The Polygon (MATIC) sidechain is preparing to perform a hard fork on January 17, in particular to optimize transaction costs on the network during peaks in use. In addition, the production of blocks will be reorganised in order to be fluid within the various validators.

New update for Polygon

As the Polygon (MATIC) sidechain continues to welcome its share of decentralised applications (dApps) and continues to be a destination of choice for most traditional players, as its recent partnership with Mastercard recently proved, it is about to undergo an upgrade to optimise its scalability.

Based on various discussions in the Polygon forum and observations, a hard fork of the sidechain will take place tomorrow, Tuesday 17 January, and network validators are already invited to upgrade their nodes to the new version.

A hard fork, as opposed to a soft fork, makes it possible to modify the rules of a network in an immutable way following a common agreement between the community (DAO) and the validators. To learn more about this principle, we invite you to read our article on the difference between hard and soft fork.

The hard fork will therefore modify the consensus rules of the Polygon network, and this through the following 2 axes:

- Reduce the impact of a large number of simultaneous transactions on the network costs;

- Review the organisation of the sidechain to optimise block validation time.

Optimising transaction costs

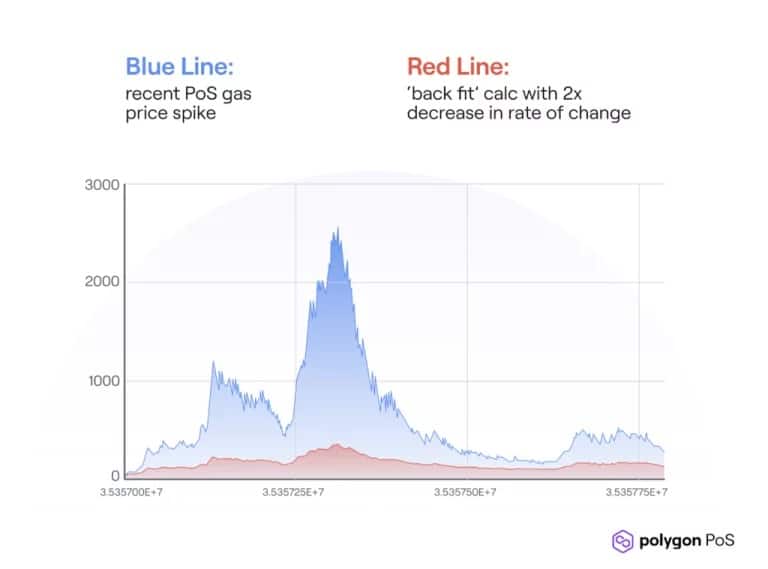

In order to solve this first point, Polygon wishes to “smooth” the cost curves inherent to the use of the network, especially when the latter is confronted with peaks in use. To do this, the “BaseFeeChangeDenominator” value will be multiplied by 2 in order to cap gas increases in the blocks.

“For a transaction to be included in a block, a gas fee is required. […] Gas price increases are normal when demand rises on any blockchain protocol. But “gas spikes”, which represent exponential price growth, are not. “

Figure 1 – Gas price in the current form of the Polygon network (blue), then in its post fork version (red)

According to the release, this change should greatly reduce major price fluctuations while better respecting “the gas dynamics of Ethereum (ETH)”. In short, during peaks on the network, the increase in transaction fees should be much lower.

The reorganization of the sidechain

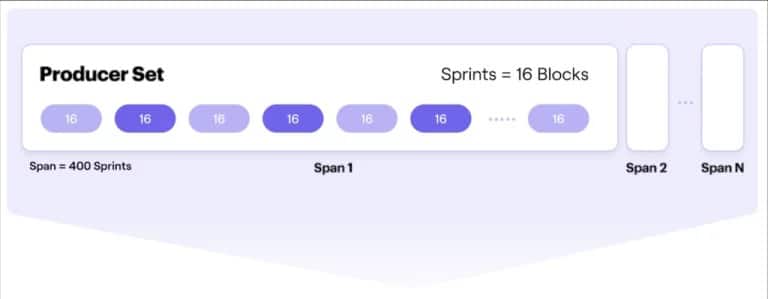

To simplify this mechanic, which has some rather technical aspects on the Bor Chain (in charge of the production of blocks on Polygon), the reorganisation aims at reducing the number of blocks produced by a single validator in order to limit their impact on the finality of transactions.

This specificity, called “sprint length”, will be greatly reduced, as the block production for each validator will be reduced from 64 to only 16 blocks. In terms of time scale, the time allowed for the same validator will be reduced from approximately 128 to 32 seconds.

Figure 2 – Illustration of the reorganisation of blocks on Polygon

“By reducing the duration of the sprint, the time during which a validator continuously produces blocks decreases. The result? A decrease in the chance that a secondary or tertiary validator (who has not discovered the primary validator) will step in to produce blocks, thus reducing the number of reorgs overall. “

Polygon’s release states that the number of blocks ultimately produced by each validator will remain unchanged, and thus the rewards for them will remain the same.

MATIC is currently trading at $0.99, which is an 18% increase over the last 7 days.