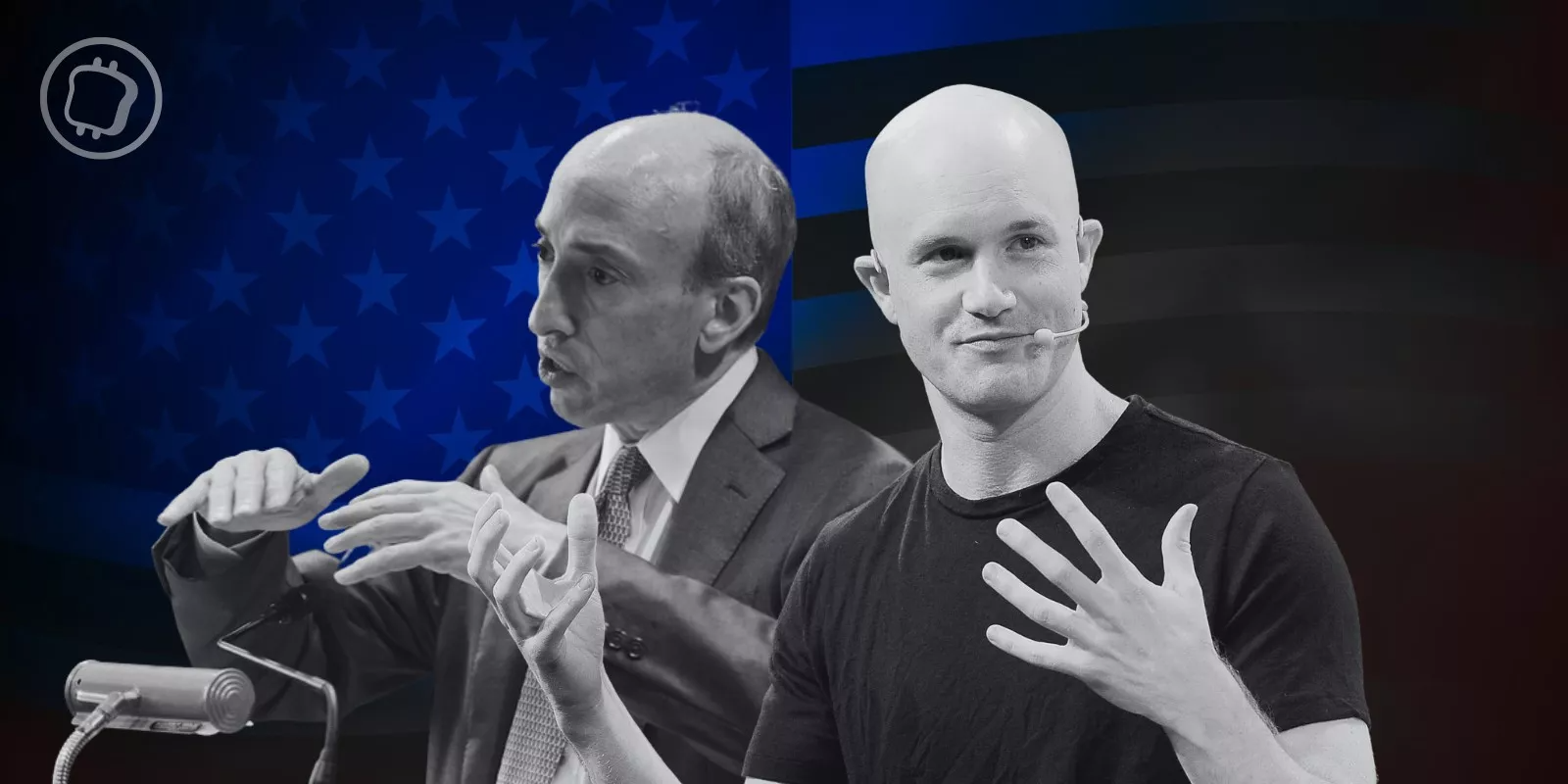

The dispute between Coinbase and the Securities and Exchange Commission (SEC) takes a new development as the regulator claims that the cryptocurrency exchange was fully aware of the laws governing its activities. Coinbase, for its part, refutes the allegations, arguing that regulators do not comply with their own statements and obligations.

SEC responds to Coinbase

New twist in the battle between Coinbase and the US Securities and Exchange Commission (SEC): according to the financial regulator, the cryptocurrency exchange headed by Brian Armstrong knew full well that the laws in force have always been able to apply to its activities.

The document filed by the SEC on 7 July reads:

“

“.

“Since becoming a public company, Coinbase has repeatedly informed its shareholders of the risk that crypto-assets traded on its platform could be considered securities and therefore that its conduct could violate federal securities laws. “

The letter, filed with a judge in response to Coinbase’s latest request, also claims that the exchange is a “multibillion-dollar entity advised by experienced legal counsel that willfully ignores more than 75 years of controlling law under Howey [see: Howey test, Editor’s note],” and that it stubbornly believes it can determine what it believes is and is not a security.

Paul Grewal, Coinbase’s Chief Compliance Officer, has responded to the SEC’s latest allegations in a series of tweets in which he says that the document does not add anything new, and that the regulators are “ignoring their obligation to consider the public interest and investor protection when they allowed us to go public over 2 years ago”. He added:

“They are ignoring their own chairman’s statements 1 month later, made in testimony before Congress, that there are no regulatory authorities applicable to cryptocurrency exchanges like ours. “

Coinbase under the weight of regulatory pressure

According to Piper Sendler analyst Patrick Moley, regulatory uncertainty in the US – which has already all but wiped out Binance.US – would portend major difficulties for Coinbase, at the forefront of US cryptocurrency exchanges in arms with the SEC.

As a result, Mr Moley has cut his rating on Coinbase from “overweight” to “neutral”, expecting the crypto exchange to see its trading volumes and number of users fall to their lowest levels in 2 years.

As we can see below, Coinbase (COIN) shares reacted very positively to the Bitcoin cash ETF application filed by asset manager BlackRock, which named the platform as a partner in its shared oversight agreement.

COIN share performance of Coinbase (Nasdaq exchange)

However, according to the analyst, the combination of the rise in cryptocurrency prices and the announcement of Coinbase as a partner of BlackRock will not have been enough to sufficiently boost trading volumes on the exchange. Thus, “more progress on the regulatory front and a convincing turnaround in the underlying fundamentals” would currently be required to hope for real progress on this front.