About 6 months after being blacklisted by the US Treasury, the Tornado Cash blender is still functional and active. Although it has become more difficult to access, this is proof that it is almost impossible to shut down a decentralized application. Let’s analyse the situation of Tornado Cash today

Tornado Cash still running

In a report published on January 9, 2023, Chainalysis looks back at the impact of sanctions carried out in 2022 against the cryptocurrency industry. In particular, the on-chain data analysis firm mentions the most striking sanction, namely that of Tornado Cash.

As a reminder, on August 8, 2022, the Tornado Cash blending service was the first – and only to date – decentralised protocol to be sanctioned by the Office of Foreign Assets Control (OFAC), the US Treasury’s financial oversight body. The reason: facilitation of money laundering.

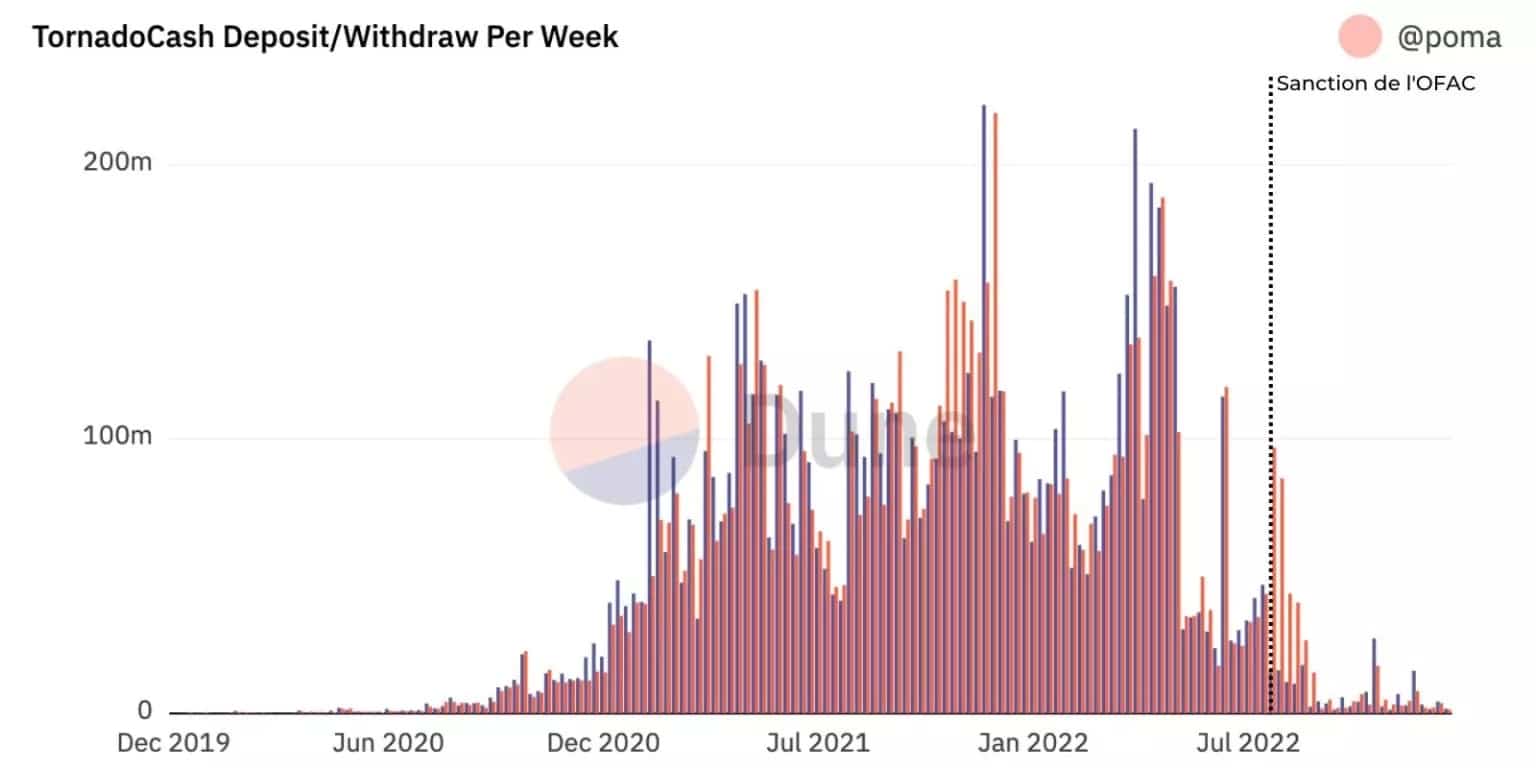

Six months later, what has been the impact of these sanctions? According to Chainalysis, they did have some effect, as usage volumes dropped by 68% in the first 30 days, “but they did not stop completely”. Indeed, if we look at the on-chain data, we see that:

Volume trends on Tornado Cash (before / after OFAC sanction)

The same is true for the number of users. While the decentralised blender was making steady progress with an average of 600 addresses per week, the sanctions imposed by the US Treasury have stopped its momentum. However, between 50 and 100 addresses continue to use the protocol each week.

Unnecessary sanctions against DeFi

As the on-chain data shows, Tornado Cash is hit but not killed. Only the protocol’s website has been taken down by the FOCA. Of course, access to the service is much more complex now, but it is still possible.

This is because, as a decentralised protocol, Tornado Cash is based on smart contracts that are still functional. In other words, as Chainalysis explains: “no person or organisation can ‘unplug’ Tornado Cash as easily as they would with a centralised service”.

Moreover, Chainalysis draws a parallel with Hydra, a centralised darknet marketplace. After the German police seized the servers and dismantled the organisation, activities stopped and cryptocurrency transaction volumes were logically reduced to zero.

In summary, there are two reasons for the drop in the number of Tornado Cash users. Firstly, the difficulty of accessing the service, which is now reserved for those who are experienced with the blockchain. Secondly, the risk of having one’s address blacklisted from certain other Ethereum applications.