Range is part of the fundamentals of technical analysis. Any cryptocurrency trader, even a beginner, should be able to identify the range of a market to spot support and resistance and thus make the right investment decisions regarding their crypto assets. We explain how to spot it and what it can be used for.

What is a range in trading

The range is the channel, the corridor, in which the price of an asset moves. In other words, the range reflects the price range in which the price of a cryptocurrency fluctuates. To calculate the range, simply subtract the difference between the highest and lowest price over a given period.

It is common to hear commentators say that the market is moving in a range: this means that the trend is not strong, the market is stagnant and the price is just moving back and forth between two key levels, which are called support and resistance.

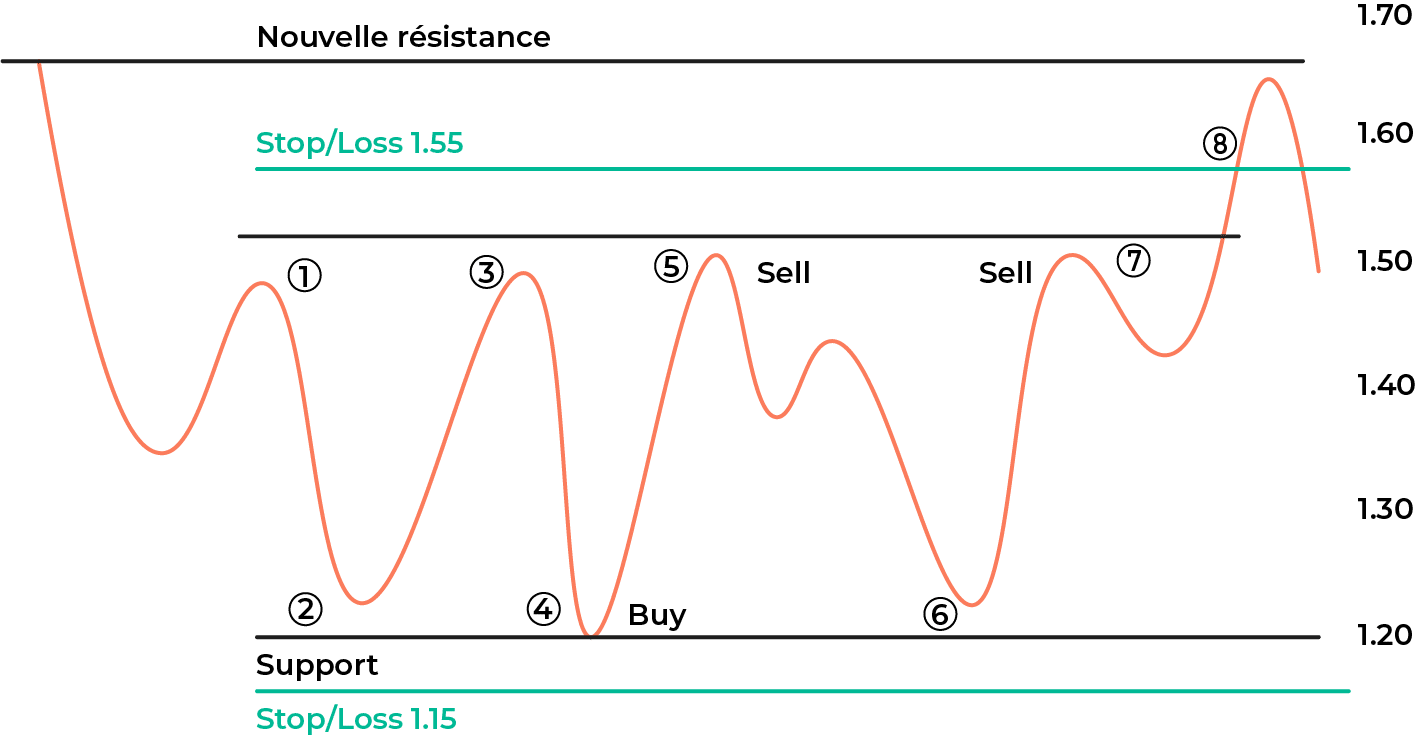

A range, with support and resistance levels, and stop losses

The market for a cryptocurrency can move in a range for a number of reasons: it can be a natural market breather (such as a technical bounce or consolidation) that occurs following a sharp move. The market may also be waiting for a major release. In this case, investors refrain from taking positions before the release of the figure or announcement.

Conversely, if the price of a cryptocurrency breaks long-term support or resistance, it is said to be moving out of its range. It is in this type of configuration that a trend reversal can occur. Hence the interest to detect the range to analyze the market.

What is the purpose of a range in cryptocurrency trading

One of the main attractions of the range is that it allows you to identify support and resistance levels, two fundamental concepts in technical analysis. Support is the lower bound of the channel, which is the lowest price, while the resistance line is the upper bound, which is the highest price in a given period.

When the market is moving in a range, the price simply oscillates between the support line and the resistance line, which are relatively close. The price bounces off the support and moves up to test the resistance, before moving back down to test the support and so on:

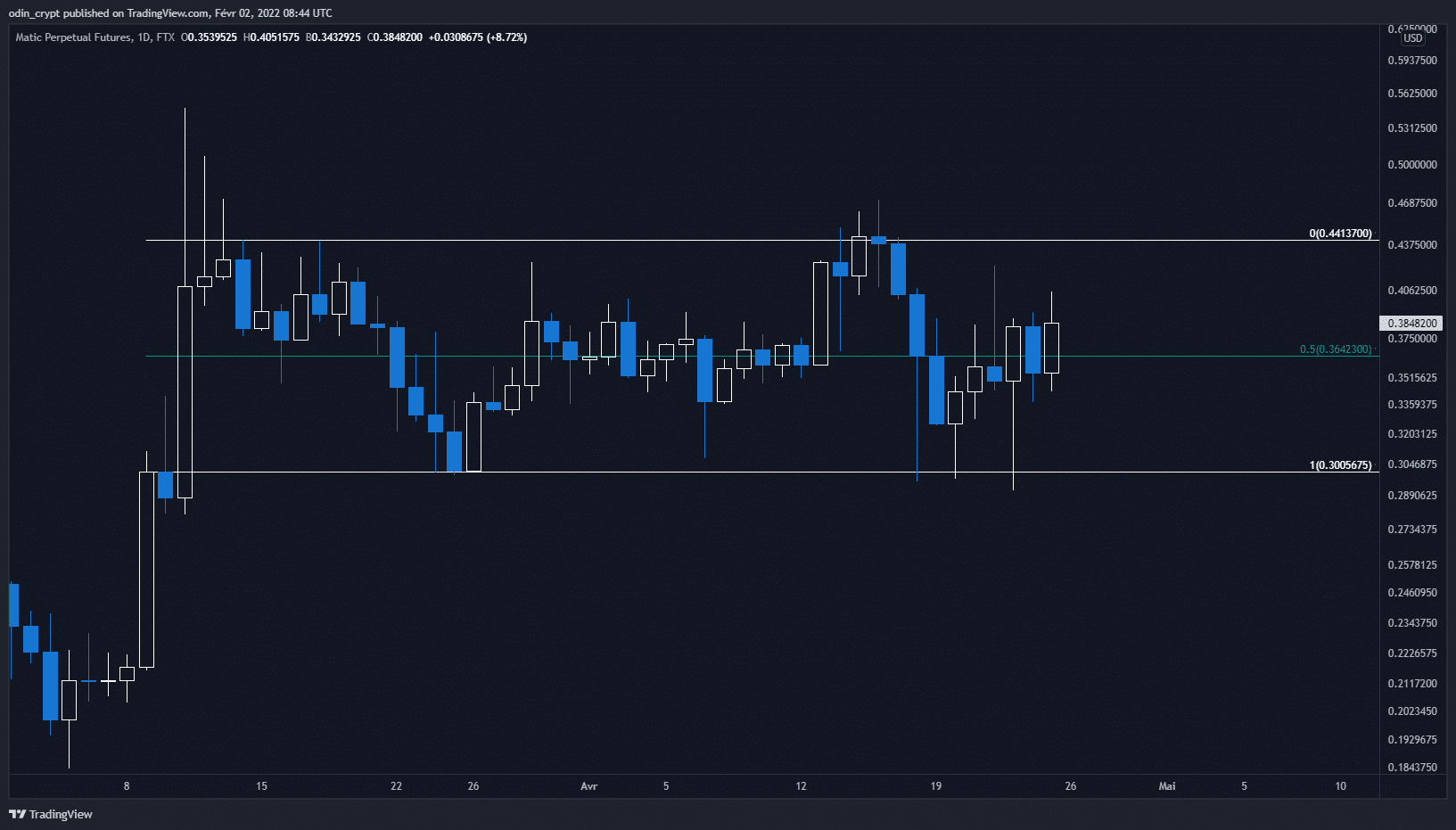

Example of a range (Source: TradingView)

A range market is also a sign that the asset price is moving without a clear trend. Generally, there is little volume when it occurs, as the market is moving without a clear direction. An exit from the range, on the other hand, often results in increased volume and higher volatility.

For this reason, the range is also an excellent indicator of volatility, as the wider the range of the market, the further away the extremes and therefore the higher the volatility. Note that the Bollinger Bands are also a very good indicator to get an overview of the volatility of a price while the RSI or MACD provide valuable indicators on volumes.

How to detect a crypto’s range exit

The range is particularly useful for spotting a reversal in the price of a cryptocurrency. The market is said to break out of its range when the resistance or support threshold is definitely crossed: a new momentum can then be established.

When an asset breaks out of its range to the upside, it is called a breakout. After breaking a key resistance, the price tends to return to test the breakout point, before rebounding and continuing its upward trajectory.

A pullback occurs after a support breakout and is formed within a downtrend. In this configuration, the price may bounce back to retest the broken support before continuing to fall.

Breakouts and pullbacks are usually accompanied by an increase in volatility and volume, so they are particularly interesting to trade.

Conclusion

The range is perhaps the most fundamental tool in chart analysis. It allows you to determine support and resistance levels over a given period of time, as well as showing the level of volatility in a cryptocurrency’s price. Spotting it therefore gives you a better chance of succeeding in your crypto asset trades.