In an effort to reassure users of its flagship stablecoin USDT, Tether has made a point of communicating about its stability, as well as any links to FTX or Alameda Research.

Tether clarifies its position on FTX

While it is still too early to assess the consequences of the FTX case, many players in the ecosystem have communicated on their own situation. This is notably the case for Tether, the issuer of USDT, which was keen to reassure on the latter’s dollar anchor and the company’s links with Sam Bankman-Fried’s (SBF) companies. Watch our live hour-by-hour coverage of the FTX and Sam Bankman Fried case.

On the one hand, Tether was keen to remain optimistic about the long-term potential of our ecosystem, but also made it abundantly clear that he would not be exposed to FTX and Alameda Research:

Regardless of the volatility this incident may have triggered, cryptocurrency and blockchain technology are driving a revolution in financial inclusion, transforming a broken model that does not work in the modern world. Secondly, we would like to confirm that at this time, Tether has absolutely no credit to FTX or Alameda Research. Tether has absolutely no exposure to Alameda Research or FTX. “

The USDT dollar peg is safe, according to Tether

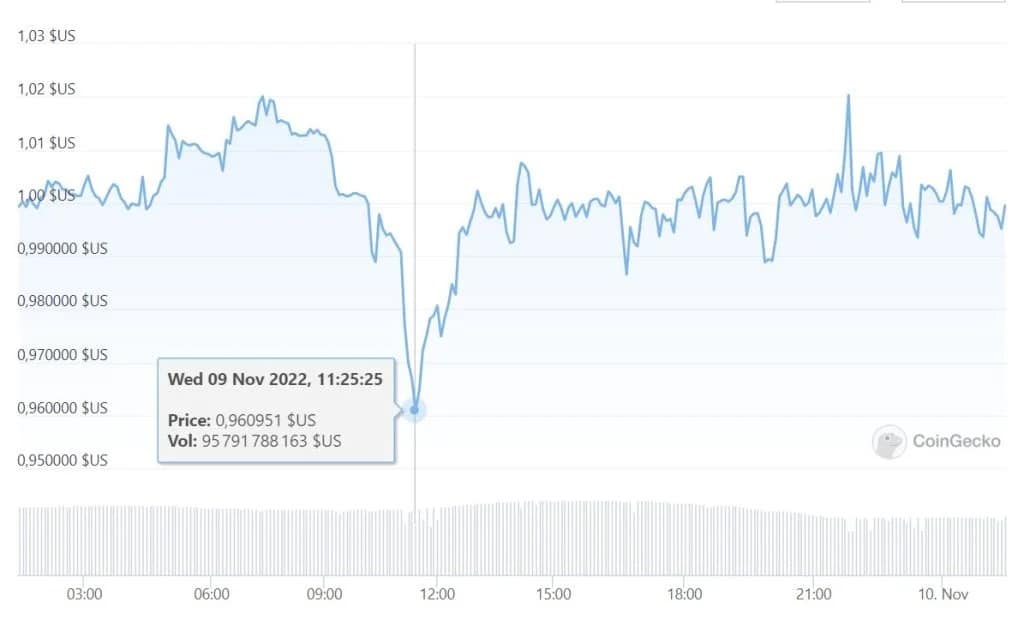

For a while, some in the ecosystem may have had doubts about the stability of Tether’s USDT. And for good reason, during the past day, it could have traded for 96 cents, as evidenced by CoinGecko’s data:

USDT price on CoinGecko

In reality, Tether is pointing to an API issue that CoinGecko faced on Wednesday morning. An issue that has since been resolved.

Of course, while it may seem counter-intuitive, the price of any stablecoin can move up or down to some extent. This can be seen in periods of high volatility, as the USDT issuer explains:

During periods of market volatility, the price of the USDT which is quoted on exchanges can fluctuate. This occurs because there is more demand for liquidity than exists in the order books of this platform and has nothing to do with Tether’s ability to maintain its peg, nor the value or composition of its reserves. “

In fact, even in these situations, Tether is still able to trade its stablecoins at a one-to-one ratio, thanks to its reserves, and the situation usually resolves itself within a few hours, as volatility decreases.

However, even in a regulated business like Tether, it is wise to consider the potential black swan scenario, as the events with FTX have reminded us. For this, it may be appropriate to diversify your stablecoin holdings, so as not to put all your eggs in one basket.