Venture capital funds have not been particularly enthusiastic about the cryptocurrency sector in recent months. How can this be explained and could the trend be turning around?

Venture capital funds uninterested in Bitcoin and cryptocurrencies

From a price perspective, it’s been a relatively quiet summer for cryptocurrencies. Queen Bitcoin (BTC) has stagnated for the past three months, losing -0.12% over the period… and wiping out any hopes of gains raised in mid-July. Venture capital funds also seem to be losing interest: their investments have reached a low point not seen for two years.

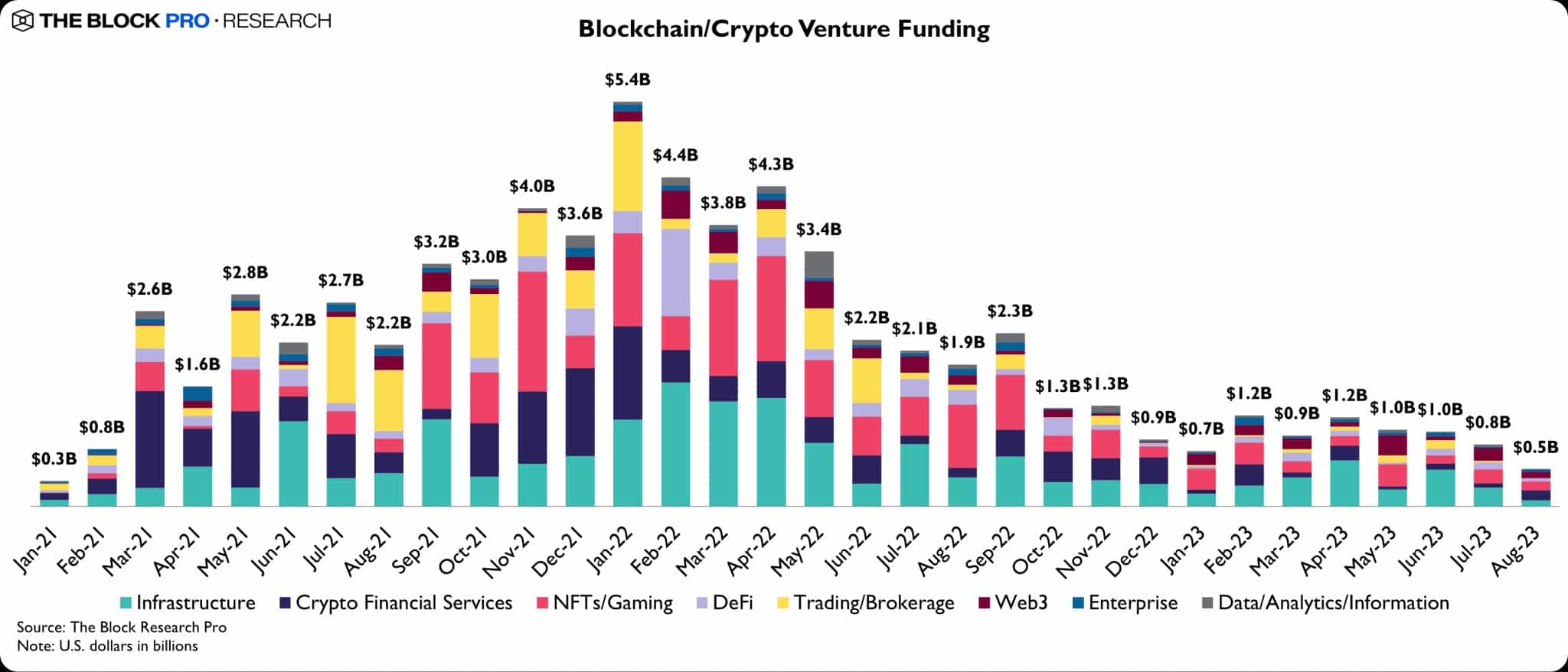

Firms invested “just” $500 million in cryptocurrency-related startups during August. And the trend is not just linked to the summer torpor common at the end of the summer. Last year, the figure had in fact reached almost $2 billion, as analysts at The Block show:

Sharp decline in investment in cryptocurrency companies

It is also noted that for the month of August, investments related to infrastructure services fell sharply, in favour of the crypto services category. In total, this is the fourth consecutive month of decline for this type of investment.

How do you explain this lack of interest?

There are a number of factors that could explain this lack of interest in cryptocurrencies from venture capital funds. Firstly, the bear market environment is obviously influencing the appetite of investors, whoever they may be. Secondly, the ecosystem is still suffering from the many consequences of the fall of FTX. It showed that even the most apparently solidly established companies have no guarantee of lasting.

It should also be noted that there is a general lack of interest: venture capital funds are putting their hands in their pockets less this year, whatever the sector. This can be explained by the broader context of inflation, and the caution surrounding future players in certain sectors, such as artificial intelligence.

All these factors combine to create a wait-and-see environment. One of the things the ecosystem is watching is, of course, whether the SEC approves Bitcoin spot ETFs. If this were to happen soon, it would be a great signal of confidence, which could encourage even the most reticent of venture capital funds to invest.