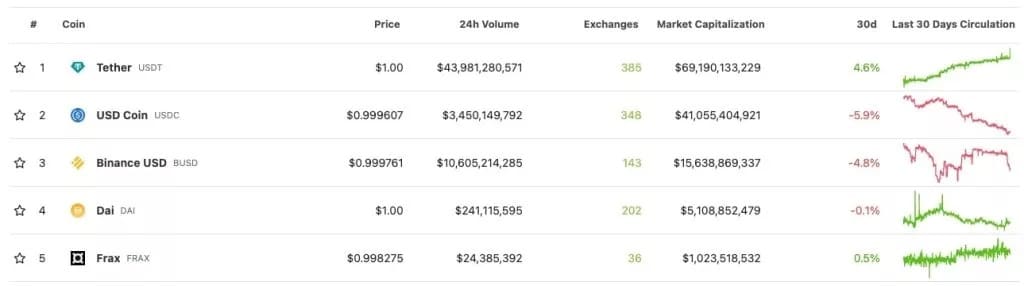

As New York regulators get tougher on stablecoins, with a recent frontal attack on Binance’s BUSD, let’s take a look back at the top 5 stablecoins in the cryptocurrency market in February 2023.

Stablecoins in the crosshairs of regulators

Earlier this week, we reported on some grim news for the stablecoin industry. Following pressure from New York regulators, the firm Paxos will no longer be able to issue the Binance BUSD.

Although rumours have been circulating for some time that the US Securities and Exchange Commission (SEC) was planning to go after Paxos, the decision comes rather suddenly and is likely to have a major impact on the stablecoin landscape as we know it today.

BUSD issuance is now blocked, but users can still exchange them for dollars. However, the capitalization of the Binance stablecoin is expected to gradually decrease. Let’s take a look at the top 5 stablecoins on the market in February 2023, which could potentially be an alternative to the BUSD:

The 5 most capitalised stablecoins in February 2023

5 – Frax (FRAX)

With a market cap of approximately $1.023 billion, Frax Finance’s FRAX is the 5th largest stablecoin on the market as of February 2023. It operates on a rather special principle called “fractional-algorithmic”.

FRAX is the first hybrid stablecoin to be backed by both collateral and algorithmic. In other words, FRAX’s price stability is maintained by a USDC collateral but also by an algorithm that works in conjunction with the Frax Share (FXS).

This duality offers a greater degree of security than a traditional algorithmic stablecoin. The USDC collateral pool is continuously adjusted to maintain a dollar price. Through a new kind of stand-alone contract (called AMO), the arbitrage mechanism is automatically managed and profits are redistributed to the FXS token.

4 – Dai (DAI)

Capitalized at $5.1 billion, the 4th largest stablecoin in the market in 2023 is the DAI. It is a so-called “decentralised” stablecoin, issued by Maker DAO, one of the largest decentralised finance protocols (DeFi).

This stablecoin is fully decentralised and transparent. The parity of the DAI against the dollar is ensured by a basket of assets issued on Ethereum (ETH) and locked in smart contracts. All of this is of course verifiable by anyone who dives directly into the blockchain.

The operation of the DAI is orchestrated by the governance of Maker DAO, composed of the MKR token holders.

3 – Binance USD (BUSD)

With a market cap of approximately $15.6 billion, the Binance USD (BUSD) is the 3rd largest stablecoin in the market as of February 2023. It is also the 7th most capitalised asset in the entire cryptocurrency market.

BUSD was born in September 2019 from a partnership between Binance, the market’s leading cryptocurrency buying platform, and Paxos Trust Comapy, a company providing cryptocurrency services to banking institutions.

This stablecoin is centralised, meaning that the value of its tokens is backed by dollars. In concrete terms, for every 1 BUSD issued, there is 1 dollar in the Paxos reserves. Until then, the BUSD was considered a stable and reliable financial product because it was one of the only stablecoins approved by the New York State Department of Financial Services.

2 – USD Coin (USDC)

Capitalized at approximately $41 billion, USD Coin (USDC) ranks as the second most capitalized stablecoin and the 5th most capitalized cryptocurrency in the market.

Issued by a consortium called CENTRE and consisting of several companies, including Circle (the main one) and Coinbase, the USD Coin is also a centralised stablecoin. In other words, every USDC in circulation is theoretically backed by 1 US dollar in Circle’s reserves.

The USDC has grown enormously in popularity in recent months, especially following concerns about the market’s leading stablecoin, Tether’s USDT.

1 – Tether (USDT)

Unsurprisingly, it is Tether (USDT) that holds the top spot of the most capitalized stablecoins in the market. With $69 billion in tokens in circulation, it also ranks third among the market’s cryptocurrencies, behind Bitcoin (BTC) and Ether (ETH).

Launched in 2014, USDT is the first stablecoin of its kind. It is backed by the US dollar through the guarantee of the company Tether Limited, in the same way as the USDC and BUSD. In other words, the price equilibrium is maintained by trust in the company.

However, this has not always been the case. Between the hidden links with the Bitfinex exchange and the admissions that the guarantee has not always been 100%, investors have gradually turned to more secure alternatives.