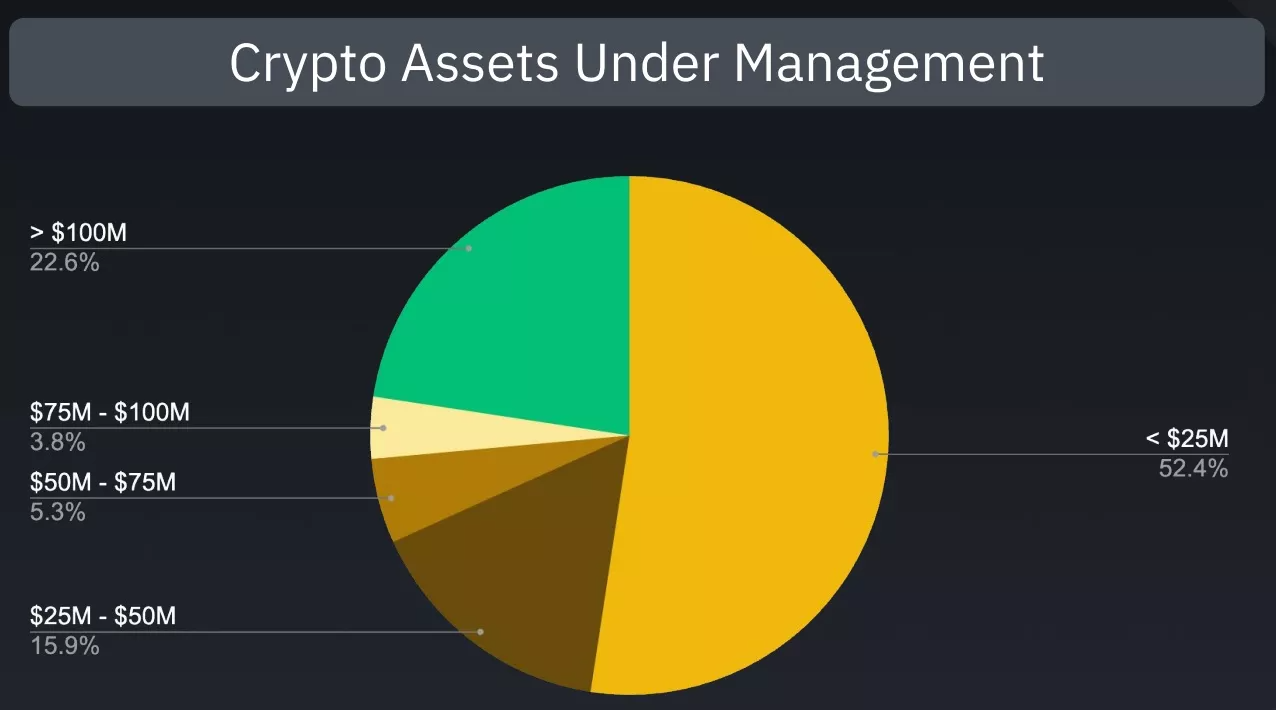

The illustration below shows the amounts invested by these 200 institutional investors. For example, we can see that just over half have less than $25 million under management, while almost 23% have more than $100 million under management:

Figure 1 – Cryptocurrency amounts invested by institutional investors surveyed

These investors have more than 5 years of experience in crypto investing for 48.1% of them and we can also note that it has been less than a year for only 2.4%.

In addition, there are many reasons for taking an interest in the ecosystem:

- Earnings expectancy: 42.8%;

- Willingness to be exposed to technology: 37.5

- Portfolio diversification: 11.5% ;

- The remaining 8.2% are categorised by other reasons.

A variety of exhibition sectors

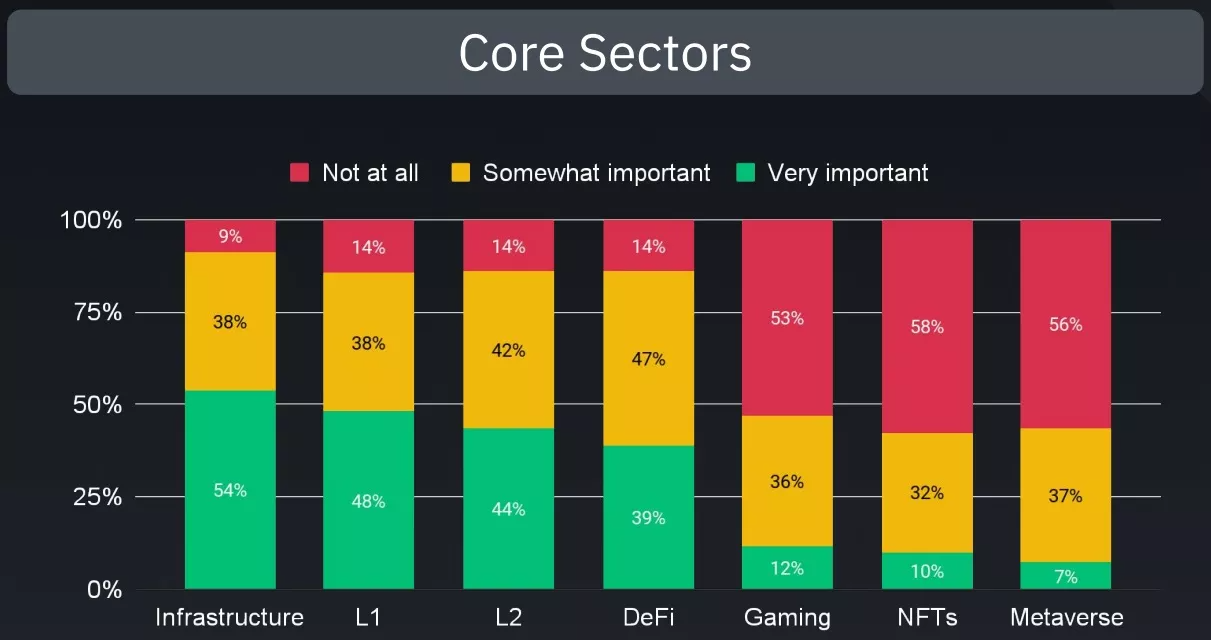

While the cryptocurrency market as a whole remains generally correlated, the sectors are varied and in this regard, we can see that not all are housed in the same boat. And for good reason, respondents will much prefer blockchain infrastructure, layers 1, layers 2 and decentralised finance (DeFi) to a lesser extent, while everything to do with non-fungible tokens and metaverse is left behind:

Figure 2 – Cryptocurrency investment sectors

Among the niche sectors, these same investors attach great importance to wallet-related innovations for half of them, but also to zero-knowledge proof technologies for 27%, and 21% with regard to crypto integrations with artificial intelligence.

Sources of distrust in investments

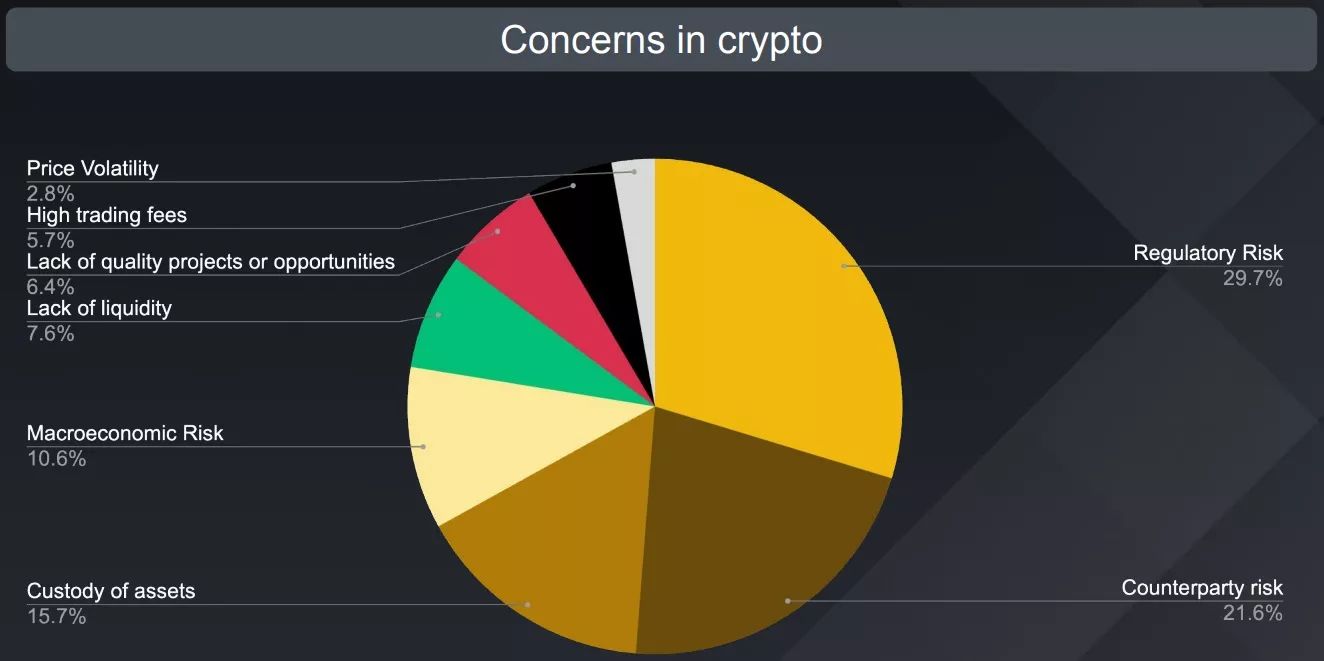

Another interesting point to explore concerns the factors institutional investors are keeping a cautious eye on in crypto. While market volatility is a point that seems to come up a lot, we find that this only worries 2.8% of the population surveyed by Binance Research. Unsurprisingly, regulatory risk tops the list for 29.7% of respondents:

Figure 3 – Sources of distrust among institutional investors in crypto

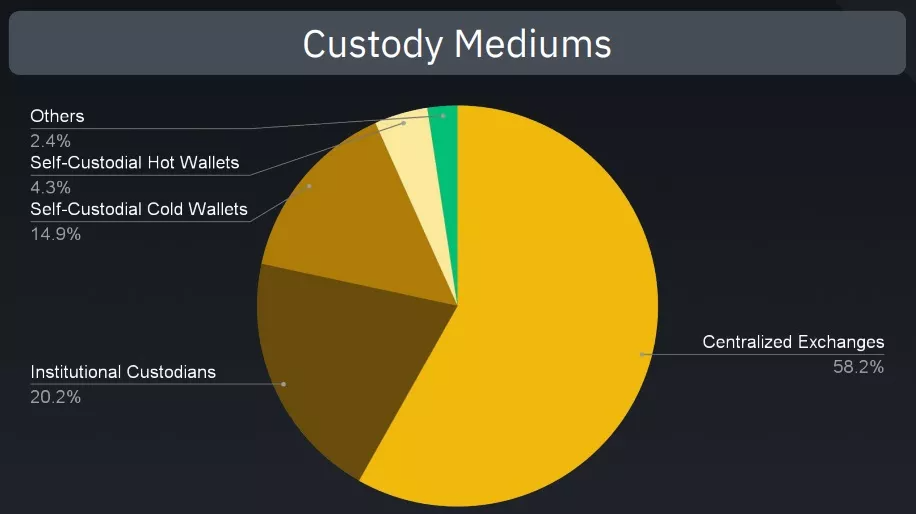

In addition, counterparty risk is also an important consideration for 21.6% of investors, and 15.7% are concerned about the safekeeping of their digital assets. An interesting parallel can be drawn with the way in which these assets are stored, namely 58.2% on centralised exchanges:

Figure 4 – Means of cryptocurrency storage among institutional investors surveyed

On the other hand, we can note that less than 15% of respondents store their assets themselves using cold wallets.