Two days ago, an airdrop of ApeCoins, the new token of the Bored Ape Yacht Club ecosystem, took place to reward holders of these non-fungible tokens (NFTs). However, no snapshot was taken to determine who was eligible. This allowed one individual to bypass the airdrop system and collect the equivalent of $1.1 million. Explanation

$1.1 million in ApeCoins… without Bored Ape

We announced it 2 days ago, the famous Bored Ape Yacht Club has released its ApeCoin, its new token to support its entire ecosystem. For the occasion, Yuga Labs, the project team, organised an airdrop to reward holders of Bored Ape non-fungible tokens (NFTs).

A total of 150 million tokens were distributed during the airdrop, representing 15% of the total tokens planned for circulation, amounting to no less than 800 million dollars.

However, contrary to what we usually see during an airdrop, no snapshot was decided by the team. In other words, it was enough to have a Bored Ape at the time of the airdrop to be eligible, it was not necessary to have one over a certain period of time.

So, some smart guy managed to use a ploy to get BAYCs… just long enough to get the airdrop. And for a rather large amount of money: the individual managed to win the equivalent of 1.1 million dollars.

What happened?

First, the individual had to find a vault containing several Bored Apes via the NFTs exchange platform OpenSea. In a simplified way, a vault is a representation of an NFT in the form of tokens. Thus, each token represents a fraction of the base NFT, and it can be sold as a regular token.

The vault in question, which contains Bored Apes 8214, is worth 500 ETH, or $1.5 million at current prices. Our fellow could have bought the NFTs, but it would have cost him a lot of money. So he decided to do otherwise.

He used what is known as a flash loan, a kind of low-cost cryptocurrency loan, a technique used in the Hundred Finance and Agave protocol hacks earlier this week. In order to qualify for the flash loan, however, our man had to use a BAYC as collateral.

With the loan secured, he was able to purchase enough tokens from the vault to use the 5 BAYCs to benefit from the airdrop, allowing him to benefit from five times the reward in ApeCoins, or over 60,500 tokens. The tokens were then sold on the Uniswap (UNI) platform in Ethers (ETH) for a value of $1.1 million. The individual then sold the BAYC used as collateral to pay back the original loan, before walking away with his Ethers in his pocket.

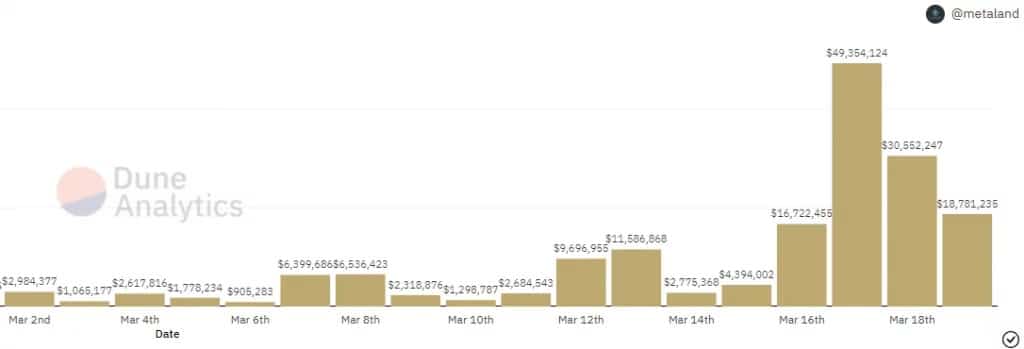

Whether one attributes this to a rather well thought out arbitrage strategy or an airdrop exploit, one thing is certain: BAYCs saw big market movements during the airdrop period, as the chart below shows.

Daily sales amount of BAYC during March

An increase in sales that is precisely due to the lack of snapshots for the airdrop, but which could also have allowed this million dollar breach. In any case, it was necessary to think about it.