Tether, the issuer of USDT, has announced that it no longer holds any commercial paper in its reserves to back its stablecoin. The company is taking another step towards greater transparency as it has also switched from commercial paper to US Treasury securities.

Tether abandons commercial paper

Tether, the issuer of the USDT stablecoin, has announced that it has completely abandoned commercial paper to back its reserves in favour of US Treasury securities.

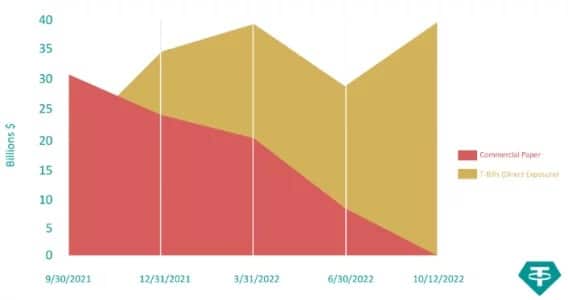

The firm is fulfilling its July 27 pledge to reduce its commercial paper holdings from $3.7 billion to just $200 million by the end of August, before permanently eliminating them “by the end of October”.

As stablecoin issuers must be above reproach with their reserves, Tether has long been criticised for its management of funds used to back USDT, particularly with regard to its share of commercial paper.

Commercial paper is a short-term, unsecured note issued by a company with a maturity generally not exceeding 9 months. Mainly used to avoid the need for large companies to call on banks, commercial paper is often criticised because its origin is not always easy to verify, and this can be seen as a lack of transparency.

Tether marks a significant shift here, as it still held 65% of commercial paper in May.

USDT issuer moves into Treasuries

This strategy has been completely abandoned in favour of US Treasury securities (often called T-bonds), which are issued directly by the US government via the Treasury Department. These bonds, unlike commercial paper, have a much longer maturity (up to 30 years). They also allow their holders to earn interest twice a year.

Tether’s share of commercial paper (red) and Treasury securities (yellow)

Tether, which issues the most capitalised stablecoin in the cryptocurrency market, has been on the rise again in recent months, with announcements promoting its transparency to the point where it is again widening the gap with Circle’s USDC, its main competitor. Its future therefore seems to be mapped out in this direction, as confirmed by the press release:

“This announcement is part of Tether’s ongoing efforts to increase its transparency, with investor protection at the heart of Tether’s reserve management. This is a step towards even greater transparency and trust, not only for Tether, but for the stablecoin industry as a whole. “

In addition, Tether announced on August 18 that its reserves will now be audited monthly, rather than quarterly as was previously the case. These audits are now carried out by BDO Italia, the 5th largest audit firm in the world behind the Big Four.