On Monday, Grayscale executives and their lawyers met with the SEC regarding the conversion of the GBTC and Bitcoin Spot ETF. Is this a sign of forthcoming approval?

Grayscale meets with SEC for GBTC meeting

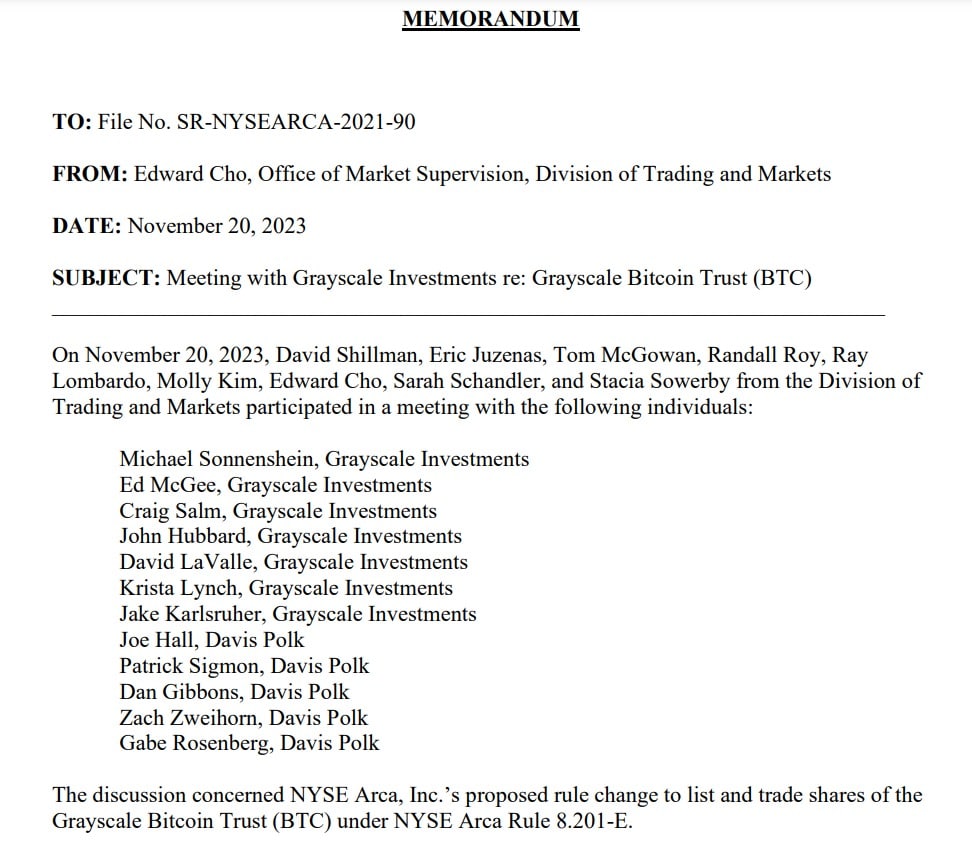

According to information contained in a Securities and Exchange Commission (SEC) memo, members of the government agency’s Trading and Markets Division met with Grayscale’s management team on November 20.

The document states that 7 Grayscale executives were present at the meeting on Monday, including CEO Michael Sonnensheim and General Counsel Craig Salm. In addition, they were accompanied by 5 representatives from the David Polk law firm:

Note about the meeting between Grayscale and the SEC

As the note explains, the subject of this meeting was a “proposed rule change” to list the Grayscale Bitcoin Trust (GBTC) on the NYSE Arca as a spot ETF on Bitcoin (BTC).

While the detailed content of these discussions is not known, this is further evidence that exchanges are well and truly underway between the various parties, suggesting that we are getting closer to eventual approval.

Financial lawyer Scott Johnsson also noted that an agreement had been reached between Grayscale and BNY Mellon on November 16. The agreement specifies that BNY Mellon will play a key role in the issue and future purchase of GBTC shares:

Grayscale making preparations pic.twitter.com/9A87FZK1su

– Scott Johnsson (@SGJohnsson) November 21, 2023

On the subject of GBTC, the latter continues to catch up between its real price and its OTC price, but never quite manages to bring the two prices together for good. Thus, a discount of 11.86% is still in effect, with an OTC price of $29.2 versus a share price of $33.13.

At present, GBTC’s capitalization represents just over $22.93 billion in assets under management.

Returning to the meeting between Grayscale and the SEC, while the importance of these negotiations should be stressed, this in no way guarantees imminent approval. On a completely different subject, Coinbase, for example, met with the SEC around 30 times in 2022, without ever managing to make any progress on the subject of crypto regulation.