The Central Bank of the Republic of Argentina has banned payment service providers from making or facilitating the purchase of cryptocurrencies for their customers. Is this an admission of weakness in the face of inflation that exceeds 100% in the country

Argentina’s central bank takes a stand against cryptocurrencies

This week, the Central Bank of the Republic of Argentina (BCRA) imposed a curious step backwards on payment service providers offering payment accounts (PSPCP) with regard to cryptocurrencies. These PSPCP are simply no longer authorised to carry out or facilitate transactions in digital assets not regulated by the BCRA.

It should be noted that this new rule applies only to centralised players that are not, in principle, crypto-native, which could force Argentine investors to turn to traditional crypto platforms or decentralised solutions.

Amongst the justifications for this measure, we find the usual pretext of a hypothetical risk to the financial system:

Those interested must carry out the transaction themselves. The measure ordered by the BCRA aims to mitigate the risks that transactions with these assets could generate for users of financial services and the national payment system. “

A deeply devalued currency

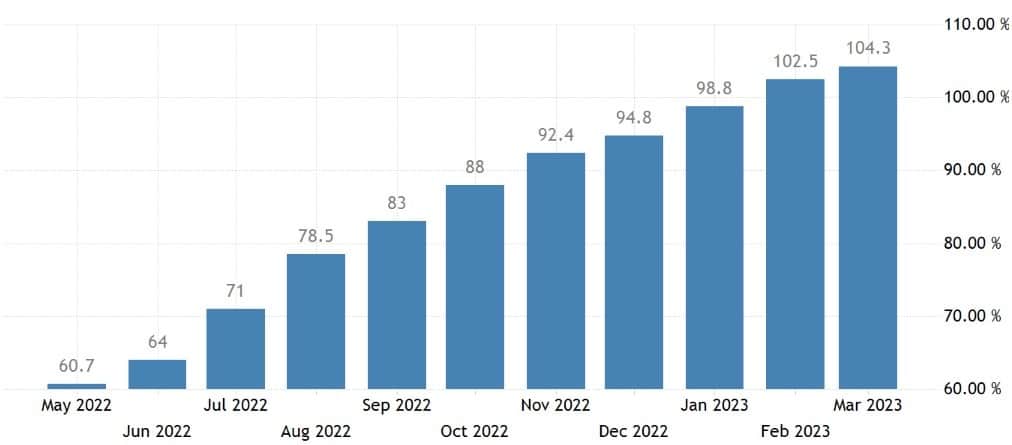

Given totally out-of-control inflation, cryptocurrencies are enjoying some popularity in Argentina. Indeed, this inflation is now over 100%, as shown by data from Trading Economics, which in fact anticipates a rate of 106.9% on 12 May for the month of April:

Figure 1 – Inflation in Argentina

Faced with this inflation, the BCRA was even forced to create a new 2,000 Argentine peso note (ARS) at the start of the year. The value of the Argentine peso against the dollar has been falling steadily for several years now.

In fact, the currency is in the process of recording its 40th consecutive month in the red, down more than 75% since January 2020 :

Figure 2 – Argentine peso against the dollar

From this point on, we can understand why Argentines are so attracted to cryptocurrencies. The simple fact of converting their national currency into stablecoins in dollars would make it possible to limit the damage of inflation, without eliminating it.

While with our Western eyes, we mainly compare the Bitcoin (BTC) price to the dollar, but a chart comparing it to the Argentine peso allows us to radically change our perspective.

And with good reason: BTC has risen by more than 54% since 6 May 2022, trading at nearly ARS 6.6 million according to sources, and is almost back to its all-time high (ATH):

Figure 3 – Bitcoin price against the Argentine peso

Faced with all these factors, the country’s central bank’s decision may therefore be seen as an admission of weakness, given its failure to maintain confidence in its currency.

For Argentinians familiar with cryptocurrencies, this could encourage them to use self-guarding solutions, enabling them to no longer depend on trusted third parties.