The bears are out… The fall in cryptocurrency prices has affected the decentralised finance (DeFi) sector, which is losing $67bn in just under three weeks. Where do the major projects stand now

DeFi: total value locked in plunged

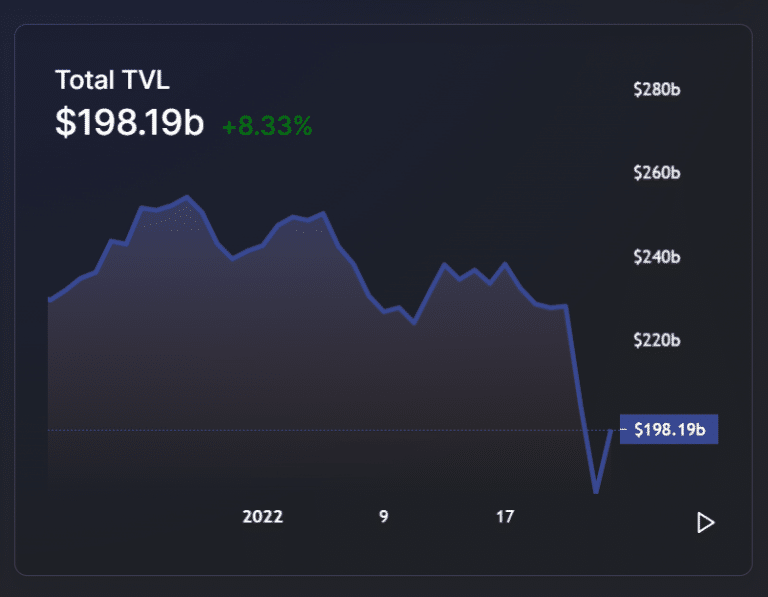

According to data released by DeFi Llama, the total locked-in value, or TVL, of the DeFi sector peaked at $249.9 billion on January 5. But it plummeted over the weekend to a low of $182.9 billion. That’s $67 billion gone:

TVL evolution of DeFi protocols (Source: DeFi Llama)

However, it is noted that the total value locked in on DeFi projects is on the rise. It is up +8.3% over the last 24 hours, reaching $198.1 billion this morning.

This fall can also be mitigated by comparing this figure with the beginning of last year. As of January 1, 2021, the total value locked up on DeFi projects was “only” $18.7 billion… A threshold ten times lower than it is today.

Curve (CRV) still leader in DeFi

If you look at the ranking of DeFi projects by total value locked in, Curve is still dominant. The multi-channel protocol accounts for $19.3 billion in TVL. It is followed by MakerDAO (MKR) with $14.7 billion and then Convex Finance (CVX) with $14.4 billion.

In terms of the blockchains used, Ethereum (ETH) continues to be the most widely used by far, with projects worth a total of $116.7 billion. But its hegemony is less clear-cut than before: it now accounts for only 58% of the global LST.

However, its competitors are still quite far behind: blockchain Terra (LUNA) is second with $16.6 billion, followed by Fantom (FTM) at $12.2 billion, then Binance Smart Chain (BNB) at $11.9 billion.

The general slowdown felt in the cryptocurrency sector has therefore logically extended to DeFi. The notable exception is non-fungible tokens (NFTs), which continue to be popular despite falling prices.