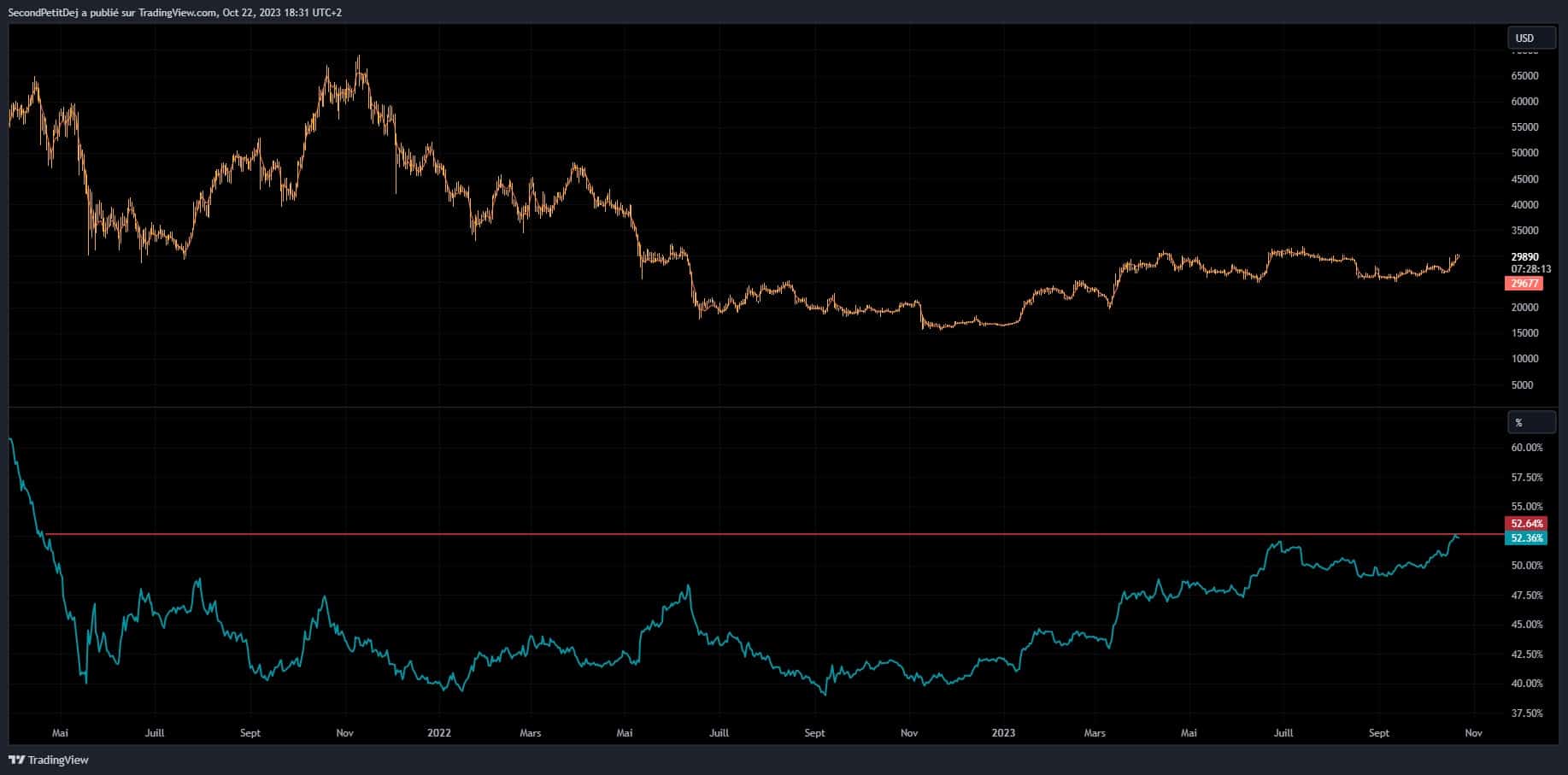

Bitcoin’s dominance reached over 52.6% on the cryptocurrency market on October 20, 2023, a level the king of cryptocurrencies hadn’t seen since April 2021. Further proof that Bitcoin is the best store of value during complicated times, alongside the narrative of spot BTC ETFs?

Bitcoin dominance exceeds 52.6%

This Friday, October 20, Bitcoin’s dominance rose to over 52.6% on the cryptocurrency market, a point the king of cryptos hadn’t reached since April 2021, more than two and a half years ago.

Bitcoin’s dominance is an important metric for assessing the weight of BTC’s capitalization against the rest of the cryptocurrency market at any given moment. To find out more, read our article on Bitcoin dominance.

On the graph below, we can see that Bitcoin’s dominance has been on an increasing curve since the beginning of this year 2023. Its 2 most notable rises occurred between March 10 and 20 (from 43% to 47.8%) and June 5 to 29 (from 47.3% to 52%).

Bitcoin price (orange) and BTC dominance (cyan)

A steady rise in correlation with the Bitcoin price, up over 80% since January 1, 2023. This correlation has been particularly noticeable this week, with BTC’s dominance peaking at a time when the BTC price is also on the rise, currently battling with the symbolic resistance of the $30,000 mark.

The Bitcoin price has been particularly influenced by the news this week, firstly with the false news concerning the acceptance by the Securities and Exchange Commission (SEC) of BlackRock’s Bitcoin ETF, and then with Ripple’s victory over the SEC.

Besides this news, we could also add that BTC is establishing itself as a safe haven in the face of current geopolitical problems, in addition to the inflation problems observable in the US and here at home.

Bitcoin has seen its best 7-day performance in 17 weeks, the last of which was in June. Although this week’s first movement confirms investors’ interest in ETFs, it’s worth remembering that we’re in a bear market, and that Bitcoin is subject to high volatility due to reduced market depth.

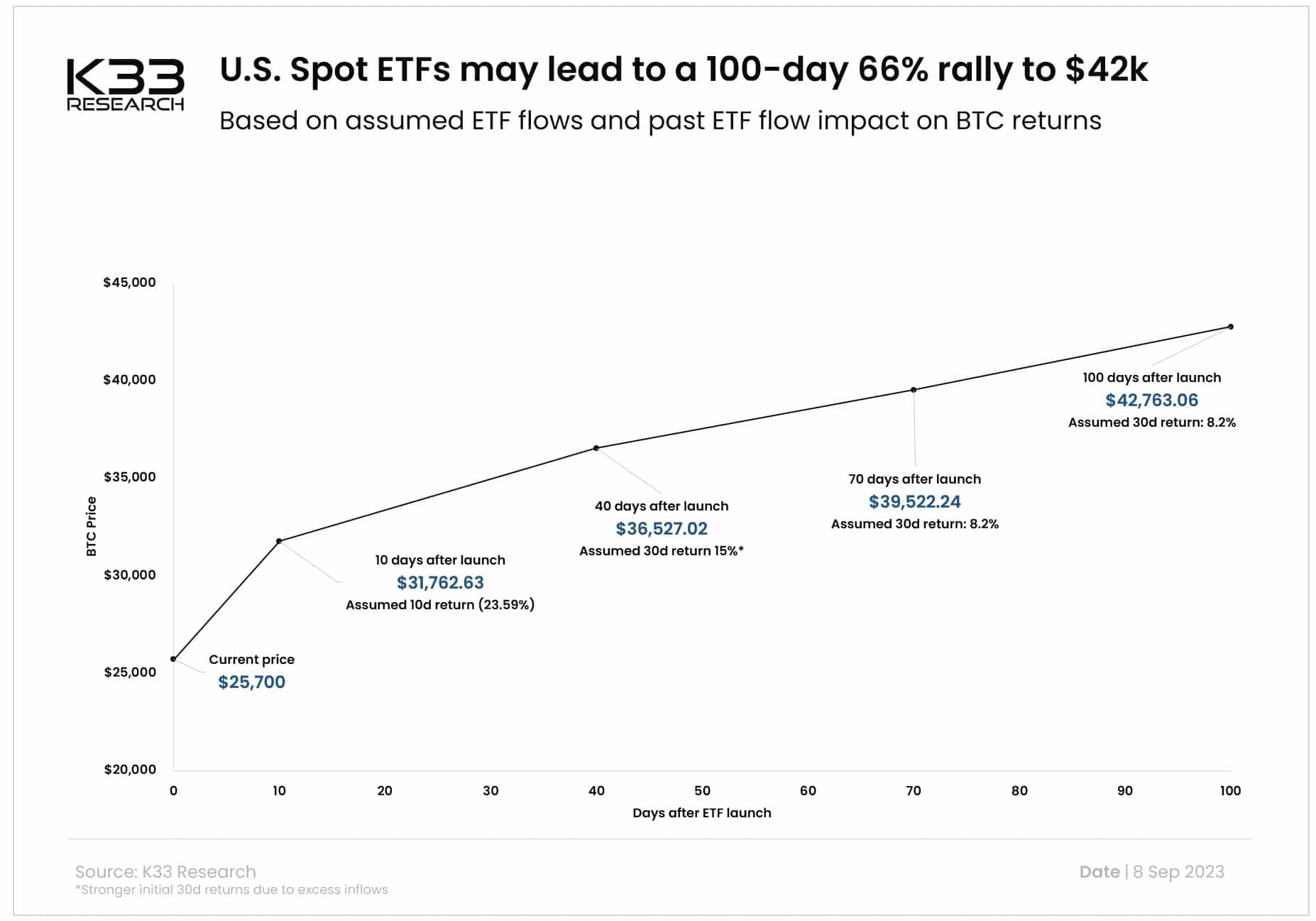

Last month, based on an analysis of 4 years of data flows and various metrics, a K33 Research analyst spoke of the major influx of liquidity that could result from the acceptance of the first spot Bitcoin ETF in the USA, and the consequences this could have on the BTC price:

Hypothesis of BTC price evolution following acceptance of a spot BTC ETF (K33 Research)

According to its forecasts, in the best-case scenario, the arrival of a spot Bitcoin ETF could lead to a rise of around 66% in the Bitcoin price over a 100-day period. Outside of the ETF narrative, most investors have their eyes on the halving of April 2024, an event that often precedes a significant rise in the BTC price.