Inflation down, wages up. That’s the optimistic forecast from the Banque de France, which sees economic constraints easing for individuals between now and 2025. What can we expect?

Banque de France forecasts favorable inflation trends

François Villeroy de Galhau, Governor of the Banque de France, spoke yesterday on France Inter. He made a commitment to the French people to sharply reduce the inflation rate within a year:

“It’s not just a forecast, but a commitment: we’re going to bring inflation down to 2% by 2025 at the latest. “

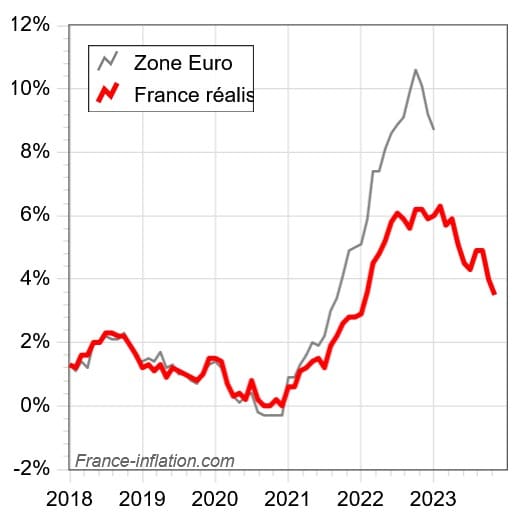

The Governor of the Banque de France points out that inflation has already slowed significantly over the course of 2023, from 7% at the start of the year to 3.5% today. Growth is also picking up, and this will be sustainable, according to François Villeroy de Galhau:

“We see a sharp slowdown in 2023, but then growth picks up again in 2024 to 0.9%, then to 1.3% in 2025, to reach 1.6% in 2026, and this, because we’ll be out of inflation. “

Inflation trends in France compared with the eurozone

Rising wages, falling inflation

The Banque de France therefore believes that inflation will have slowed sufficiently for wage increases to finally offset it:

“It’s good news: from now on, prices will rise less quickly than wages “

It’s a key issue: the food sector continues to experience rising inflation, which reached +7.8% in November. This is particularly true for fresh produce, where prices have yet to fall. Hence François Villeroy de Galhau’s cautious approach:

“The French economy has fairly solid engines, but it’s a gradual recovery and we mustn’t, of course, claim victory. “

The trend is also visible elsewhere in Europe. In the UK, inflation has just fallen sharply, from 4.6% in October to 3.9% in November. The same is true of Germany, where producer prices fell much more than expected. As for the Eurozone, Euronext confirmed that average inflation was 2.4% for November. Pressure is therefore easing on the Old Continent.