After two gloomy weeks, the cryptocurrency market is starting to wake up. Thanks to the strong momentum of the last 24 hours, all of the top 100 cryptocurrencies are in the green. Why has the market climbed 6%? And will this rise be enough to wipe out the losses caused by the affairs surrounding the SEC? The answer in this article.

Bitcoin is waking up, altcoins are still asleep

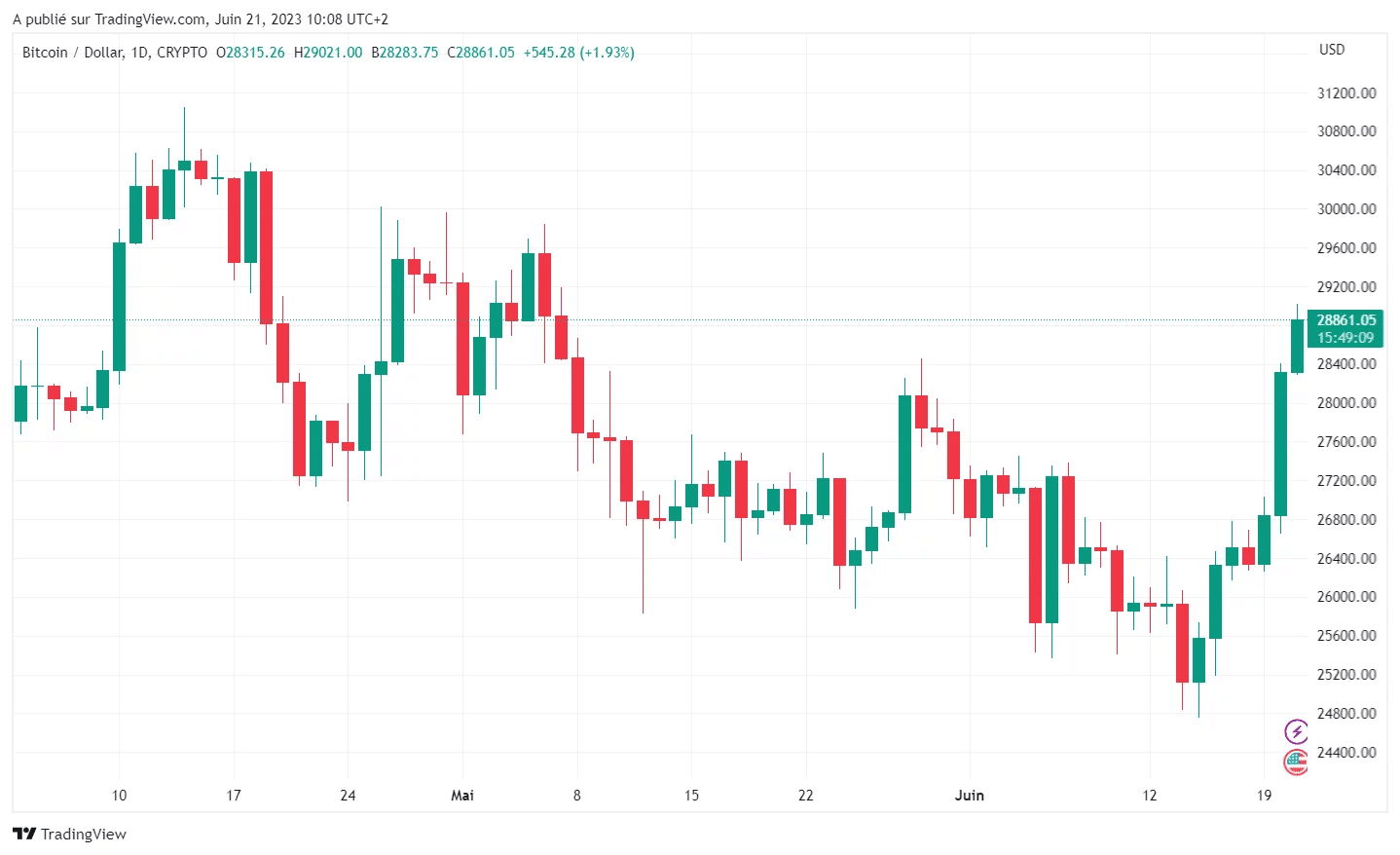

It was a rude awakening for investors in the cryptocurrency market: after a month and a half on a downward trend, the price of Bitcoin (BTC) suddenly climbed to approach the $29,000 mark, a price it had not reached since 7 May. This means that the recent losses caused by the SEC’s legal action are beginning to be offset.

Over the last 24 hours, the king of cryptocurrencies has recorded a 7.8% rise, from $26,700 to $28,800. Similarly, over the last 7 days, Bitcoin has risen by 11.5%

Trading View – Bitcoin (BTC) price between April 2023 and today

As for the other cryptocurrencies, the lights have also been green since yesterday morning: +4.8% for ETH; +3.5% for BNB; +7.7% for ADA; +5.6% for SOL; +6.7% for MATIC.

In the top 100 market capitalisations, excluding dollar- and gold-backed assets, not a single cryptocurrency recorded a loss.

However, the battle is far from over for altcoin investors. Although BTC has managed to rebound from its recent slump, caused by the Securities and Exchanges Commission’s (SEC) recent attacks on Binance and Coinbase, alternative cryptocurrencies still remain at half-mast.

Cryptocurrencies described as “securities” by the SEC have not recovered from the huge losses suffered in the week of 05-11 June 2023:

- At $0.88 per token, the price of MATIC plunged 30% after the SEC’s announcements. It is currently trading at $0.65;

- Staring at $300 at the beginning of the month, the price of BNB had plummeted to $224. Today, BNB has broken through the $250 barrier;

In just a few days, the SOL price had fallen from 22 dollars to 14.5 dollars. The current price is $16.8.

After the rain comes the sun

Despite the SEC announcements, the cryptocurrency market still seems attractive to retail and institutional investors. One of the explanations for today’s rise is the impact of the recent announcement made by BlackRock.

Last week, the world’s largest asset manager filed an application to launch a Bitcoin spot ETF. If approved by the US regulator, this ETF will be listed on NASDAQ, one of the three largest stock exchanges in the US.

After BlackRock led the way, other companies in the financial sector have taken the plunge: WisdomTree, with more than $87 billion under management, has also applied to roll out a spot Bitcoin ETF.

Meanwhile, asset manager Invesco recently reapplied to the US regulator to roll out a similar product. Invesco is one of the world’s financial giants, with around $1.4 trillion in assets under management.

So this renewed interest in Bitcoin from the financial giants is benefiting the entire cryptocurrency market. Is this the start of an uptrend aimed at breaking the symbolic $30,000 barrier once and for all? The next few weeks will be decisive