The cryptocurrency wind is blowing strong in South Korea, with the South Korean won recently overtaking the US dollar in terms of volume traded on centralized exchanges (CEX). This trend is largely due to competition between the country’s leading exchange platforms, such as Upbit, Bithumb and Korbit, which are vying to attract users with low or no-fee campaigns.

Cryptocurrencies are all the rage in South Korea

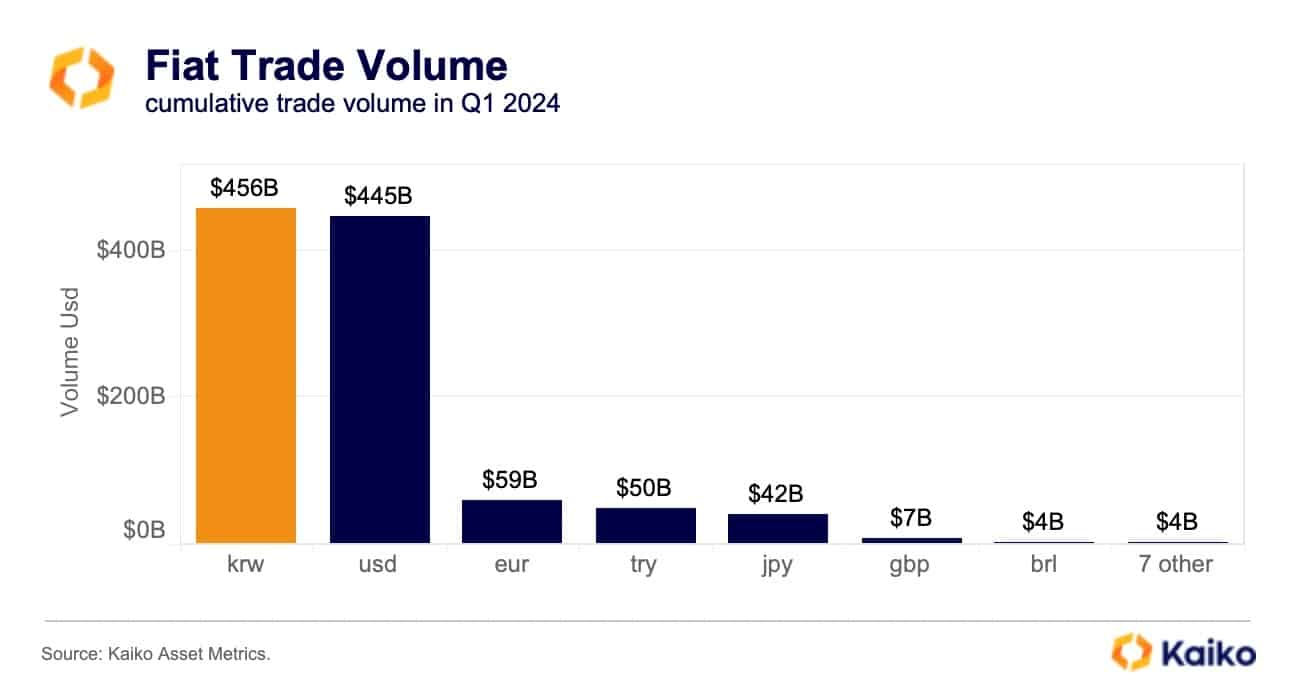

According to recent analysis by Kaiko, the South Korean won has overtaken the US dollar as the most traded currency for cryptocurrency on centralized exchanges (CEX).

The KRW thus overtook the USD on to the tune of $11 billion in terms of trading volumes over the first quarter of the year.

Cumulative trading volume for major currencies in the first quarter of 2024

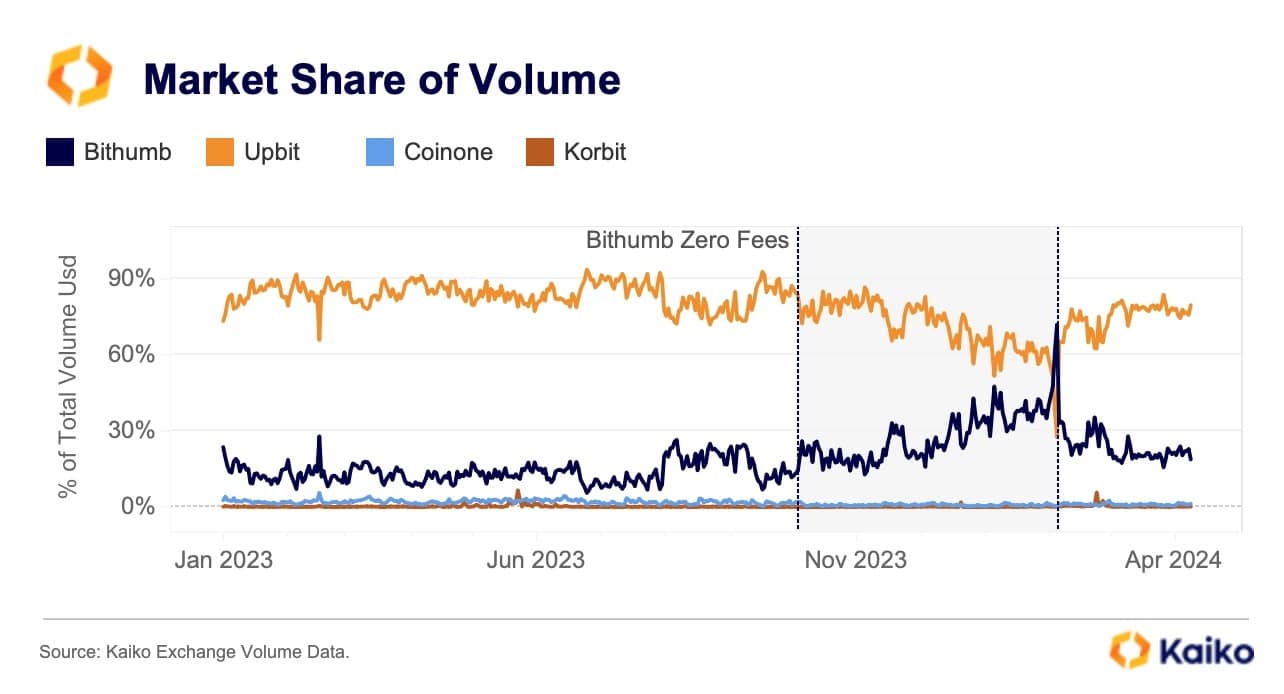

According to Kaiko, these high volumes can be attributed to the competition being established between the various South Korean CEXs.

While crypto exchange Upbit remains the industry leader in South Korea, with around 82% market share over the past 3 years, its main rivals Bithumb and Korbit have launched “0 fees” campaigns on trades made on their platforms in an attempt to reverse the trend.

A policy that has paid off for Bithumb, the cryptocurrency exchange having seen its market share triple after the introduction of zero fees last October.

Even so, Bithumb suffered operating losses to the tune of 14.9 billion won over the year 2023, or around $11 million.

These figures led the exchange to end its 0-fee campaign earlier this year so that it could once again generate a profit on trading operations. However, this led South Korean investors to return to Upbit, and this after Bithumb had managed to capture up to 40% of market share in February.

Market shares of major cryptocurrency exchanges in South Korea

Whatever the case, all this has benefited South Korean investors, who have thus enabled the South Korean won to overtake the dollar in terms of volume traded on cryptocurrencies for at least a quarter.

The South Korean government is expected to roll out new measures concerning cryptocurrency exchanges as early as next July as a consequence of the collapse of the Terra ecosystem (LUNA), which had caused the loss of $40 billion.

These measures include prison sentences for criminal acts, or the obligation to segregate customers’ cryptos from those of the exchanges.

The South Korean government, however, is far from closed to cryptocurrencies. Back in February, the ruling party indicated that cryptocurrencies would not be taxed until at least 2027, in order to contribute to tax relief for South Koreans.

According to Kaiko, the recent approval of the Bitcoin and Ethereum ETFs in Hong Kong could also encourage the development of markets in the Asia-Pacific region.