Africa is witnessing the return of the gold standard with the official launch of Zimbabwe Gold (ZiG) by the Reserve Bank of Zimbabwe (RZB). This new currency is being introduced after years of high inflation and extensive dollarization of the national economy. Nevertheless, gaining public confidence will be the main challenge for the central bank.

The gold standard makes a comeback in Africa

The Reserve Bank of Zimbabwe (RZB) has officially introduced its gold-backed currency, Zimbabwe Gold (ZiG).

Following a period of hyperinflation in 2020 reaching up to 785%, Zimbabwe’s inflation rate remains high, recording 55% in March 2024.

Faced with the collapse of their national currency, many Zimbabweans have adopted the use of foreign currencies, mainly the dollar and the South African rand, leading to a significant dollarization of the economy. Foreign currencies became dominant in Zimbabwe’s commercial and daily transactions.

After several attempts by the Central Bank to recast the currency, a return to a gold standard was finally considered.

Prior to the 1970s, most currencies were backed by a physical asset, gold. With the end of the Bretton Woods Agreement in 1971, the United States officially started printing money, making fiat currencies and inflation a tool for economic growth at the expense of people’s savings.

The adoption of the ZiG by the Zimbabwean population is not assured, after several attempts to recast the currency, Zimbabweans remain wary of new initiatives led by the Central Bank.

Nevertheless, last week the Chairman of the RZB announced that he had 2.1 tonnes of gold and the equivalent of 0.4 tonnes of gold in diamonds, ready for conversion, representing a total value of $166 million.

A trend towards de-dollarization

Gradually, the world seems to be moving away from the use of the dollar, turning to alternatives such as local currencies, Bitcoin, and now the gold standard.

In January 2024, the United Arab Emirates made its 1st payment in digital dirham to China, dispensing with the dollar. In July 2023, Iran, Russia and China publicly called for de-dollarization. In March 2024, the BRICS+ announced the development of a blockchain-based payment system and a common digital currency.

Since 2021, El Salvador has benefited from Bitcoin as its legal tender, and now Zimbabwe is introducing a gold-backed currency.

These developments indicate a trend towards independence from the dollar and other fiat currencies affected by corrosive inflation.

Supply-limited currencies such as gold or Bitcoin, while making access to liquidity and wealth creation more difficult, guarantee long-term value stability, making their sustainability more certain.

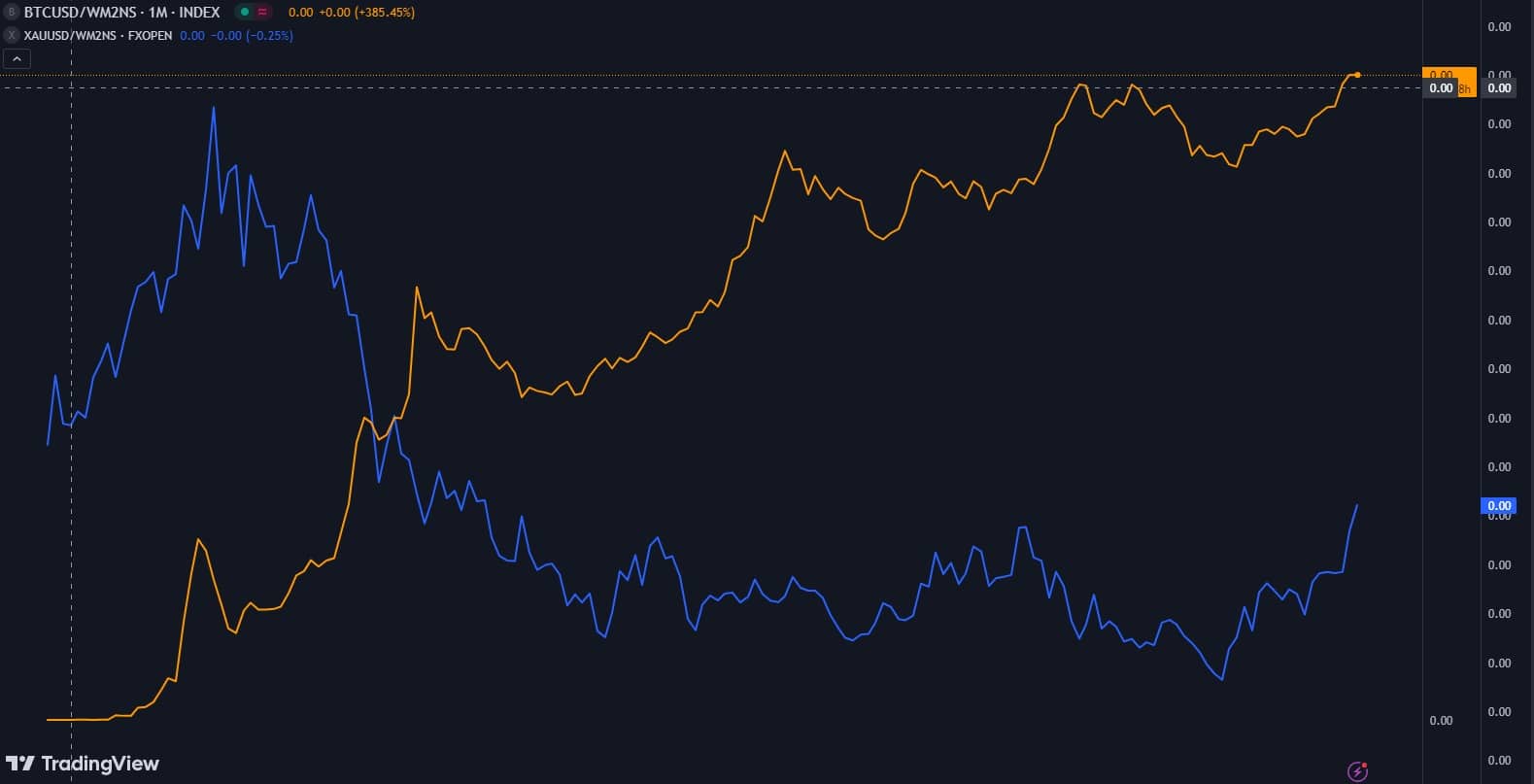

The price of Bitcoin and gold taking into account the increase in the dollar money supply since 2009

The chart above illustrates the evolution of Bitcoin and gold prices, adjusted for dollar inflation. While gold has failed to counter inflation since its 2011 peak, it has nonetheless retained its value since 2015. At the start of 2024, gold has risen significantly, surpassing $2,300 per ounce, a new all-time high.