On Thursday, the European Central Bank (ECB) continued its measures to try and bring inflation back down to 2%, by adding 25 basis points to its 3 interest rates. Earlier this week, the Fed made a similar decision.

The European Central Bank (ECB) is raising interest rates

With inflation soaring in recent years, central banks around the world have been forced to review their monetary policies. With this in mind, the ECB announced on Thursday that it was raising its 3 key rates by 25 basis points.

As a result, the interest rate on the main refinancing operations will rise to 3.75%, those on the marginal lending facility to 4%, and 3.25% for the deposit facility. These measures will take effect from 10 May.

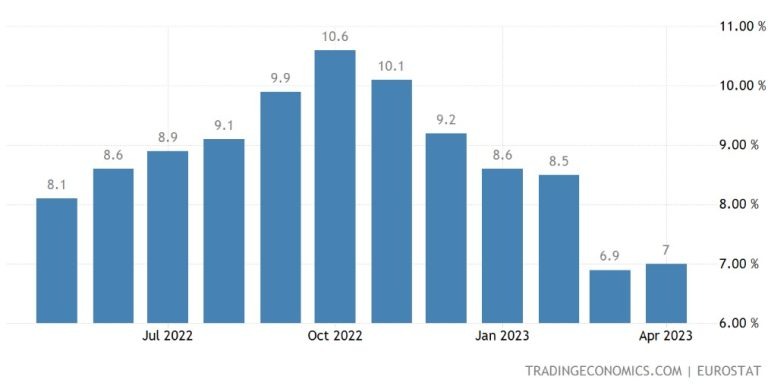

The aim of these rate rises is to bring inflation down to 2%, compared with 7% in April in the eurozone:

Figure 1 – Consumer price inflation in the eurozone

While the rate hikes have started to take effect, there is still a long way to go and the ECB says they will be maintained for as long as necessary:

“Future decisions by the Governing Council will ensure that key interest rates are reduced to levels that are sufficiently restrictive to allow inflation to return rapidly to the medium-term objective of 2% and are maintained at these levels for as long as necessary. “

In her speech announcing the rate hike, ECB President Christine Lagarde also pointed out that food inflation in April was 13.6%. Inflation excluding food and energy was 5.6%.

Similar choices in the US

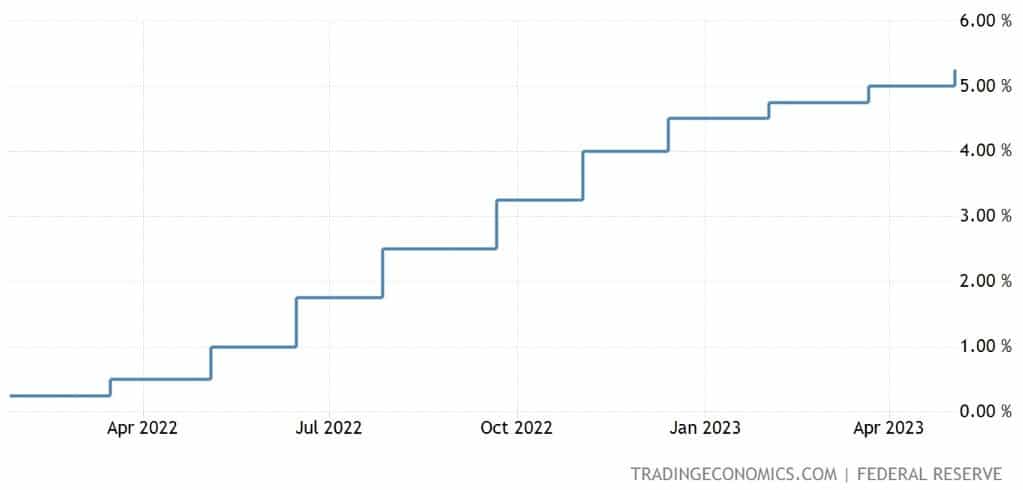

Before the ECB, the US Federal Reserve (Fed) also decided to raise rates on Wednesday. Here too, fed funds rates were raised by 25 basis points, as expected by the consensus, taking them to 5.25%:

Figure 2 – Fed interest rates

As the chart above shows, the Fed has been raising rates continuously for a year now, with the next decision due on 14 June.

The price of Bitcoin, meanwhile, has not been particularly affected by this macroeconomic news, and continues to trade within its range of $27,000/30,000, at just over $29,000 at the time of writing