As the price of energy rises and the price of Bitcoin (BTC) falls, the profitability of the mining business is back to 2020 levels. Despite this, we also see that the hashrate is at historically high levels.

The profitability of Bitcoin mining is becoming less attractive

The perverse cocktail of the bear market and rising energy prices is now having an impact on the profitability of mining. Indeed, Bitcoin miners are seeing their profits fall to 2020 levels, according to the latest survey from Arcane Research.

According to the latest data, miners are earning $17.9 million a day from mining. This compares with $62 million days at the November 2021 highs. Like the price, this profitability has been divided by almost 3.5 in less than a year.

Combined with rising energy prices, this trend is likely to lead to smaller players pulling the plug on their machines. Indeed, given these factors, it is no longer profitable to mine in densely populated areas, where the cost of electricity is higher than in other geographical regions favoured by artisanal miners.

In order to cover their costs, these miners have to sell part of the rewards they receive. As with any industry, there is no economic incentive to continue if the production costs exceed the turnover.

The consequences of this on the network

When a drop in profitability leads to a drop in mining activity, this mechanically leads to a slowdown in the network. This dynamic comes from the fact that there is less computing power available to produce blocks. Arcane Research notes that since the BTC price fell back below $20,000, the blockchain has gone from 6.28 to 5.9 blocks per hour.

But let’s put this into perspective. While block production is certainly not linear, it has generally averaged between 140 and 160 blocks per day since 2015.

To keep a certain consistency, the difficulty of mining will adapt according to the computing power offered by the miners. Currently, this difficulty is on record levels, as shown in the graph below:

Figure 1: Bitcoin network mining difficulty

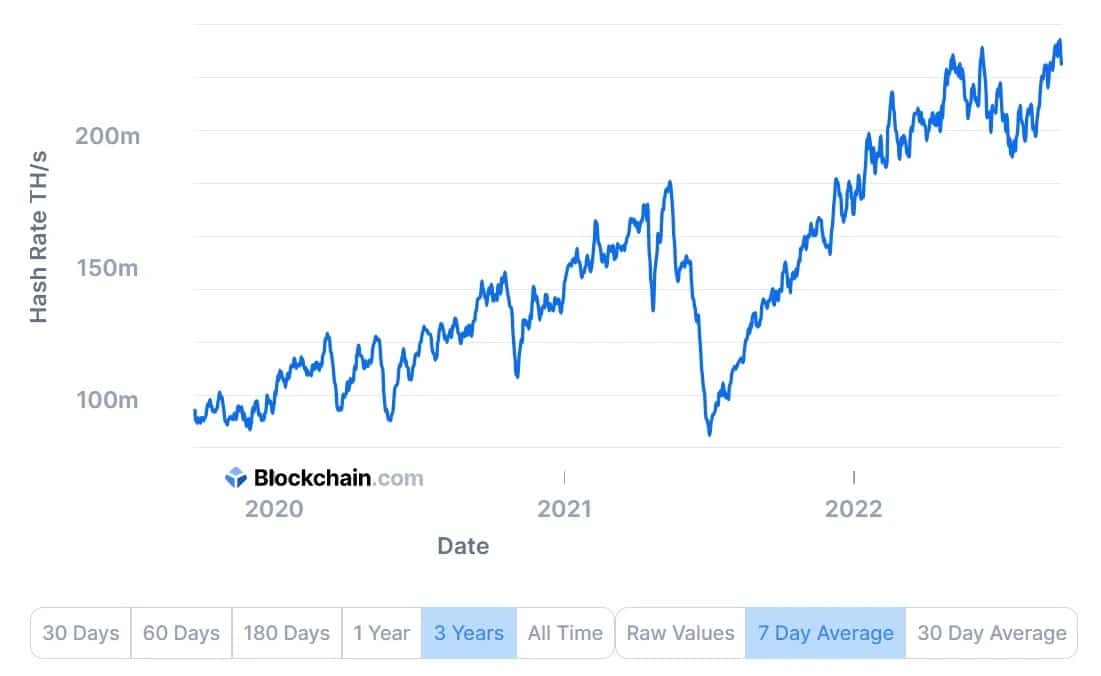

On the other hand, the hashrate does not yet reflect a real capitulation of miners. And for good reason, the mining power deployed is also on historical highs, with an average over the last seven days of 225 terahashs per second:

Figure 2: Hashrate deployed by Bitcoin miners

This is to be welcomed, because even if a future capitulation of miners cannot be ruled out, this data shows that the Bitcoin network has never been more secure. As for the price of BTC itself, it was hovering around $19,000 at the time of writing