Ripple has won a battle with the SEC that has sent the price of XRP soaring. Although this announcement brings its share of positive prospects, it must be qualified: let’s take a closer look.

Ripple wins major SEC battle over XRP

Ripple wins major SEC battle over XRP

On Thursday, Ripple won a major victory in its battle with the Securities and Exchange Commission (SEC) over its native token, XRP. For three years now, the question has been whether or not the asset is a security.

Judge Analisa Torres has provided some answers, rejecting in part the SEC’s request, which means that, in short, XRP is not a security in the case of secondary market trading.

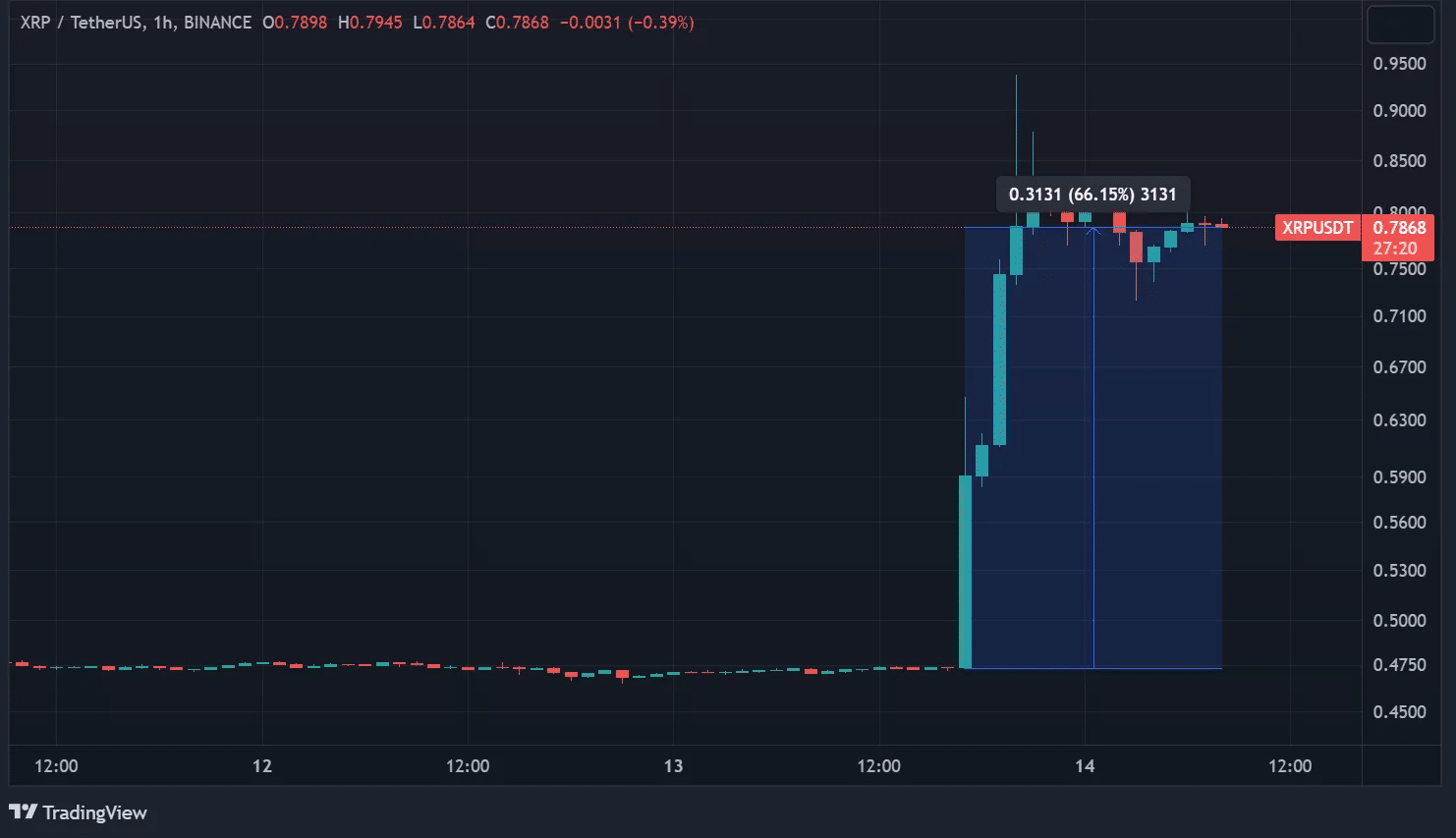

Since the announcement, the price of the asset has surged and is trading up 66% over 24 hours at the time of writing. From around $0.47 on Thursday afternoon, the price of XRP has now reached $0.79 and even briefly exceeded $0.93:

XRP price

In parallel to this court ruling, several centralised exchanges have once again listed the XRP on their platforms, no longer fearing accusations of trading in securities. This is the case for Kraken, Bitstamp, Binance.US and Coinbase, for example:

W.

W for @ripple

W for the industry.

W for the builders.

W for a clear rulebook.

W for updating the system.Oh, and XRP is now open for trading.

– Coinbase ️ (@coinbase) July 13, 2023

A victory with a difference

While Ripple’s victory provides many answers for the ecosystem from a regulatory point of view, it must be qualified. Judge Analisa Torres’ verdict teaches us that whether or not a financial asset is considered a security will depend on how it is presented.

The way in which Ripple has promoted XRP in its various marketing campaigns aimed at institutional investors in the past is far more contentious. For good reason, the future performance of the asset was widely presented as being dependent on Ripple’s success.

The judge clearly considered that the company was not in compliance in this respect:

“

“.

“With respect to the first requirement, the Court has already held that Ripple’s institutional sales constituted the unregistered offer and sale of investment contracts in violation of section 5 of the Securities Act. “

So, there will indeed be a trial on this part of the case, and Ripple may well be sanctioned for violating securities law.

As a result, investors should remain cautious in the face of this rise, whose high volatility could cause harm to investors who indulge in fear of missing out (FOMO).