For the first time, the number of USDCs on the Ethereum blockchain (ETH) has surpassed that of USDTs by reaching 40 billion units. USDT still leads in total units in circulation across all blockchains, but the gap between the two stablecoins is narrowing by the day.

USDC outnumbers USDT

Messari predicted it, the market did it. The number of USDCs in circulation has surpassed USDTs (Tether) on the Ethereum blockchain (ETH) and is now over 40 billion total units.

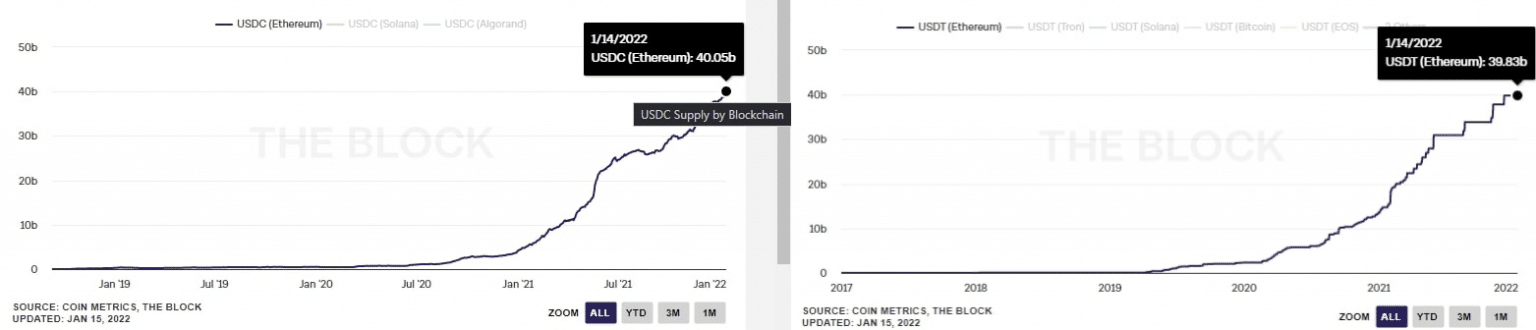

At the time of writing, there are 40.051 billion USDC circulating on Ethereum compared to 39.828 billion USDT.

Both currencies are so-called stablecoins, i.e. cryptocurrencies that are pegged to the dollar at a 1:1 ratio. In short, one USDC or one USDT = 1 dollar.

Investing in stablecoins is becoming increasingly popular as they are much less subject to the volatility of the cryptocurrency markets. This makes them particularly attractive investments in situations such as market downturns.

Units of USDC and USDT in circulation on Ethereum (ETH) (Source: The Block)

USDC and USDT are present on several different blockchains and largely dominate the stablecoin market. It is interesting to note, however, that for USDC, the vast majority of units in circulation are on the Ethereum blockchain. For Tether (USDT) almost half of the tokens are on the Ethereum network.

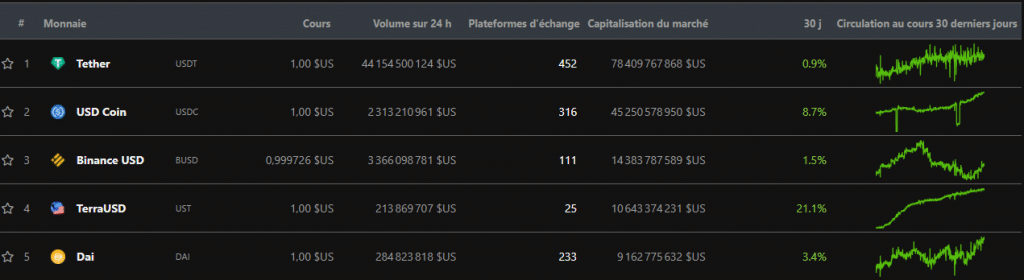

Ranking of stablecoins by market capitalization (Source: Coingecko)

Tether (USDT) remains in first place, however, with a market cap lead of over $30 billion over USD Coin (USDC).

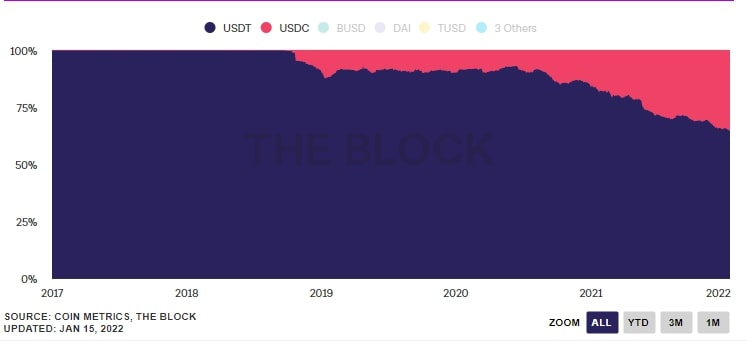

However, as the chart below shows, the USDC continues to grow, and by leaps and bounds.

USDC and USDT market shares (Source: The Block)

The USDC’s gain in ground is not new. Indeed, USDC supply had already more than doubled in two months at the beginning of 2021.

Almost a year later, the USDT accounts for 53.37% of stablecoins in circulation, its lowest level ever. The USDC, on the other hand, is now at its highest level ever, at 29.38%.

The USDT is in troubled waters

Tether was the first stablecoin to gain traction in the cryptocurrency market, as it appeared in the first. However, it has had several legal setbacks and has had several worrying flaws for its users.

In 2018, US federal prosecutors had investigated following suspicions of bitcoin price manipulation with Tether.

The issuing company, Tether Limited, has always claimed that its USDT was backed by the dollar, which is inherently the role of a stablecoin. Except that in 2019, following a legal tussle, the firm’s lawyer had to admit that USDTs were only backed by $0.74. In short, users were guaranteed less than the value of their investments.

To regain the trust of its users and to face the rise of its main competitor, the USDC, the company announced in July 2021 that it would provide a detailed audit of its USDT. And just a few days later, Tether executives were again accused by the US justice system of fraud by concealing large transactions in the early years of the firm’s existence. In October, Tether Limited and Bitfinex were fined $42.5 million, again in connection with the guarantee of the value of stablecoins.

In conclusion, even if Tether has made efforts by working hand in hand with the justice system by freezing addresses, containing USDT, considered as criminal, it will have to act very quickly to regain the trust of its users. To date, more than 500 addresses are frozen, for an amount of several hundred million dollars.