Since Saturday, the community has shown concern over a move by the Ethereum Foundation, suggesting an intention to sell the equivalent of $30 million worth of ETH. While the market may indeed be entering a corrective phase, is this particular move really significant? Here’s what we think.

Is the Ethereum Foundation willing to sell its ETH?

On Friday night, an address affiliated with the Ethereum Foundation transferred 15,000 ETH to Kraken for a value of around $30 million. Since then, this event has not failed to provoke reactions from the community on Twitter.

Indeed, such movements generally signify an intention to sell, and several observers have pointed out that when the Ethereum Foundation sells ETH, it regularly coincides with a local market high:

Ethereum Foundation’s large-scale selling in recent years record: Recently the Ethereum Foundation sold 15,000 ETH. In 2021, EF did sell 20,000 ETH at a high point. But in 2020, 100,600ETH was sold at a price of 657. pic.twitter.com/BCiSlutQ5F

– Wu Blockchain (@WuBlockchain) May 7, 2023

If we look at the ETH price, it is true that the uptrend of the beginning of the year seems to be running out of steam, and it is likely that a correction will occur after such a rally:

Figure 1 – ETH price year-to-date

However, it is important not to indulge in cognitive biases that might lead one to think that the market is falling because of a supposed sale by the Ethereum Foundation.

We don’t know for sure whether ETH has already been sold. However, even if this were the case, while such a move could temporarily move the market, it would not be enough on its own to change a trend.

In addition, the Ethereum Foundation has recurring expenses in the same way as a business. As a result, its cash flow is earmarked for various purposes to fund the development of the Ethereum blockchain. Based on this premise, it is only logical that it should choose to regularly convert part of its ETH into less volatile assets, on the one hand to capitalise on a rising market, but also to pay its expenses.

15,000 ETH: is it really worth it?

Obviously, the fact that an entity involved in the development of a blockchain can sell the native cryptocurrency of that same blockchain is enough to cause a reaction if you don’t take all the elements into consideration. But now that we’ve explained why, is this amount really significant?

Firstly, in terms of daily volumes, 15,000 ETH is not really significant. While it is higher than Kraken’s spot volumes, which have recorded between 2,000 and 3,000 ETH daily in recent days on the ETH/USDT pair, it is very little compared with Binance, for example, which easily exceeds 350,000 ETH per day.

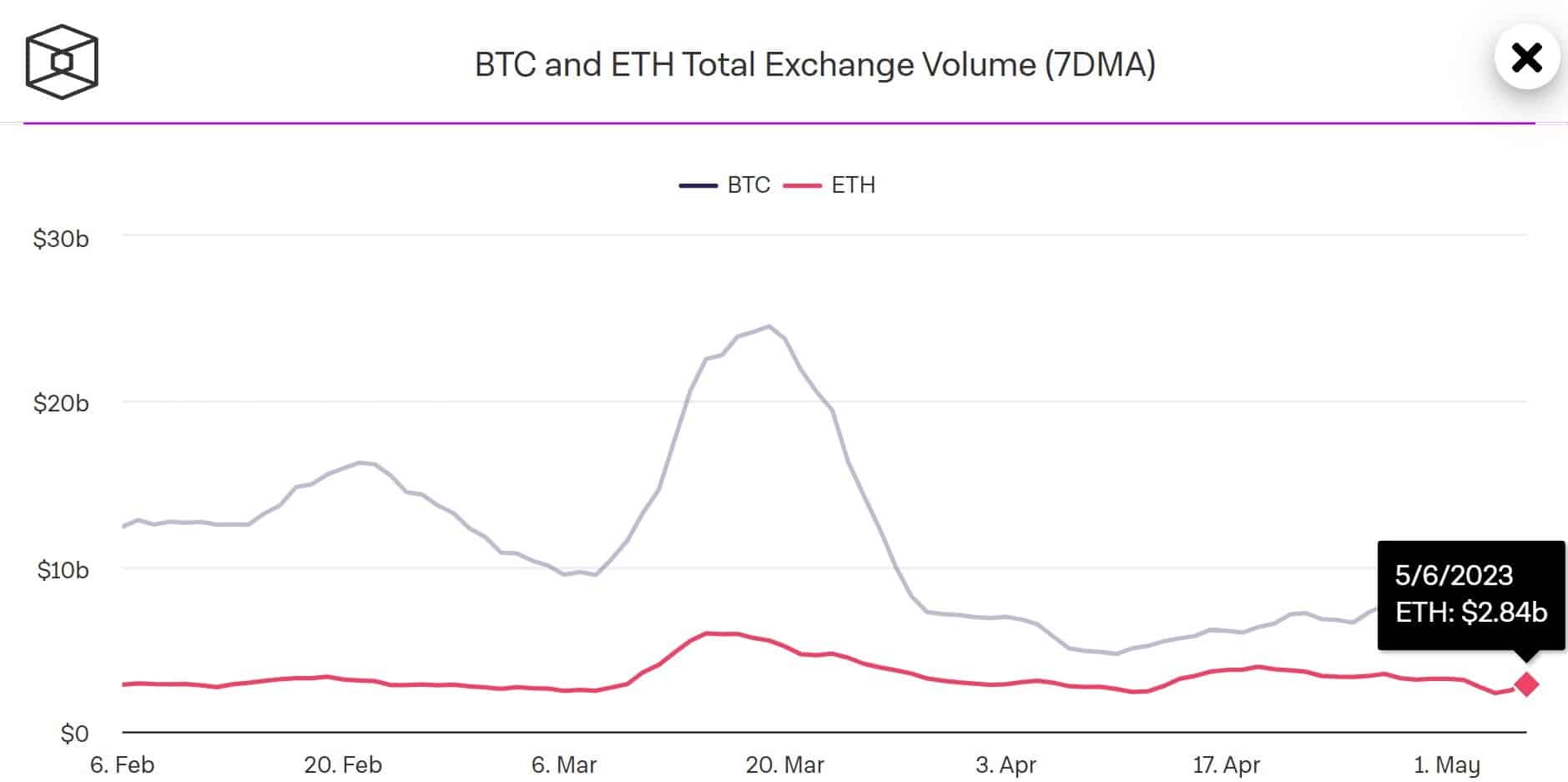

Looking at the data from our colleagues at The Block, the 7-day moving average of total ETH spot trading volumes was $2.84 billion for Saturday:

Figure 2 – 7-day moving average of ETH spot trading volumes

In addition, it may be interesting to compare these 15,000 ETH with other data to see “what they represent” on a market scale. For example, the daily average of ETH burnt over the last 7 days is 10,440.

Over the last 24 hours, 11,437 ETH have been destroyed, which means that currently, 15,000 ETH correspond to around 1.5 days of burn.

While the market may indeed fall in the near future, all these factors put the Ethereum Foundation’s movement into perspective.