Meta has presented its quarterly results, showing a 24% fall in profits compared with 2022. But are all the figures really bad?

Meta’s profits are down in the first quarter

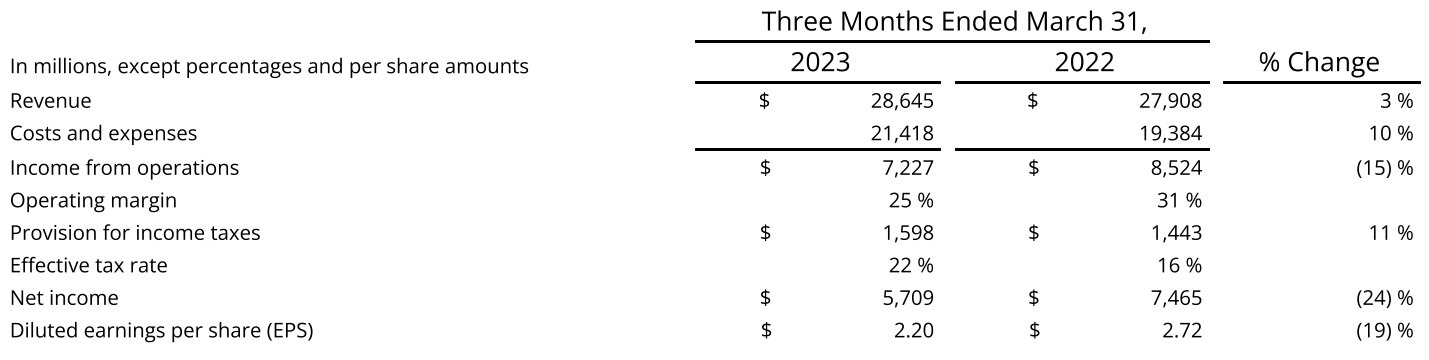

This week, Meta Group released its quarterly results, and while revenues were up compared to Q1 2022, profits were down sharply. Profits fell from $7.46 billion to $5.7 billion, a drop of 24%.

Gross revenues rose by 3%, from $27.9 billion to $28.64 billion. Earnings per share rose to 2.2 dollars, down 19%:

Meta’s Q1 2023 results

Many factors can affect a company’s earnings. Here, for example, we can point to a 10% increase in spending compared with the first quarter of 2022, or almost 21.42 billion dollars.

One of the factors behind this rise in spending was the restructuring campaign in March, with the announcement of 10,000 redundancies. The cost of this wave of redundancies is estimated at 1.14 billion dollars.

As far as the workforce is concerned, it stood at 77,114 on 31 March this year, although the people to be affected by the redundancies are still included in these figures.

Correct results despite everything

Despite falling profits, these results could have been worse than expected, after Meta’s setbacks with everything to do with Web3, such as the difficulties encountered with its Horizon World metaverse or the abandonment of non-fungible tokens (NFT) on Instagram, for example.

Mark Zuckerberg, founder and CEO of Meta, described the first three months of 2023 as “a good quarter”, with a community that “continues to grow”. He also highlighted the promising developments in artificial intelligence (AI):

“Our AI work is yielding good results in our applications and businesses. We’re also becoming more efficient so we can build better products faster and put ourselves in a stronger position to deliver on our long-term vision. “

Other interesting data to note is that the group’s long-term debt stands at $9.92 billion, and the company repurchased $9.22 billion of Class A shares during the past quarter.

Meta shares have continued to climb since the start of the year, and even opened in a bullish gap on Thursday, closing the session up by around 14% at 238.59 dollars. The group is worth 618.53 billion dollars on the stock market.

For the current quarter, the company expects earnings of between $29.5 and $32 billion, and a range of $86 to $90 billion for the full year, including restructuring costs of $3 to $5 billion.