The teams in charge of FTX, the exchange that has been in bankruptcy since last November, want to call on Galaxy Digital to monetise their cryptocurrency portfolio. If the bankruptcy court grants FTX’s request, Galaxy Digital will have to manage FTX’s exposure to the crypto market, in particular by staking cryptocurrencies and selling others.

FTX decides to put its wallet to good use

The new management of FTX, chaired by John Ray III, has called on giant Galaxy Digital to help manage its cryptocurrencies, according to a new filing on Wednesday 23 August. The bankrupt cryptocurrency exchange hopes to monetise the assets in its portfolio, in particular through the sale and staking of cryptos, a discipline that cannot be improvised :

“Galaxy Asset Management has extensive experience in the management and trading of digital assets, including the types of transactions and investment objectives envisaged. “

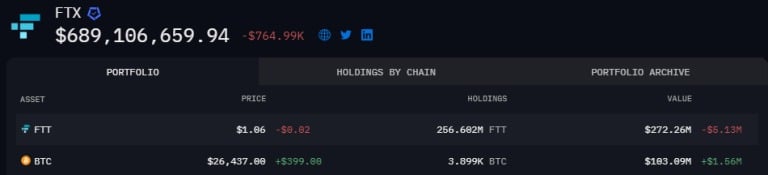

All the more so since, according to Arkham Intelligence data, FTX’s wallet is valued at almost $700 million. Most of this wallet is made up of FTT, its own token, and Bitcoin (BTC). However, it is highly likely that other wallets belonging to FTX are not included in this count, so the sum could be much higher.

For example, there is currently around $550 million worth of cryptocurrencies in just 2 wallets owned by Alameda Research

Overview of FTX’s current wallet

Thanks to this agreement, Galaxy Digital would be able to manage FTX’s exposure to cryptocurrencies in order to limit the impact of their volatility and, of course, make the operation profitable in order to help recover the exchange’s debts. Galaxy Digital will also be responsible for trading cryptocurrencies to convert them into stablecoins or fiat currency, as FTX’s management wishes to repay its creditors exclusively via these 2 solutions.

In return, Galaxy Digital will receive a monthly management fee calculated on the basis of liquidated assets and a percentage of the net value covered by the transactions. FTX states in its document that other investment advisors had been proposed, but that the creditors’ committee had agreed on the choice of Galaxy Digital.

However, the bankruptcy court will have to determine whether the arrival of Galaxy Digital as investment manager for FTX’s cryptocurrencies will be in the best interests of the exchange’s aggrieved creditors before the deal is official. Should FTX’s application be accepted by the court, Galaxy Digital will be obliged to act in FTX’s best interests.