Despite the decline in the crypto market, the Bitcoin price nevertheless performed better in September than the main stock market indices of traditional finance. Since this summer, the price has tended to show a sideways trend, adding to the argument about a possible low point.

Bitcoin is doing better than traditional finance

At a time when the global economy is expressing a sense of gloom and doom, Bitcoin (BTC) can boast that it did better than traditional finance in September. While its price is not rising, it is interesting to note that it has fared better than the major indices, showing greater resilience over the period analysed.

For example, between the high of September 1 and the closing price at the end of the month, the TradingView BTC INDEX price fell by 3.84%.

Applying the same method to some global benchmarks, we get the following results:

- S&P 500 = – 9.31% ;

- NASDAQ 100 = -10.28% ;

- CAC40 = – 5.11% ;

- DAX = -4.75%.

After a large part of the year when the fall of Bitcoin and other cryptocurrencies was multiplied compared to traditional finance, since September, the asset seems to be stalling. It is now offering a sideways move, supporting the $17,585 low point scenario, the level of which was hit last June:

Figure 1: Bitcoin price

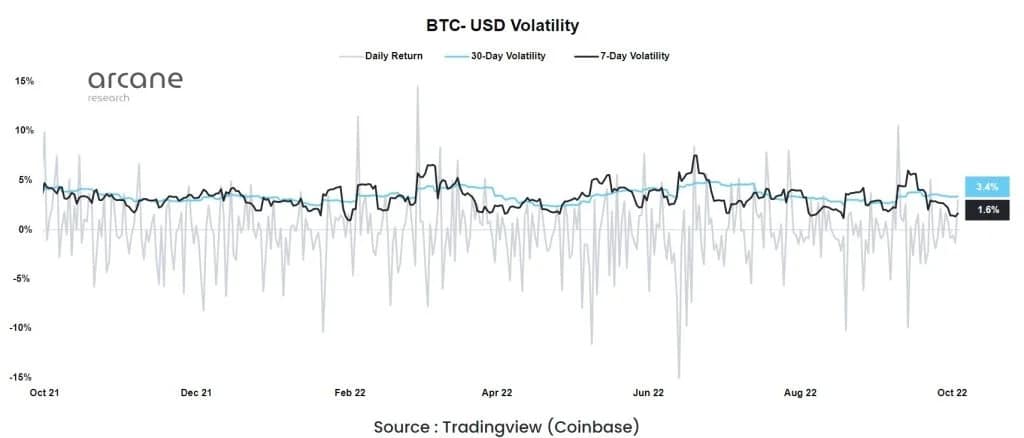

The chart above also shows a sharp decrease in volatility since the successive falls. Arcane Research notes that seven-day volatility has fallen to 1.6%, and that over the past year, it has tended to rise again after such a low point:

Figure 2: BTC volatility over the past year

Has the low point been found at last

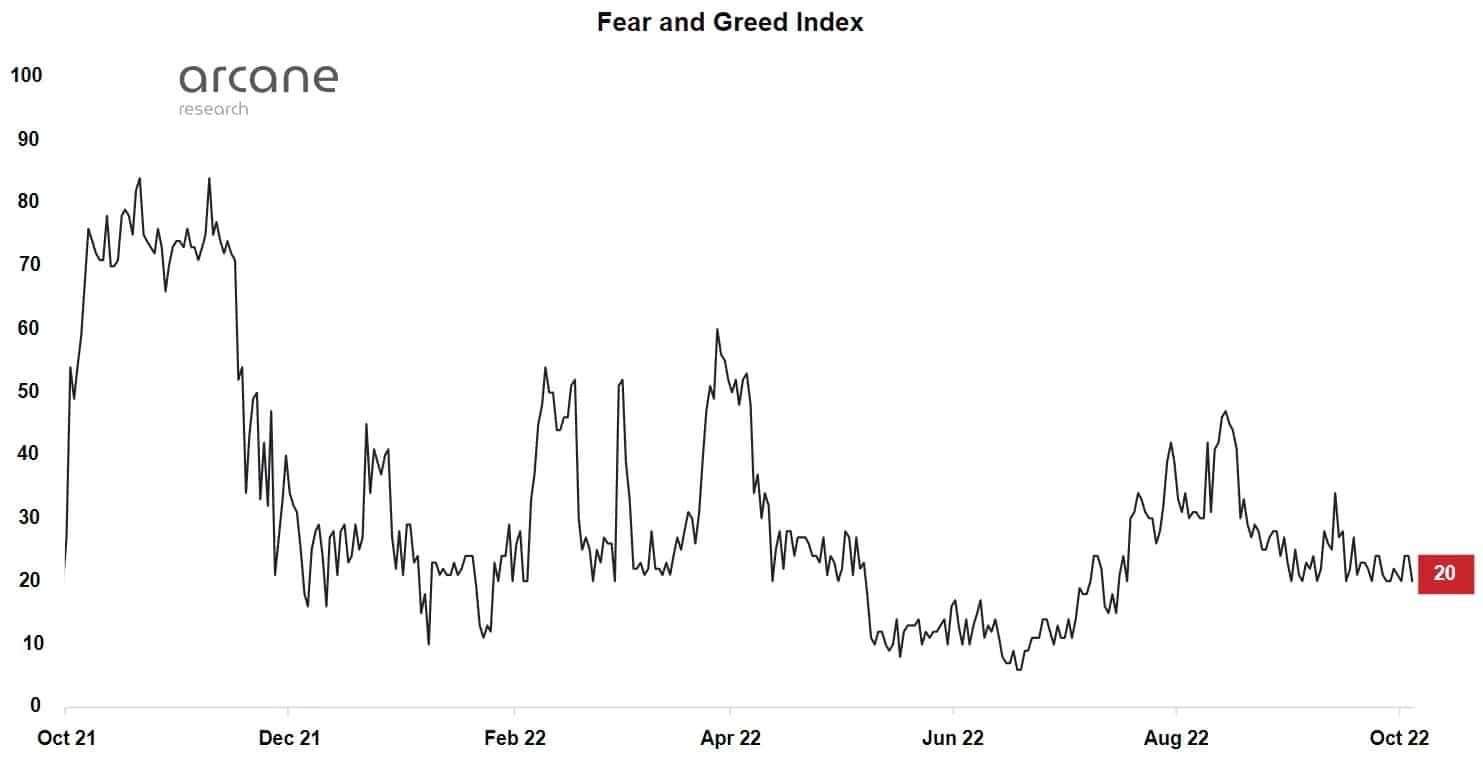

If the “Fear and Greed” index of the crypto market is still at an “extreme fear” level, we can nevertheless notice a stabilization since the panic of the beginning of the summer:

Figure 3: Fear and Greed Index of the crypto market

While there are several indications that this infamous low point is behind us, we should still be cautious. Despite the short-term outperformance against stock indices, the crypto market is still very dependent on the sentiment of institutional players.

War and hyperinflation are still elements that keep the markets under pressure. Thus, financial analyst Vincent Ganne, who speaks Monday to Friday on our private Grille-Pain group, also called for caution:

We’re not going to get a lot of money out of it,” he said. In some countries it is still accelerating. If it were to accelerate in the US in October or November, it doesn’t matter if the US economy creates fewer jobs or if the unemployment rate goes up a little bit, the FED will stay the course. “

In fact, despite all the good news on the crypto market and the technical progress of the various projects, the past has shown us in recent months this dependence on the US economy. Thus, if the FED chooses to continue its hawkish policy, through new key rate hikes, this lull may not last.