German neo-bank N26 is finally entering the cryptocurrency market, several years its rival Revolut. The new service launched in white label with the Bitpanda platform will only be available in Austria before rolling out to other countries, including France.

Cryptocurrencies are coming to N26

Customers of the neo-bank N26 have been waiting for it for a long time. Thanks to a partnership with Austrian platform Bitpanda, N26 is launching cryptocurrency trading tools.

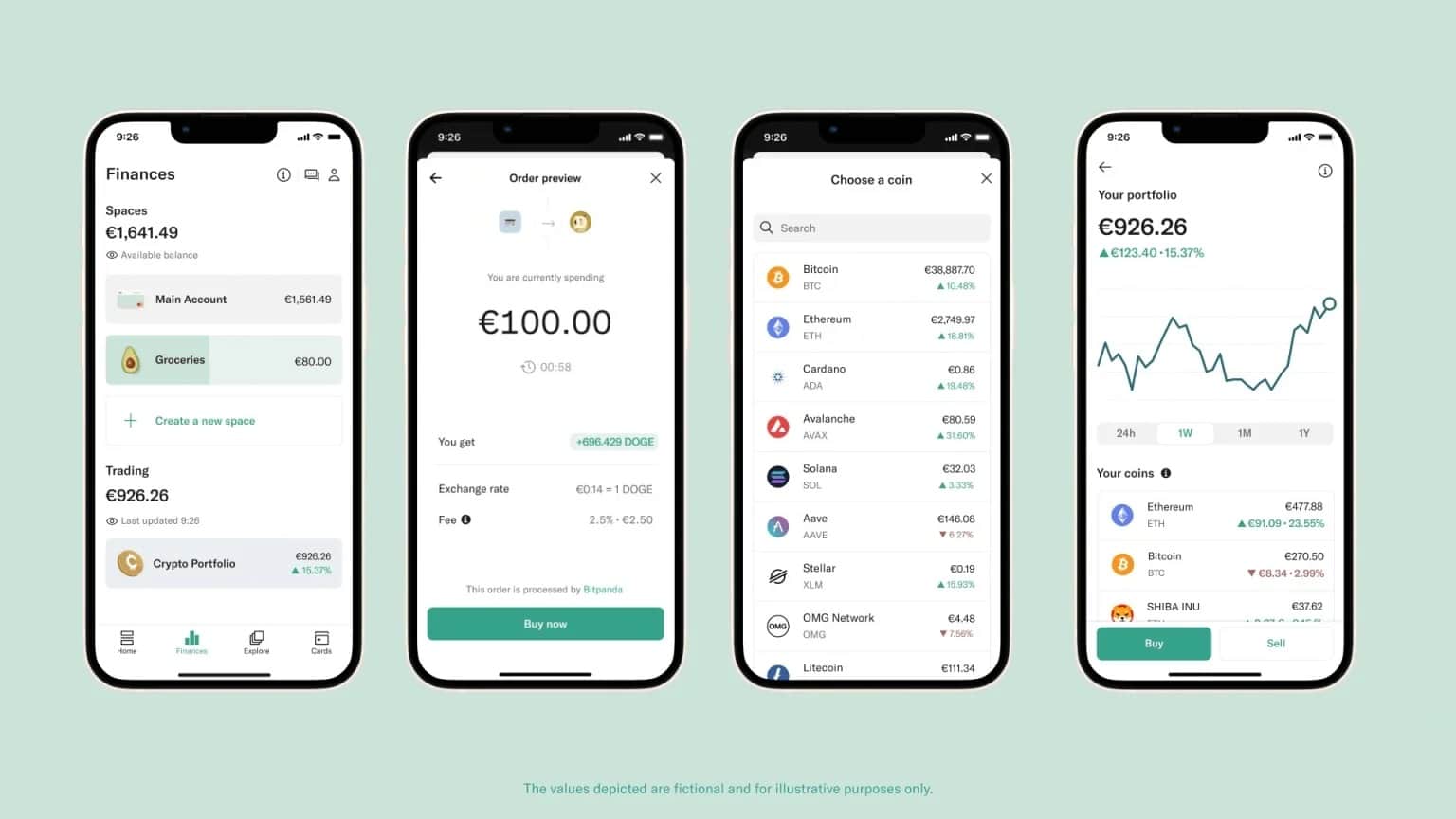

As of today, customers in Austria are able to buy, sell and trade more than 100 cryptocurrencies, including Bitcoin (BTC), Ether (ETH), Dogecoin (DOGE) or Avalanche’s AVAX.

In terms of fees, N26 charges its customers 1.5% for Bitcoin transactions and 2.5% for all other cryptocurrencies. This is the same fee as on Bitpanda. For holders of the N26 Metal offer, they will pay 1% and 2% transaction fees on Bitcoin and other crypto currencies respectively.

Valentin Stalf, CEO of N26, believes that crypto-currencies “remain a sought-after and attractive asset class for investors and a growing part of the financial system”, despite the fact that they have seen a decline in value during the bear market we are going through. He added:

“Crypto-currency trading is often the entry point into investing for a new generation of investors looking to explore ways to grow their wealth. “

In its statement, N26 says the service will be rolled out to other markets in the coming months. As Bitpanda is also registered as a PSAN with the Autorité des marchés financiers (AMF), the launch of this new service in France is not far off.

Overview of N26’s cryptocurrency interface

More features to come on N26

This is not the first time Bitpanda has managed to partner with a startup to bring cryptocurrencies to its customers. In November 2021, French ‘super-app’ Lydia integrated Bitpanda’s trading solutions into its app.

In addition to crypto-currencies and thanks to Bitpanda, Lydia also offers company shares and ETFs. Thus, N26 might follow in Lydia’s footsteps and add more assets to its offering in the near future.

In any case, this move by N26 could give it a second wind against its rival Revolut when it comes to the cryptocurrency market. Indeed, the latter has already implemented services related to crypto-assets for several years now and still has a nice lead over its competitor.