Bitcoin miners are among the holders who historically hold on to their BTC, even in times of dearth. But have they reached a phase of capitulation? That’s the opinion of a CryptoQuant analyst, although it may be questioned. We take stock.

Bitcoin miners in capitulation phase

As a reminder, a capitulation occurs when a mass of holders choose to sell their assets, while facing strong selling pressure. As Prof Chaîne explained in his analysis at the beginning of July, market participants have been under this pressure for months now:

The entire market, as well as cohorts of short and long term investors, are in a state of considerable latent loss on their positions. This loss of profitability is causing increased selling pressure that is pushing participants to realise substantial losses, selling their offer to the most resilient investors. “

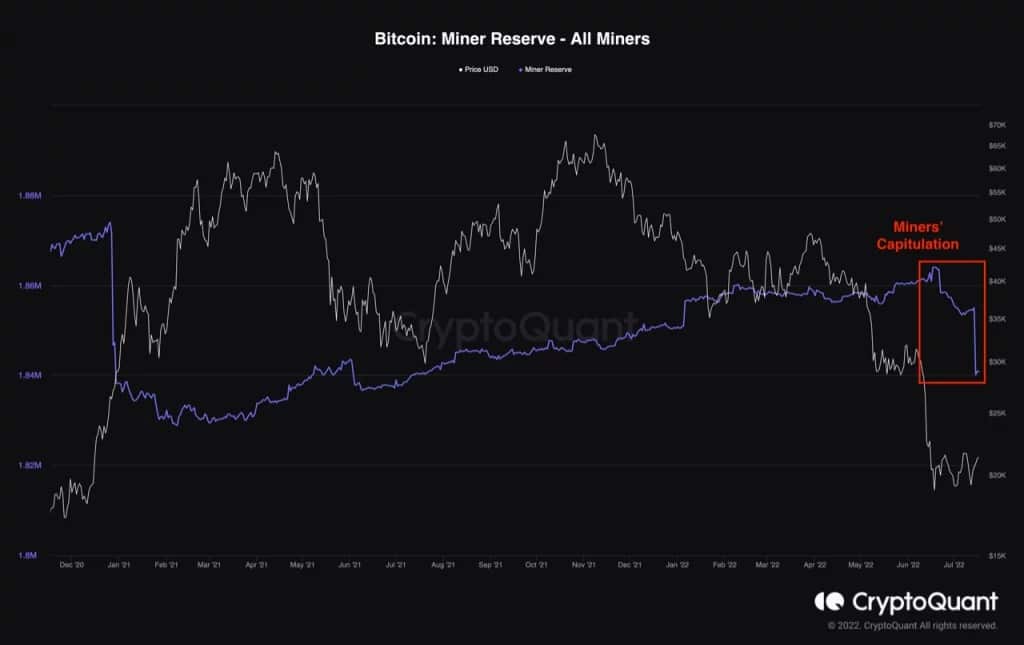

And this seems to be the case for Bitcoin miners, who are gradually giving in, according to data shared by CryptoQuant. As seen in the following chart, miners held on for a while after the last drastic drop in the BTC price, but have started to sell off massively:

Evolution of miners’ BTC reserves versus price

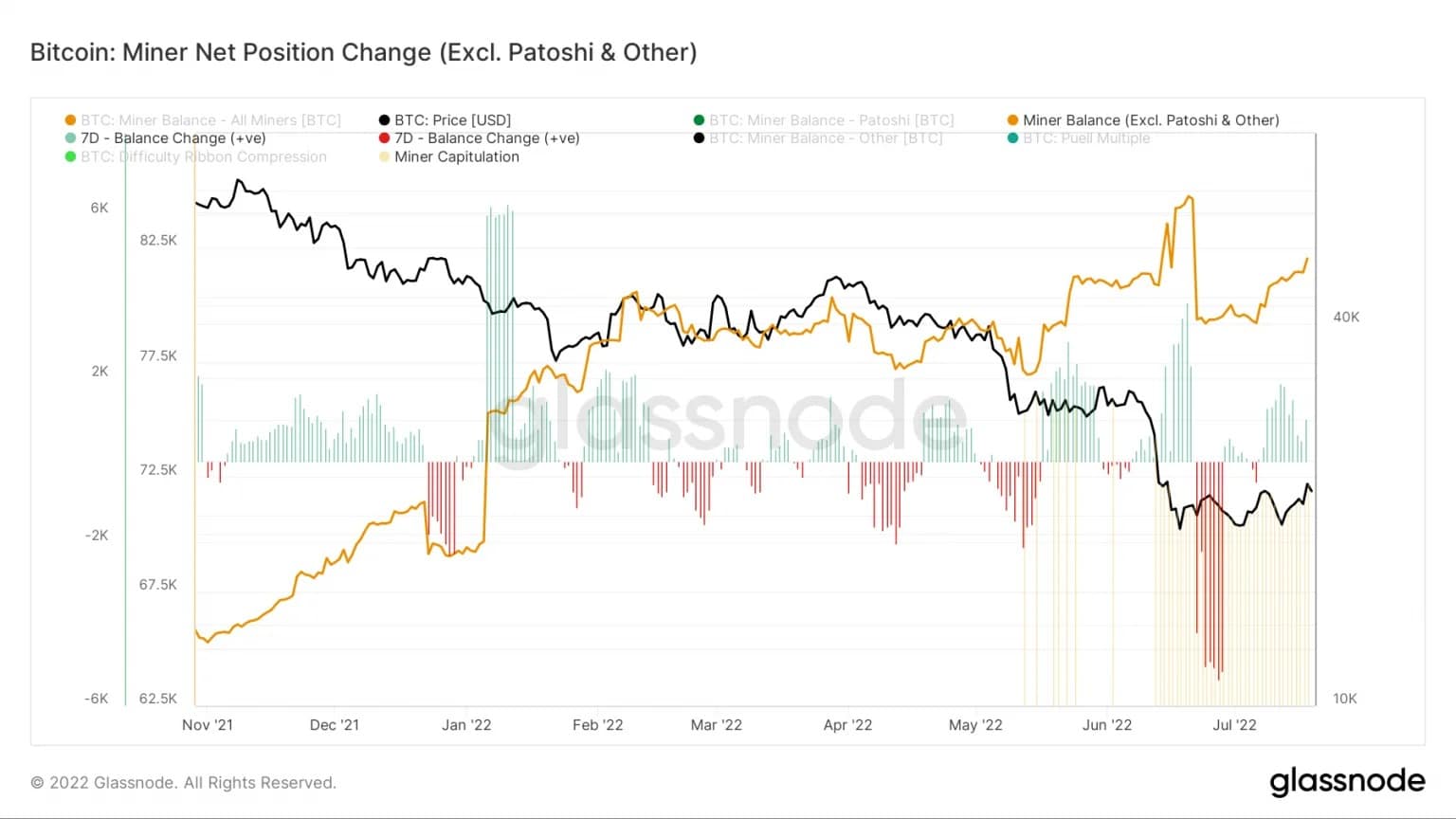

However, this data needs to be measured. According to Cryptoast analyst Prof Chaîne, the trends are not that clear-cut. Based on Glassnode’s data, we do see that miners are under considerable pressure, but we’ve actually seen a slight build-up over the past few days:

“While miners are indeed under pressure due to declining revenue and increasing difficulty in mining, a coordinated sell-off like the one that occurred in June is not observable at this time. Rather, according to Glassnode data, it appears that miners are saving again, as evidenced by the influx of over 3,000 BTC to their wallets in the last 7 days. “

Bitcoin miners change position

What does this mean for the Bitcoin price?

So be careful. If miners decide to sell in a coordinated fashion, it could mean another drop in the price of Bitcoin, which has been flirting with the $20,000 mark for days. But as it stands, this does not seem to be the case.

The question is therefore whether we have reached the bottom of this bear market. Here again, opinions are divided. While some see the rally of the last few days as a sign of renewal for the BTC price, others see it as a trap, with a bottom to come. Wait and see…