Famous hedge fund Pantera Capital predicts Bitcoin at $148,000 after the next halving in April 2024, basing its optimism on previous halvings and the mechanics of reducing the supply of BTC. Let’s look at these predictions in more detail.

$148,000 bitcoin post halving

A bit of positivity, at a time when Bitcoin has lost its relatively short momentum to seek support from the $25,000 mark: Pantera Capital, the world’s largest hedge fund specialising in cryptocurrencies, predicts BTC at $148,000 after halving, scheduled for April 2024.

Historically, halving is an event that has always been followed by a rise in the price of Bitcoin. It occurs every 210,000 blocks, and aims to reduce by 2 the BTC reward distributed when each block is mined, as Satoshi Nakamoto explained in his famous whitepaper:

The total circulation will be 21,000,000 coins. They will be distributed to the network nodes when they create blocks, the amount being divided by two every four years. “

If you would like to find out more about this key Bitcoin event, please read our dedicated halving factsheet.

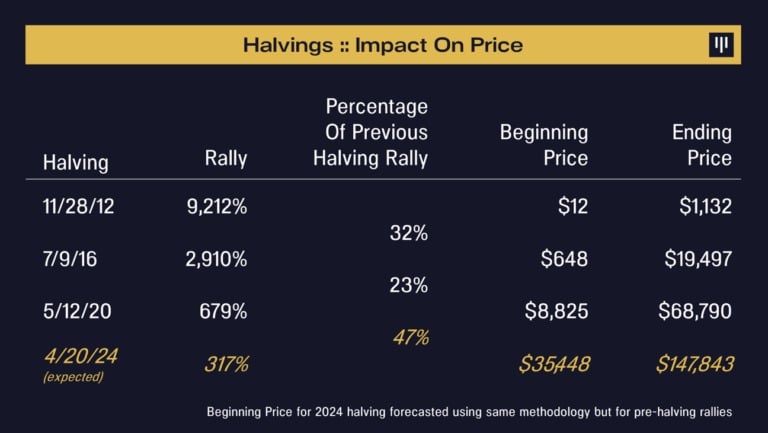

Bitcoin price evolution as a result of previous halvings, with prediction for April 2024

In its latest “Blockchain Letter” (in which the company explores the key topics of the moment) dated 22 August, Pantera Capital states that the next Bitcoin halving will be no exception to the rule, as long as the key components driving up the price do not move.

“If the demand for new Bitcoins remains constant and the supply of new Bitcoins is halved, the price will rise. In the past, demand for Bitcoins has also increased prior to the halving event due to the anticipation of a price increase. “

How does Pantera Capital support its theory?

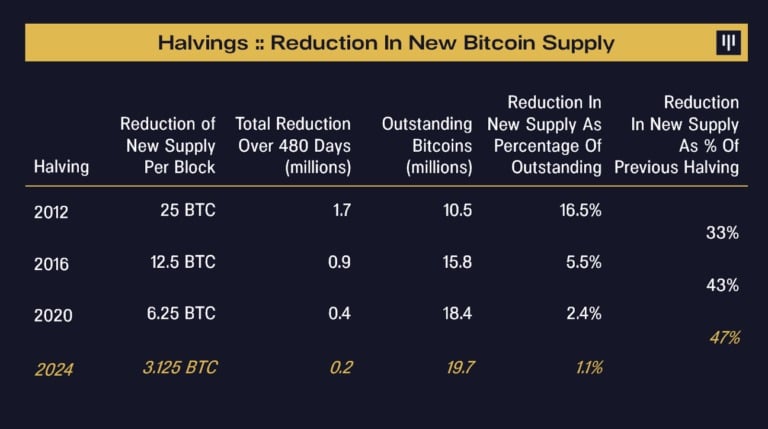

The halving of Bitcoin reduces the reward in Bitcoin – the reward will fall from 6.25 to 3.125 BTC per block at the next halving – so fewer and fewer BTC are being put on the market, which mechanically reduces supply, where demand is theoretically constantly evolving.

Consequences of Bitcoin halvings on supply

On the other hand, history seems to be repeating itself with the first indications of an upcoming rise, according to Pantera Capital:

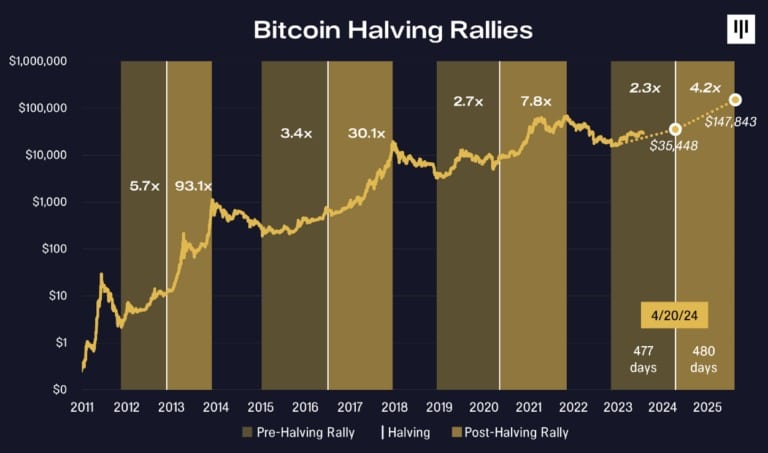

“Historically, Bitcoin bottomed 477 days before halving, climbed before halving, and then exploded higher after halving. The rallies that followed the halving lasted an average of 480 days, from halving to the peak of the next bull cycle. If history were to repeat itself, the price of Bitcoin should have bottomed on 30 December 2022. The low was reached on 9 November 2022, in the middle of the FTX fiasco, a month earlier than expected. “

Then, further on:

“If history were to repeat itself, the next halving would see bitcoin rise to $35,000 before the halving and $148,000 afterwards. “

Post-halving 2024 prediction from previous halvings

Alongside this, Pantera Capital also adds that the recent positive ruling by a judge re-characterising Ripple’s XRP was good news, as was the buzz created by the various Bitcoin ETF applications, with giant BlackRock leading the way, and that this could contribute to a general positive momentum.

“We think we’ve seen enough – the markets can’t stay down any longer. We would then see a rally until early 2024 and then a strong recovery after the halving.”