On the Oasis blockchain, the stablecoin USDT has suddenly lost its parity with the dollar, dropping to less than $0.12. The EvoDeFi bridge, which is used by the majority of the protocols based on Oasis, was the cause. The latter had tried to warn about the bridge’s lack of security in recent weeks. We’re not sure if it’s a rugpull or just a technical problem, but we’ll tell you all about it

USDT drops to $0.12 on Oasis

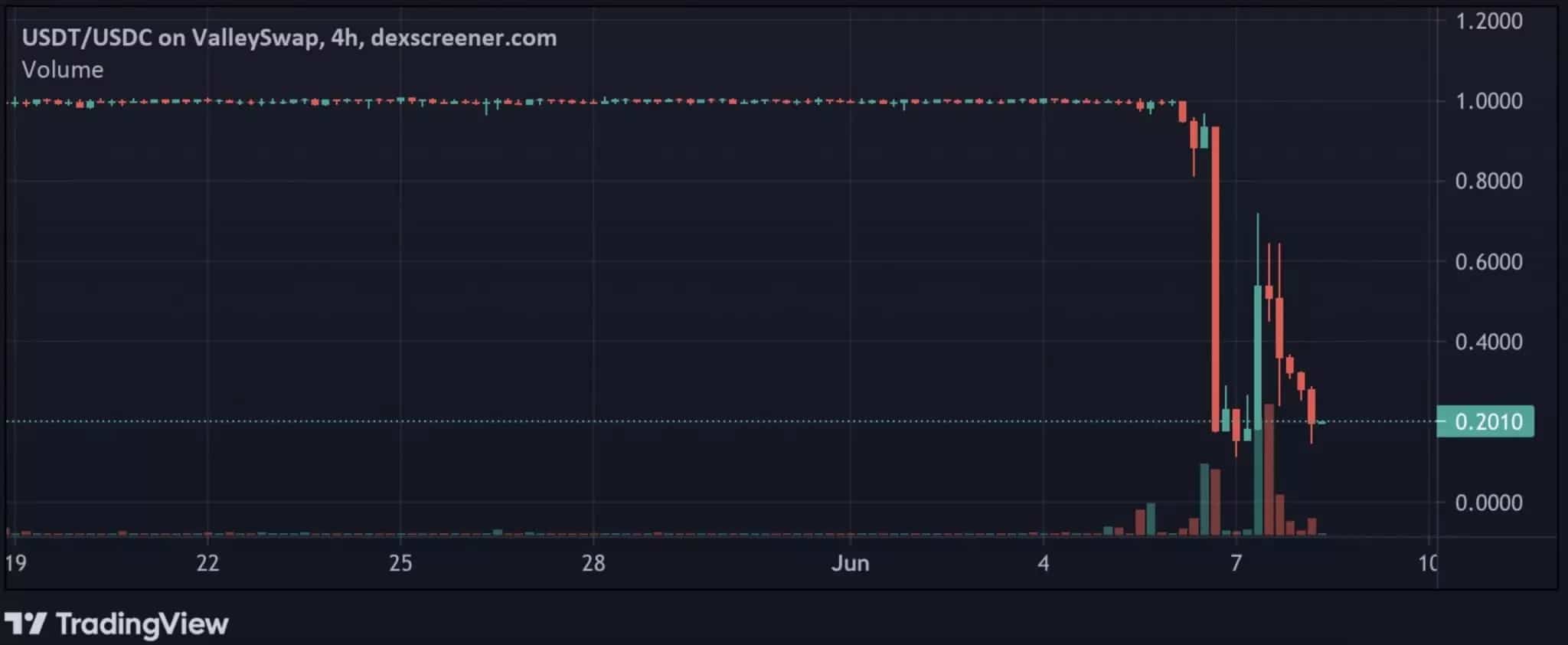

It’s like déjà vu. During the day yesterday, the stablecoins USDT and USDC started to lose their parity with the dollar on the Oasis blockchain. While the USDC quickly returned to normal, the USDT continued to fall until it reached $0.12.

Figure 1: Fall of USDT on the Valley Swap exchange

For the moment, it seems that this only concerns the Oasis blockchain protocols based on the EvoDeFi bridge. These include Valley Swap, Oasis’ main decentralised exchange, which alone captures 77% of the total value locked (TVL).

At the time of writing, the bridge has been suspended by the EvoDeFi team. This means that users can no longer transfer their USDTs to another network in order to resell them at their usual prices. At the same time, arbitrage is blocked and no one can contribute to the USDT repeg on Oasis.

According to DefiLlama data, the total value locked in on Oasis has plummeted by more than 40% in just 24 hours, from around $215 million to just $62 million at the time of writing.

Figure 2: Total Value Locked (TVL) on Oasis as of 08/06/2022, 10:30am

Understanding the EvoDeFi bridge on Oasis

The first network developed on the Oasis blockchain and compatible with Ethereum (ETH) was released last January and is called Emerald ParaTime. On it, Oasis Foundation has developed a bridge with the Wormhole inter-blockchain transfer protocol and built its own decentralised exchange, Yuzu Swap.

However, some protocols have chosen to base themselves on another bridge, namely EvoDeFi. This was the case for Valley Swap, which captured most of the activity of the decentralised finance ecosystem (DeFi) on Oasis. However, it was not validated and supported by the Oasis Foundation.

On the contrary, it had even directly alerted its user community to the risks associated with using this bridge. Indeed, it pointed to a flaw in the code that would allow administrators to move funds around and withdraw them with impunity.

Admin backdoor take function aside, critical parts of the bridge are NOT open source and NOT decentralized, which allows the operator to take funds from the bridge.

Everyone please beware of risks of using EvoDeFi and DApps that connect to them such as ValleySwap and RIMSwap. https://t.co/WCOtekVdym

– Oasis Foundation (@OasisProtocol) May 4, 2022

In this alert dated 5 May, the Oasis Foundation also warns that “key parts of the bridge are NOT open source and are NOT decentralised, allowing the operator to extract funds from the bridge”. This is why they have called for caution and advised their users against using decentralised exchanges based on this bridge.

How to explain this USDT depeg on the bridge

With this article, we don’t want to add fuel to the fire, and even less to participate in the feeling of fear that is taking hold around Oasis. On the contrary, we want to clarify the situation and explain concretely what is currently happening on this blockchain.

Many reports explain, without further clarification, that the USDT has de-indexed from the dollar rate on the Oasis blockchain. As you can see, this is only true for USDT bridged from EvoDeFi.

Moreover, note that the contract for this asset is different from that of the USDT bridged from Wormhole. The latter, supported by the Oasis Foundation, is transferable and exchangeable on any Ethereum, Polygon or other network protocol.

Important note to the Community. More info https://t.co/yEq41aNnYf pic.twitter.com/IZIQxtBAhd

– Oasis Foundation (@OasisProtocol) June 8, 2022

In fact, users started to fear that this USDT was not really guaranteed to be 1:1 by a treasury. Thus, they sold their USDTs en masse to take cover, causing the USDT price to fall.

At the moment, there is no evidence that the EvoDeFi team is involved in the situation. That said, the suspension of bridge activity makes the situation highly suspicious, as it prevents anyone from arbitraging to restore parity and leaves users stuck with USDTs that have lost 70% of their value.

As the Oasis Foundation states, the assets from EvoDeFi “are not native Oasis assets”. We would therefore like to take this opportunity to remind you to be cautious when using decentralised finance protocols and to always thoroughly research the assets you hold.