A study by Adan and KPMG reveals that 9.4% of French people will hold crypto-assets in 2023. Despite the difficulties that the web3 sector went through in 2022 and even if the Hexagone remains behind its neighbours, the adoption of crypto-currencies in France is on the rise.

Cryptocurrency adoption in France is growing

For the second year running, KPMG France has been commissioned by Adan (Association for the Development of Digital Assets) to conduct a study on the adoption of Web3 and cryptocurrencies in France and Europe. This study aims to update the figures on the adoption of this sector by the general public and to explore new directions with a European dimension.

The new study shows that 9.4% of French people have already invested in crypto-assets, a figure that is 17.5% higher than the previous year, when only 8% of respondents had purchased crypto-assets.

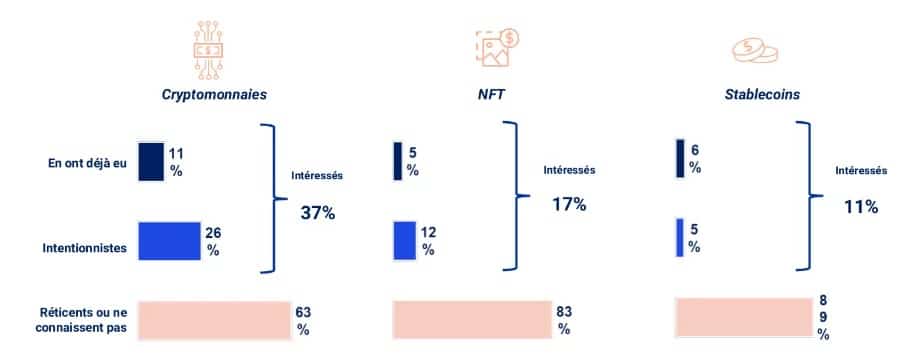

As a result, nearly 1 in 10 French people hold crypto-assets, namely at least one cryptocurrency or non-fungible token (NFT). In parallel, the study shows that 11% of French people have already held crypto-currencies in their investment portfolio, and 26% are also interested in acquiring them. Another very striking fact is that 1 in 7 French people have already held at least one cryptocurrency, NFT or stablecoin.

Furthermore, in 2023, 85% of French people are aware of the existence of cryptocurrencies (76% in 2022) and 39% of NFTs (compared to only 15% in 2022).

Adoption of crypto-assets in France

The presentation of the results of this study took place on 19 February at the Ministry of Economy and Finance in the presence of government representatives, including Jean-Noël Barrot, Minister Delegate in charge of the Digital Transition and Telecommunications.

What is the profile of French crypto investors?

The results reveal a clear overrepresentation of men among cryptocurrency investors, accounting for 63.5% alone.

The generational trend that young people under 35 are more likely to invest in cryptocurrencies is confirmed, with the latter accounting for 48% of crypto holders and 30% of intentional investors.

By 2023, more than 17% of French people aged 18-35 will own crypto-assets, compared to just 12% in 2022.

How are the French investing in crypto-currencies

The Adan and KPMG study also highlights investors’ acquisition methods and strategies. Unsurprisingly, Bitcoin is the undisputed leader in investors’ crypto portfolio assets, which is held by over 75% of them, followed by Ether and Binance BNB.

On average, French investors allocate €5,000 to cryptocurrencies, which represents an 11% share of respondents’ total savings.

Moreover, only 1-2 cryptocurrency-related transactions per month (buying, selling, trading, etc.) are made by investors. Medium/long term holders therefore largely dominate traders.

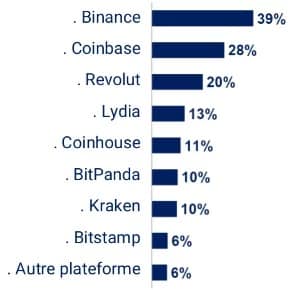

What are the most popular platforms?

The platforms selected by investors to acquire cryptocurrencies remain mostly foreign. Thus, 39% of French people have already turned to Binance, 29% to Coinbase and 20% to the neo-bank Revolut.

The leading French solution for investing in crypto-assets is FinTech Lydia, which has already been used by 13% of French people. This is followed by Coinhouse with 11%, then Bitpanda and Kraken with 10%.

Most used platforms by French crypto-investors

Where does France stand compared to its neighbours?

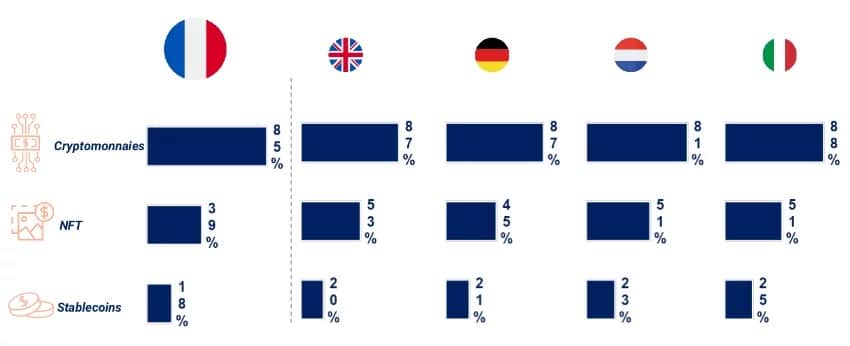

Despite these encouraging figures, France still lags behind some of its neighbours in cryptocurrency adoption. Indeed, one part of this study looked at the adoption of cryptocurrencies by the general public in Europe, specifically in the UK, Germany, the Netherlands and Italy.

The Netherlands leads the way with 23% of respondents having ever had cryptocurrencies in their investment portfolio, followed by Italy with 21%, the UK with 18% and Germany with 16%. On this metric, France ranks last with 11% of its population having ever held cryptocurrencies.

In terms of knowledge of the crypto-asset sector, France also lags behind. Where 53% of Brits are aware of non-fungible tokens (NFTs), this figure drops to 39% for the French. The same is true for stablecoins, where 25% of Italians claim to be aware of these assets, while only 18% of the French are aware of them.

Knowledge of crypto-assets in Europe