The floor price of the Moonbirds non-fungible token (NFT) collection has dropped by a quarter of its initial value after a whale decided to sell 500 NFT on her own. While her motives remain unknown, it is highly likely that this was a reaction to a tweet from the project team that revealed they were exposed to Silicon Valley Bank.

500 NFT Moonbirds sold at once

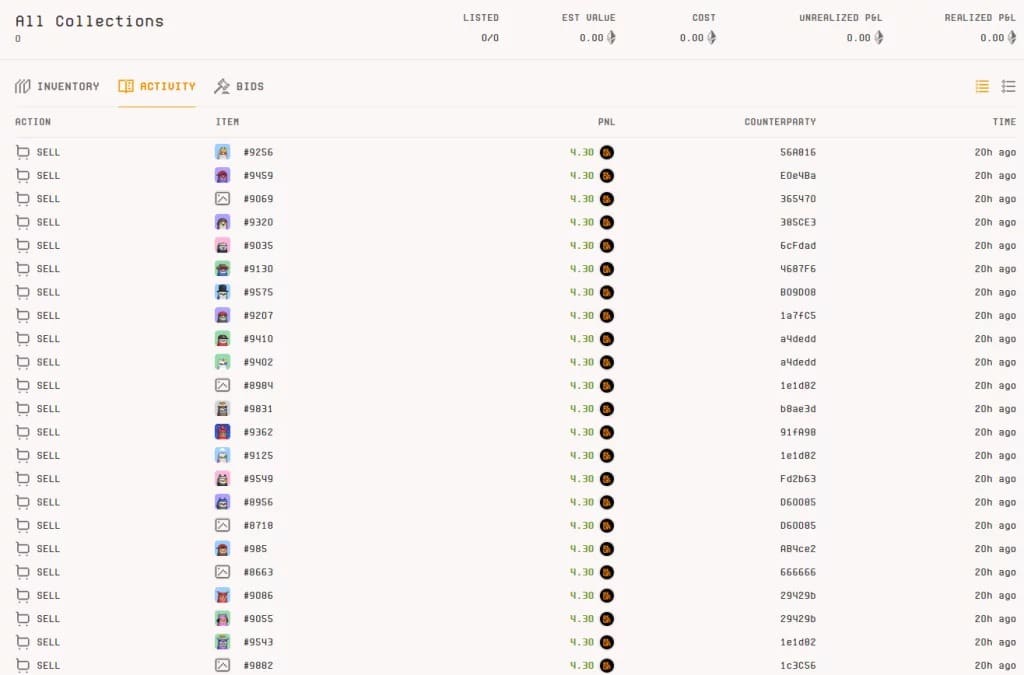

Yesterday, Saturday, March 11, a whale sold 500 non-fungible tokens (NFTs) from the Moonbirds collection on the Blur marketplace for a loss of more than 717 Ether, or more than $1 million at the current price. The seller of these Moonbirds suffered losses of between 9% and 33%, with over 200 NFTs sold at a loss of over 32%.

Figure 1 – Activity of the relevant Ethereum address on the Blur platform

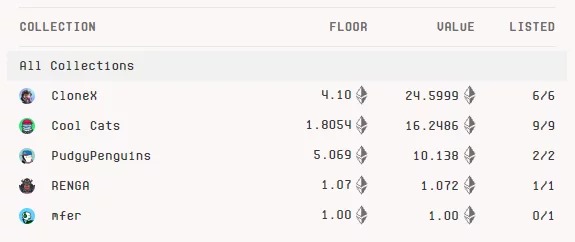

The address in question no longer holds any NFTs on the Blur platform, and its wallet now contains less than $2 in tokens from the platform. However, we can see that the same address has transferred 1,334 ETH to another wallet, which also holds high-value NFTs from the CloneX, Cool Cats and Pudgy Penguins collections.

Figure 2 – Overview of NFTs held on the second wallet

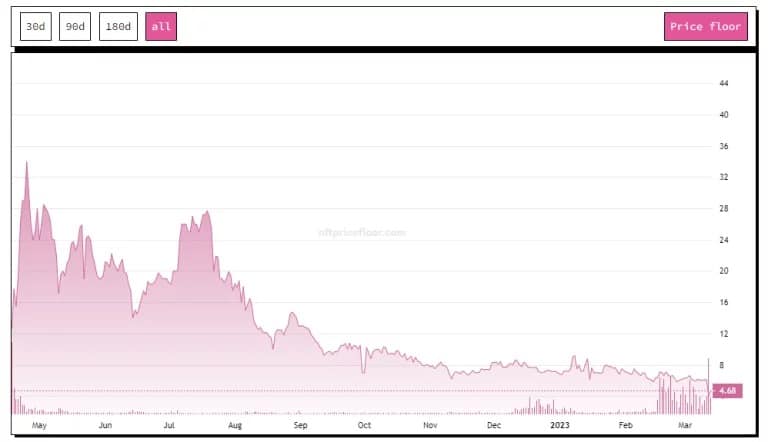

As a result of this sale, the floor price of the collection fell by more than 26% over 24 hours, from more than 6.37 to just over 4.3 ETH.

Why such a massive sale?

While we don’t know the exact motivation of the person behind this sudden and massive sale, the timing fits with a tweet from PROOF, the team behind the design of the Moonbirds collection and Moonbirds Oddities, who said they are on display at Silicon Valley Bank.

1/5: A statement from the PROOF team regarding SVB:

Many of you have seen the headlines this morning about the Silicon Valley Bank closure. The most important thing to us-in both good times and bad-is to communicate with our community proactively and transparently. :

– PROOF (,) (@proof_xyz) March 10, 2023

While some were keen to thank PROOF for its transparency, others pointed out that the project team was careful not to specify the extent of its exposure to the ailing bank. However, PROOF asserts that this exposure will not impact users’ wallets or the project’s roadmap, and that its funds were “diversified”, including Ethers (ETH) and stablecoins.

However, as one Twitter user pointed out, PROOF is not necessarily transparent in that its cash is not visible on-chain. As such, its funds may be held in banks or centralized exchanges (CEX).

Beyond the cash management of the teams behind Moonbirds, it turns out that the project would not necessarily have added value for the holders of its NFTs in the long term.

Indeed, after having put its NFTs under a Creative Commons license last August (without asking the opinion of its community and contrary to what was planned), PROOF also cancelled the physical events that were supposed to bring together NFT holders in the form of exclusive meetings

Figure 3 – Evolution of the Moonbirds collection floor price since its creation

Thus, given the timing of events, it is likely that the seller of the 500 NFTs quoted here made his decision in light of PROOF’s exposure at the SVB, but also because of a lack of long-term vision for the project in addition to the failure to deliver on the initial announcements promised to the collection’s holders.