The HUSD, the stablecoin on the Huobi exchange platform, lost its parity with the dollar yesterday. After a drop of about 14%, it finally recovered its normal value a few hours later. What actually happened

HUSD depegs the dollar

New episode in the saga of “stablecoins” that collapse. It’s the turn of the HUSD, a stablecoin native to cryptocurrency exchange platform Huobi, to lose its supposed parity with the dollar.

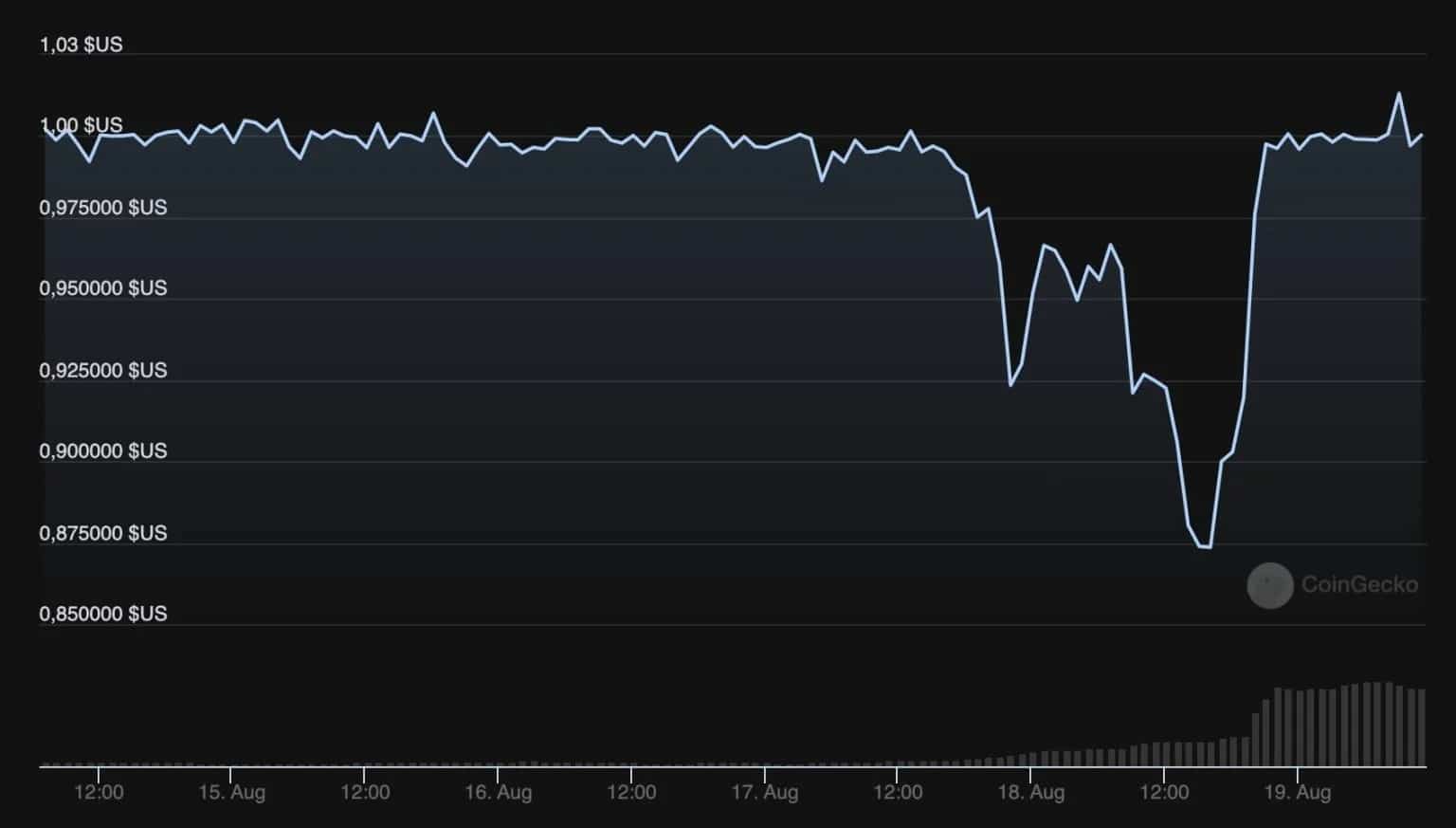

During the day on Wednesday, the HUSD price suddenly plummeted to $0.92. After recovering slightly, the asset continued to fall to a price of $0.87, a drop of almost 14% in the space of 24 hours. Finally, a few hours later, the HUSD regained its peg to the dollar.

Fig. 1: HUSD falls before recovering

Issued by Hong Kong-based Stable Universal, HUSD is an ERC-20 token based on the Ethereum blockchain (ETH). Offered for trading by the Huobi exchange, this stablecoin was sold as a “safe and secure stablecoin”, supposedly combining the stability of the US dollar with the efficiency of blockchain technology.

What happened to the HUSD?

There have been several rumours about the HUSD losing its footing. The first is FTX’s withdrawal from its USD stablecoin basket. At the time of the announcement, a fortnight before, the platform explained that “HUSD deposits will no longer be counted as part of USD balances and will no longer serve as collateral”.

More concretely, in the midst of the storm, Huobi Global published an announcement saying that it was aware of the lack of liquidity in the HUSD. Furthermore, it said it was “working with the HUSD issuer to find a solution and restore its stability as soon as possible”.

Later in the day, a new statement was finally issued. This time it was posted on the HUSD stablecoin Twitter account and explained the official reason for the drop in the price, but also for its return to normal:

“Recently, we had taken the decision to close several accounts in specific regions to comply with legal requirements, which included some market maker accounts. Due to the shift in banking hours, this resulted in a short-term liquidity issue, but this has since been resolved. “

A matter that now appears to have been resolved, but will still have cost some users dearly. In the context of tension installed a few months ago by the fall of the stablecoin UST of Terra and prolonged by the morose state of the market, many investors preferred to sell their positions at a loss rather than suffer a new fall more costly.