In discussing how its USDC stablecoin was collateralized, Circle indicated that it would like the FED to retain a portion of its reserves. Still, there is a long regulatory road ahead of them.

Towards a USDC secured by the FED?

This week, Circle returned to the topic of collateralizing USDC cash, and indicated that she would like to see some of it stored with the U.S. Federal Reserve (FED).

In fact, this is a long-term ambition, but it requires a long road to regulation:

“We have always aspired to hold the cash portion of the USDC reserve directly with the Federal Reserve, thus realizing our vision of the USDC as a true token currency. This will require stable coin legislation. Since Circle’s inception in 2013, we have been at the forefront of calls for regulation…and we are optimistic that Congress will act. “

The portion involved is cash that is held directly in dollars. This is the same percentage that was temporarily blocked in the Silicon Valley Bank (SVB) bankruptcy, causing a weekend depeg of stablecoin before returning to normal on Monday.

Transparency on reserves

Waiting for a scenario where the USDC is endorsed by the FED, Circle takes further steps to store said reserves. Bank of New York Mellon (BNY Mellon) manages almost all of this percentage in cash.

The bank is one of the 30 Global Systemically Important Banks (GSIB) identified by the Financial Stability Board (FSB) in 2022, i.e. banking institutions whose importance is such that a failure would lead to a systemic risk: the famous “to big to fail”.

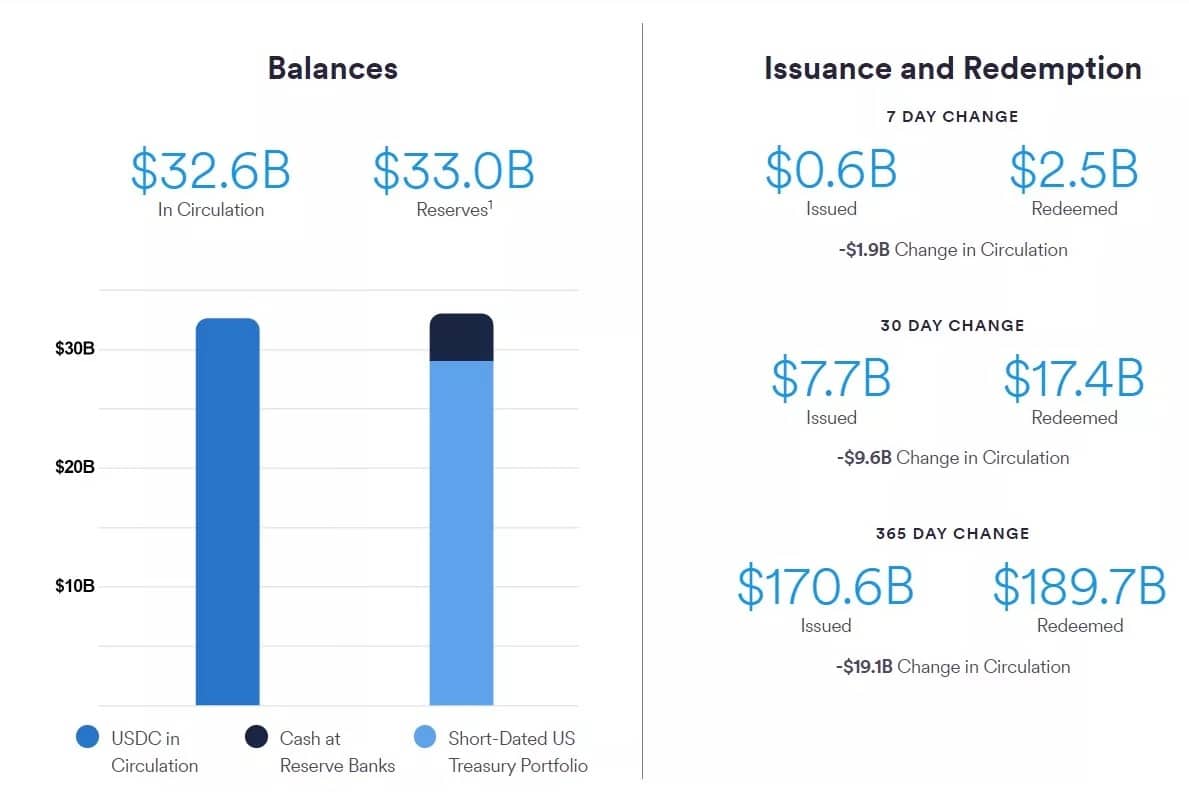

In addition, BNY Mellon also holds short-term U.S. Treasuries, which are managed by BlackRock. These bonds make up the bulk of this collateralization, nearly 89% as of March 30:

Circles reserve distribution compared to USDC capitalization

In addition, Circle points out that it is a profitable company, and that it has $800 million of its own cash. These assets could then come to the rescue of USDC in the extreme case that a portion of its collateralization were to be lost for one reason or another.

In addition, if Circle were to fail, the fact that there is a clear separation between the company’s equity and the collateralization of its stablecoins means that the latter can still be exchanged on a one-to-one basis.